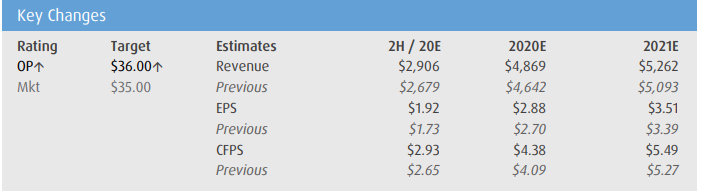

This morning, BMO Capital Markets upgraded AngloGold Ashanti (NYSE: AU) to outperform and upgraded their 12-month price target to $36 from $35. AngloGold Ashanti currently has six analysts covering the company with a weighted 12-month price target of $33. This is down from the average at the start of the month, which was $35.96. Four analysts have buys, and the other two analysts have hold ratings.

Raj Ray, BMO’s analyst, says that AngloGold’s share price has lagged its peers, the gold price and main gold indices. He comments, “While the share price underperformance has not been completely unwarranted, looking forward we see some potential near-term positive catalysts that could drive share price performance.”

He adds that AngloGold’s underperformance is mainly due to the sudden departure of the previous CEO, COVID-19 delays, cash lock-up in the Democratic Republic of Congo related to the Kibali project, alongside the indefinite delay of the London Stock Exchange listing. However, Ray then says that the interim CEO transition has been seamless and lists the potential near term positive catalysts, which are:

- Phase 2 Obuasi ramp up by Q1/21

- Potential resolution of the cash repatriation issue in the DRC

- Production growth visibility with the upcoming feasibility studies for the Gramalote and Quebradona projects in Colombia in H1/20

The next thing Ray addresses is AngloGold’s stable balance sheet, strong FCF outlook, and increased dividend. AngloGold currently has roughly $1 billion in cash with $875 million in net debt. Their net debt to EBITDA was cut in half this quarter, as it is currently 0.36x, down from 0.67x.

Ray estimates that AngloGold will have a free cash flow of $735 million, which he quantifies by saying, “Looking forward to 2021 and assuming steady state operations with no further COVID-19 related impact and ramp-up of Obuasi as planned.”

Below you can see the key changes Ray has made to 2020 and 2021 full-year estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.