Carolyn Rogers, senior deputy governor of the Bank of Canada, warned that rising interest rates may pose a “painful” squeeze for many recent house buyers. With successive hikes in interest rates and declining home prices, homeowners with variable-rate mortgages are undergoing a difficult transition.

“The bottom line is that mortgage costs for some Canadians have already increased, and they will likely increase for others in time, making home ownership more expensive.” Rogers said.

Fixed monthly payments are the most typical variable-rate product. With each increase in interest rates, a greater portion of the borrower’s monthly payment is allocated to interest. When the monthly payment no longer covers the principal, the borrower is said to have reached a trigger rate, and their monthly payment increases. In rare situations, the lender will allow the borrower to roll the interest into the principal, increasing the size of the loan.

According to projections in a new Bank of Canada research report published Tuesday, 50% of these variable-rate mortgage borrowers have already hit their trigger rate. As the central bank continues to raise interest rates to combat inflation, that share will grow to 65% by the middle of next year.

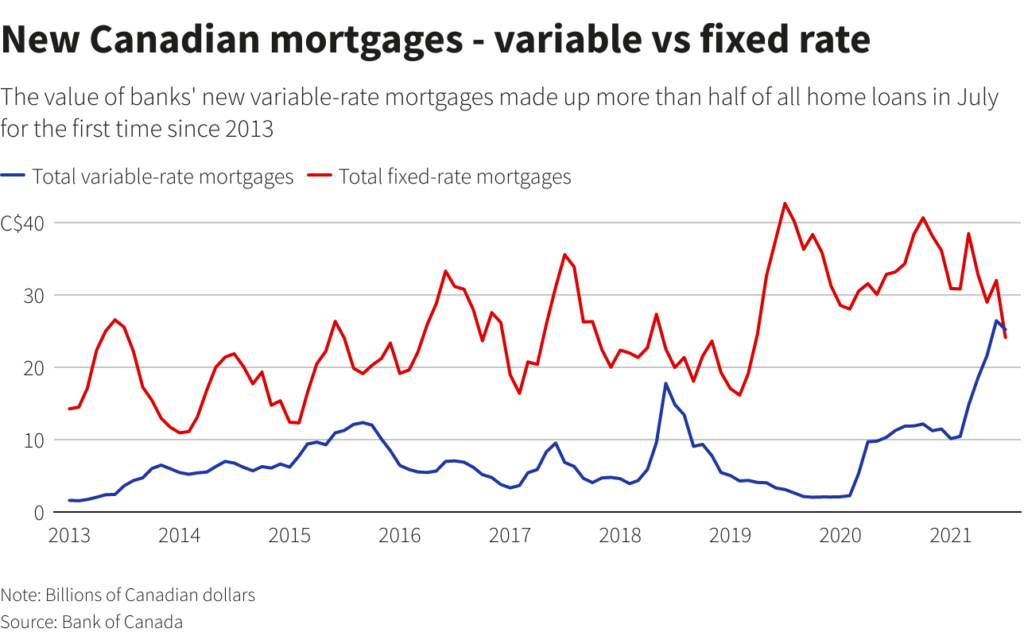

Further, around 670,000 variable-rate mortgages have been issued since the pandemic began. Variable-rate mortgages have accounted for about half of all mortgages issued since mid-2021, compared to an average of 20% in the years preceding the pandemic.

“This is not a large share of households, but it is larger than it would have been based on historical trends,” Rogers added.

If borrowers fail to make payments, problems in the mortgage market can spread to the rest of the financial system. However, Rogers assured that Canada’s banking system is well-positioned to manage future shocks as a result of measures implemented following the 2008-09 financial crisis, which enhanced capital and liquidity requirements for institutions and strengthened mortgage stress testing.

She added that the central bank is “not expecting a severe economic downturn with the kind of large job losses typical of past recessions.”

READ: Has Mortgage Fraud Been Driving Canada’s Housing Market Into Bubble Territory?

According to the research paper cited by the bank, few borrowers have had to deal with the trigger rate in the last decade because interest rates have been relatively low since the global financial crisis.

“But with the rapid increases in the policy interest rate by the Bank of Canada since March 2022, variable-rate mortgage borrowers have faced historically large interest rate increases that make reaching their trigger rate a significant possibility,” said the paper authored by Stephen Murchison, Advisor to the Governor, and economist Maria teNyenhuis.

The Bank of Canada study also noted that variable-rate mortgages now account for around one-third of total outstanding mortgage debt. In 2019, that figure was one-fifth.

READ: 25,000 Canadians Are Demanding Homeowner Relief Amid Rising Interest Rates

Interest policy rate is largely expected to rise by a quarter- or half-point on December 7, up from 3.75 percent currently. It does not directly target housing prices, but Rogers said that the bank is content to see them fall. Nationally, home values are down almost 10% from their peak in February.

“We need lower house prices to restore balance to Canada’s housing market and make home ownership more affordable for more Canadians,” she noted.

However, rising loan rates have made homes less affordable so far, with rate hikes outweighing price drops.

Information for this briefing was found via CBC and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.