Following the Deepwater Horizon disaster back in 2010, BP not only had to significantly cut back its dividend payouts to shareholders, but also reinvent itself in face of extensive scrutiny. However, it appears that the UK oil company is once again forced into a major overhaul, after being hammered by low oil prices and reduced demand for fossil fuels.

On Tuesday, BP revealed that it will be reducing dividend payouts from 10.5 cents per share to 5.25 cents per share for the foreseeable future, following a US$16.8 billion loss in the second quarter. Although such significant losses and resulting dividend cuts were much anticipated in wake of the coronavirus pandemic and oil price crash, BP also announced it will begin transitioning towards a green energy business model.

Over the next 30 years, the demand for fossil fuels is expected to drop by 50% if global temperatures remain below 2 degrees celsius, or by an astounding 75% if the temperature increase remains at 1.5 degrees celsius, according to Giulia Chierchia, who is the strategy head at BP. As a result, the company is planning to slash its oil and gas production by a minimum of 1 million barrels per day by 2030, which amounts to a reduction of approximately 40% of 2019 production levels.

While pivoting away from oil production and exploration by selling up to $25 billion in sector-specific assets over the next 5 years, BP plans to invest significant resources into hydrogen and carbon capture, and storage and bioenergy. The company is also expecting to increase its vehicle charging points from 7,500 to 70,000 in the same time frame. BP’s restructuring process is expected to cost upwards of $1.5 billion in 2020, and eliminate up to 10,000 jobs in the meantime.

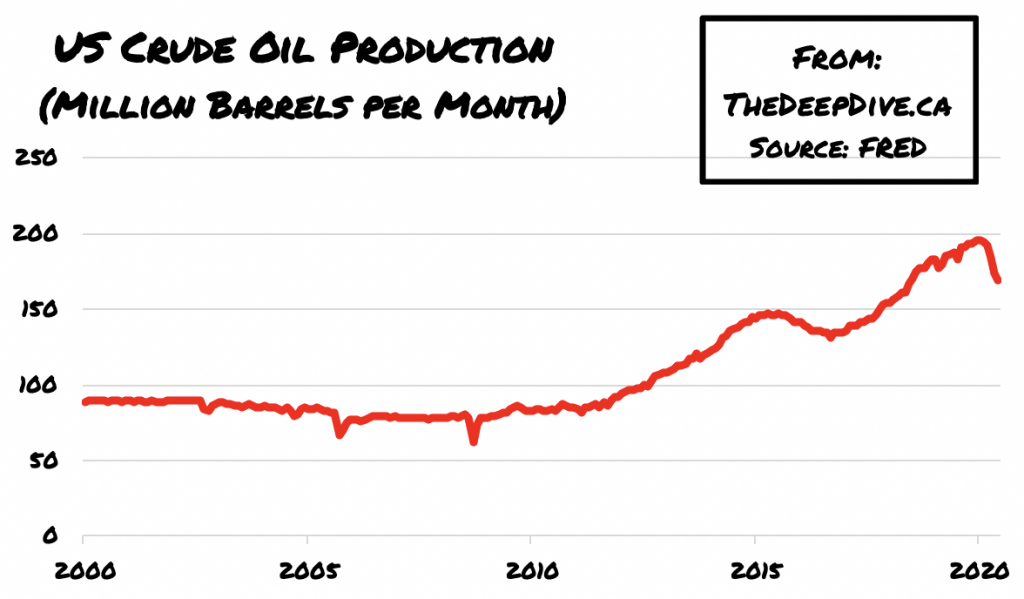

BP’s shift towards a business model that encompasses green energy is one of the first in the oil industry. However, given that the US has missed its window of opportunity to get the coronavirus pandemic under control, its economic recovery will most likely continue to stall. As a result, oil production in the US will have a long way to go before it can recover to pre-pandemic levels – if it can recover at all. Given that other oil companies may soon feel the financial burn, BP may not be the only one transitioning into the green energy headspace.

Information for this briefing was found via BP and the St. Louis Federal Reserve. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

Need More Gas Attendants! Thanks and have a nice day!

Yours Sincerely,

Malcolm Leitao

P.S. Canadian Overseas Petroleum (XOP)