On November 8th, Bragg Gaming (TSX: BRAG) reported their third quarter financial results. The company reported revenues of €12.9 million, or 9.9% year over year, while Adjusted EBITDA was €1.42 million which is 22.7% lower than last year. The firm also reported that unique players grew 14.4% year over year to 2.1 million and raised their full-year 2021 guidance to €55-56 million for revenue and adjusted EBITDA will come in between €6.6-€6.8 million for the full year.

The consensus 12-month price target on Bragg Gaming sits at C$24.13, after analysts lowered their price targets on the stock. The company has 4 analysts covering the stock with 2 analysts having strong buy ratings and the other 2 have buy ratings. The street high sits at C$32.50 while the lowest come in at C$21.

In Canaccord Genuity’s review, they reiterate their speculative buy rating while slashing their 12-month price target from C$30 to C$21 headlining “Encouraging signs across markets drive guidance increase.”

For the quarterly results, the company came in above Canaccord’s estimates. For revenue they expected it to be €9.4 million, and adjusted EBITDA of €0.476 million. Canaccord expected that the quarter would be affected by the recent German regulatory changes more. While the price target change comes from the sector selling off over the last six months rather than a change in their thesis.

On the company’s upgraded guidance, they say that this reflects improving demand, specifically in Europe. They also attribute the increase to the companies recent Playtech acquisition and expect the company to continue to be conservative on its ramp-up in North America, which could provide some upside to their current revised guidance.

Lastly, Canaccord believes that the Bluberi deal supports the thesis that there is a demand for omnichannel experiences. They write, “We see this as an important trend in the gaming space with consumers looking for a seamless online/in-house experience featuring similar games on both platforms.”

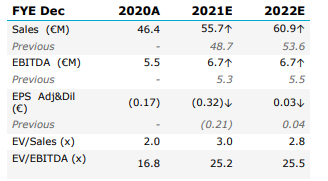

Below you can see Canaccord’s updated estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.