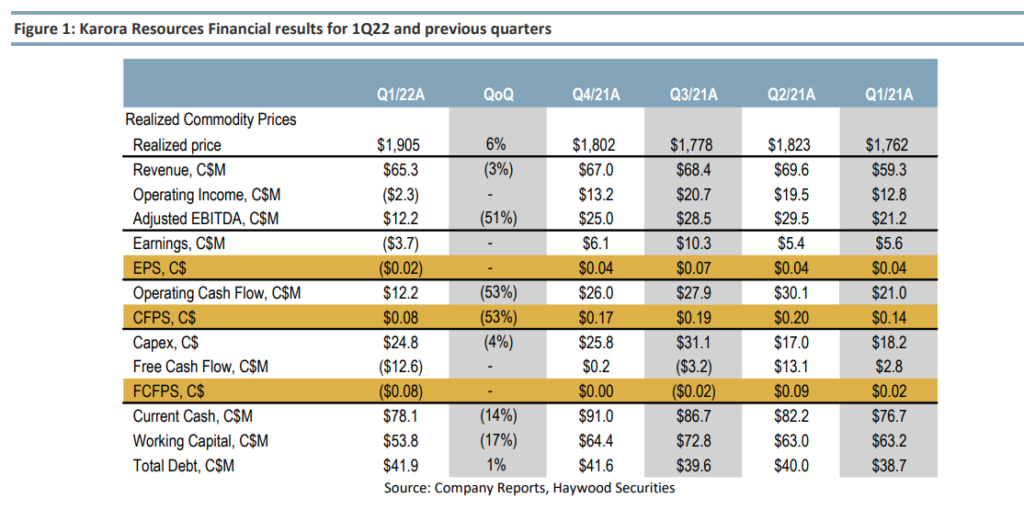

On May 12th, Karora Resources Inc. (TSX: KRR) reported its first quarter financial results. The company announced total revenues of $65.27 million, up from $59.28 million a year ago. Though the company saw an increase in its production and processing costs as inflation continues to hit all the mining companies, its costs went from $29.3 million to $42.43 million.

The company reported a net loss for the quarter of $3.71 million, this compares to the positive earnings of $5.62 million a year ago. In the same breath, the company saw its adjusted EBITDA almost get cut in half from a year ago, going from $21.21 million to $12.3 million this quarter.

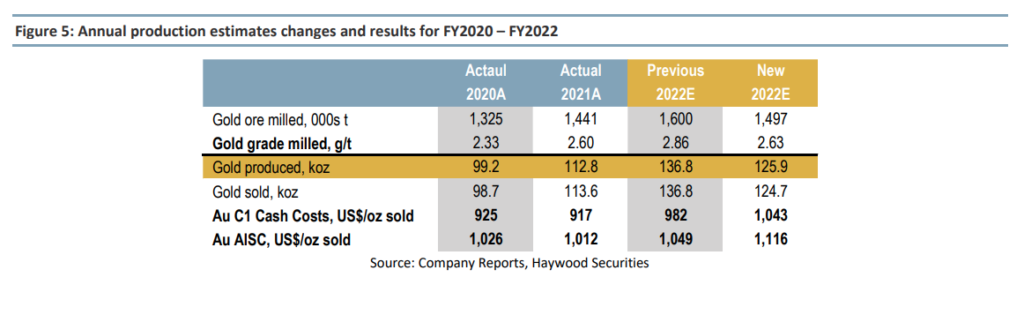

On the production side of things, the company produced 27,489 ounces of gold and sold 26,286 ounces, up from a year ago. The company also noted that it milled 394,000 tonnes and had a 94% recovery rate. Karora sold its gold for $1,905 per ounce, up from $1,762 a year ago. Cash costs per ounce grew from $952 to $1,310, while its all-in sustaining costs increased to $1,396 per ounce.

Karora Resources currently has 8 analysts covering the stock with an average 12-month price target of C$7.09, or an upside of 40%. Out of the 8 analysts, 1 has a strong buy rating and the other 7 analysts have buy ratings on the stock. The street high price target sits at C$8.50, which represents a 67% upside to the current stock price.

In Haywood Capital Market’s note on the results, they upgrade the name to a buy rating from a hold but cut their 12-month price target from C$8.50 to C$7.00, saying that the upgrade was due to the company having a more attractive valuation and improved second half of the year prospects. The price target revision meanwhile is to reflect “more challenging market conditions.”

On the results, Haywood says that they estimated that free cash flow for the quarter was ($12.6) million, which brought cash down 14% to $78 million, while the firms net cash declined from $49.4 to $36.2 million quarter over quarter. They also make note that the company’s earnings per share came in way below their estimate of $0.08.

Haywood notes that some of these results were impacted by COVID-19 still, saying that the company’s increased costs and underperformance were due to the Australian Covid regulations requiring vaccinations to work, which put pressure on both labor availability and productivity.

On another note, Haywood says that with the company increasing its M&I nickel resource by 22% to 19.6kt at the Beta Hunt Mine, it puts Karora Resources in a solid position and believes that it now looks attractive. This is mainly due to it’s Maiden 50C trend, which is in the Gamma Block, and has the potential to extend the strike length from 1.8 km to 2.6 km.

Lastly, on Haywood’s outlook, they believe that drilling at Beta Hunt, who’s development is on schedule and is 75% complete, will drive resources as the company looks to “continue to extend and upgrade the Western Flanks, A-Zone and new Larkin Zone resources.”

Below you can see Haywood’s updated estimates for the company.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.