FULL DISCLOSURE: This is sponsored content for Brazil Potash.

There’s a major shake-up coming to the potash sector. And this time, it’s not coming out of Saskatchewan.

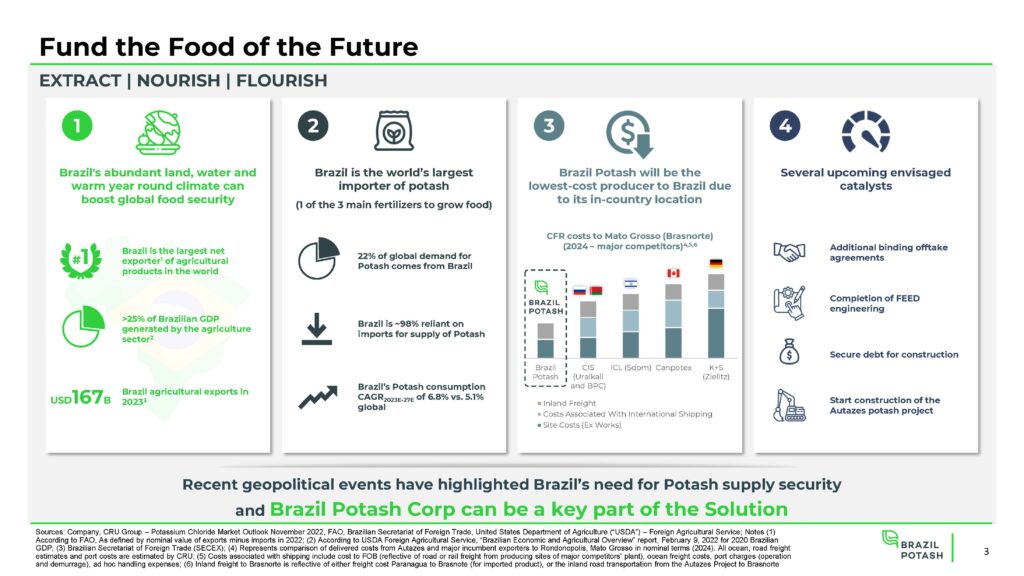

A new empire is being built in this major industry. And it’s being built in a region that imports 98% of its potash needs, despite being the number one global exporter of agricultural products. Setting the company up for a major advantage that no one else in the industry currently has.

Yes, we’re talking about Brazil Potash (NYSE: GRO) and their massive Autazes Project.

Lets dive in.

The High Level

Brazil Potash is a new issue, which listed on the New York Stock Exchange back in late November, at what was arguably, a less than ideal time to hit the market.

Bad market timing aside, the company has assembled a project that is set to dramatically change the landscape of the potash industry within Brazil.

Why? Because once in production, the asset will be one of only two operating potash mines in the country. And the only mine currently in production, which is nearing depletion, supplies a meager 2% of the current potash demand within Brazil.

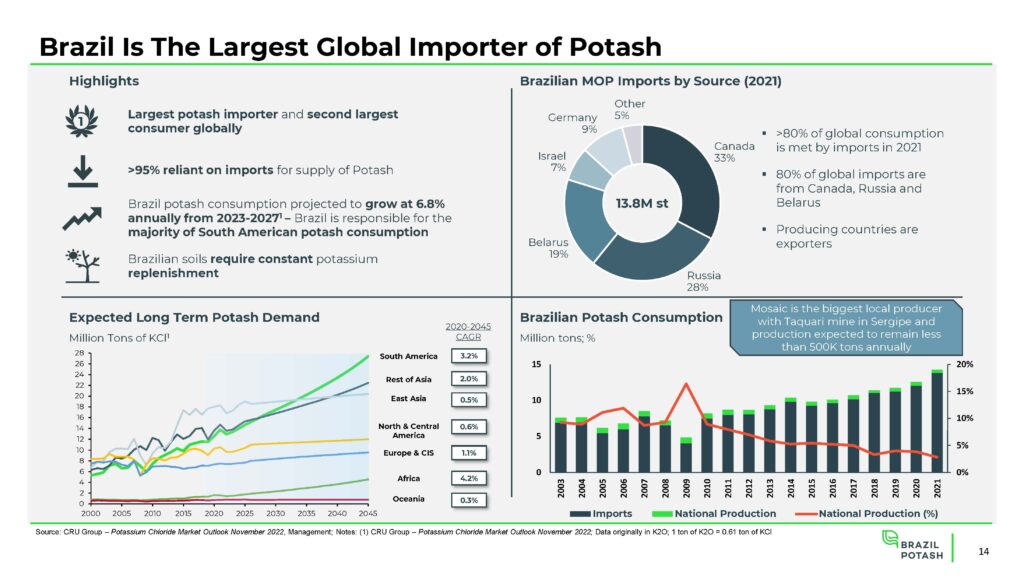

That’s right. 98% of Brazil’s potash requirements are imported, making it the largest potash importer globally. In 2021, the country brought in an estimated 13.8 million tonnes of potash, with those imports largely supplied by Canada, Russia, and Belarus. And if you didn’t catch that, two of those nations are heavily impacted by global sanctions, while the third is being threatened to be tariffed out the wazoo by its largest trading partner.

Yeah, the global potash industry is a geopolitical nightmare right now. Which is why Brazil, who is extremely reliant on imports for this key agricultural input, needs to secure its own supply.

Enter the Autazes project.

The Autazes Project

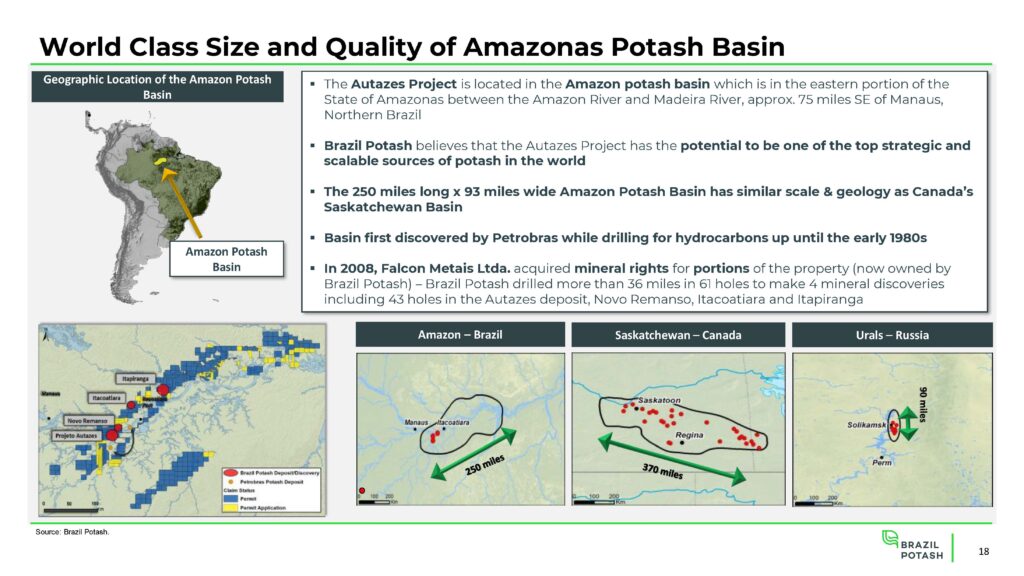

Brazil Potash’s Autazes project is found within the state of Amazonas, between the Amazon and Madeira rivers in northern Brazil. Specifically, the project is found within the recently discovered Amazon potash basin, which is believed to have similar scale and geology to the potash basin in Saskatchewan, a premier region for the production of potash.

For an idea of the size, this basin is measured to be roughly 250 miles in length, and at least 93 miles wide. Much of which Brazil Potash has secured, or is in the process of securing, for its own mining purposes.

Now, I know what you’re thinking. This is the Amazon, we can’t have more deforestation. But worry not. As per a pre-feasibility study conducted in 2022, the Autazes project has been designed as an operation with minimal surface disturbance.

The pre-feasibility study envisions an underground operation, which is to be established in a location that saw its primary deforestation occur decades ago by prior landowners – meaning minimal disturbance to the surface.

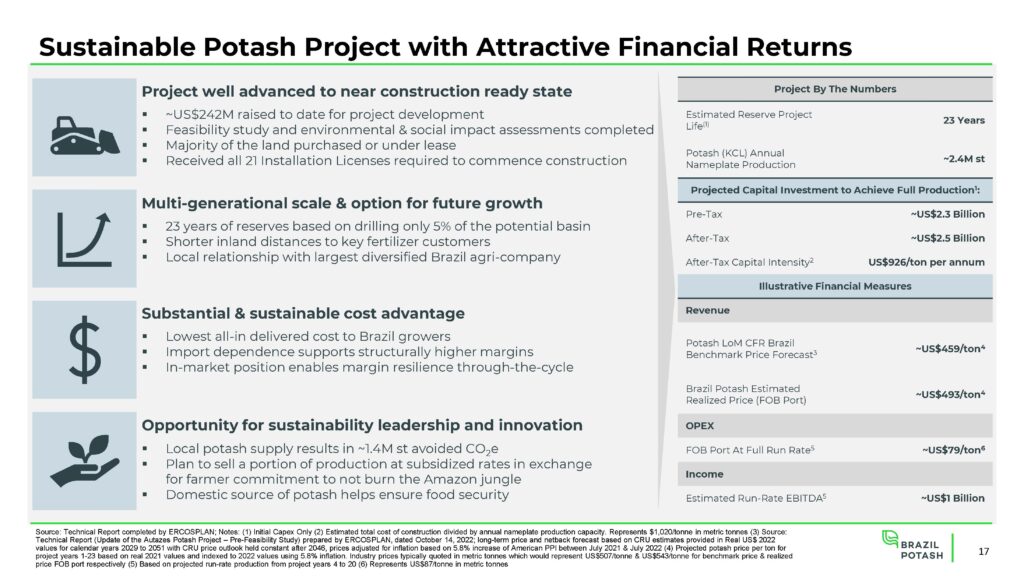

Yet, it’s a long life asset. The pre-feasibility study outline an initial 23 year mine life, with the operation producing 2.4 million short tonnes of potash every year, which is enough to supply about 17% of Brazil’s potash demand. And exploration is expected to yield further opportunities to extend the life of mine. Just 5% of the current project has been explored, leaving plenty of opportunity for expansion.

From a financial perspective, Autazes so far has seen $242 million invested into it over the last 14 years, which consisted of exploration, drilling, engineering, and licensing. Initial capex requirements for the project sit at $2.5 billion.

Once established, the mine is expected to produce potash at a cost of just US$79 a tonne FOB port at full run rates. The current market in Brazil meanwhile suggests that the company can sell each tonne of potash at US$493 a tonne – leading to an estimated run-rate EBITDA of US$1 billion a year for years 4 through 20.

In other words, it’s a money printer under the current market environment.

As it currently stands, the project is fully permitted for construction. And the company has already begun securing off take agreements for future production. To date, 550,000 tonnes of annual production has been agreed to under a take or pay contract with Amaggi, one of the largest private producers of soybeans in the world.

And while Brazil Potash intends to lock up 80% of annual production under ten year offtake agreements, Amaggi has agreed to assist in selling the remaining production not spoken for under a marketing agreement, while also providing river barge transportation.

The Brazilian Market

By now, we’re probably getting some pushback. In full disclosure, the price of potash has been sub $350 a tonne for close to two years. Yes, that is correct. And the industry typically quotes prices in metric tonnes, versus short tonnes used by Brazil Potash, which lowers the pricing a bit more.

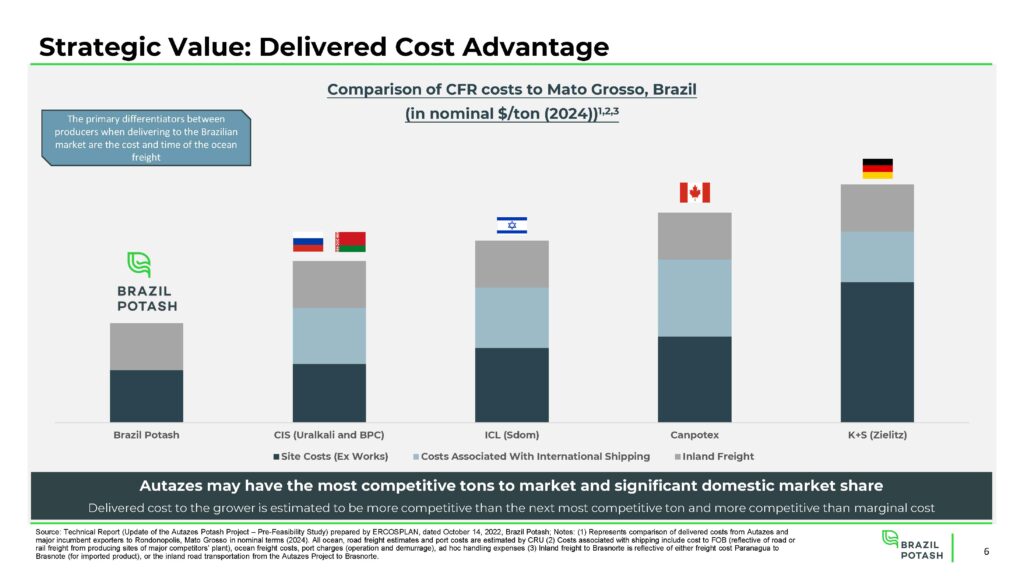

But here’s the thing. We’ve said it multiple times now that Brazil imports pretty well all the potash it uses. And importing costs money. Particularly in shipping. Which in turn bumps up the price of every tonne of potash consumed in the country. Which is a cost that Brazil Potash won’t have to bear, and as a result, the company can use similar pricing but with much higher margins.

Without international shipping costs, Brazil Potash can price its potash at the lowest level in the country, and still manage to make substantial margins on each tonne sold because of this lack of local competition. It’s only costs are inland freight, which the imported potash is also subjected to. In short: it’s the lowest cost producer for brazil.

On top of that, there’s some other factors to consider.

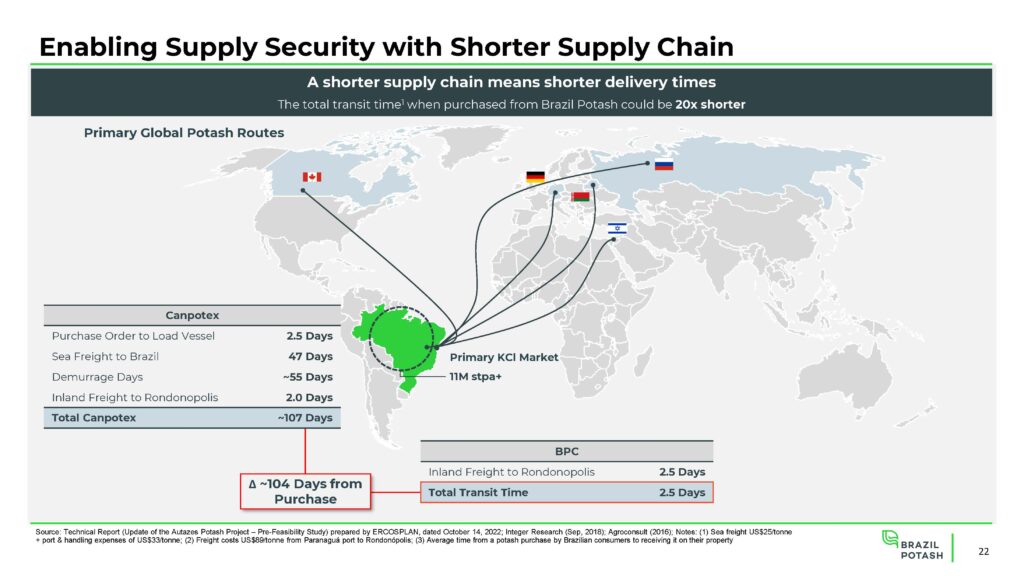

First, is the timeline. If a consumer is purchasing potash from say Canada, there is a major time difference in terms of delivery. First, it takes 2.5 days from the issuance of the purchase order to load the ship with the potash. Then, that ship has to sail for 47 days to get to Brazil. Once in Brazil, it typically lands at a port in the south, where it takes 55 days to be offloaded. Then it has a 2 day inland trip to Rondonopolis, from where it is then distributed. For a total of approximately 107 days in transit.

Potash produced at Autazes comparatively gets shipped by truck 8 miles to the Madeira river, from which point it is loaded on a barge and sent to Rondonopolis. Which takes 2.5 days – a 20x shorter transit timeline than its imported peers. In total, its estimated that Brazil Potash will have transportation costs that are 71% lower versus foreign competitors.

And secondarily, this short transportation route also results in dramatically lower carbon emissions per tonne of potash consumed. Current estimates suggest that CO2 equivalent emissions may be as much as 1.4 million tonnes lower.

Thirdly, Brazil at the national level is extremely concerned about the current state of potash in the country. Recognizing its a national food security issue, the country has assembled a national fertilizer plan, which aims to reduce dependence on imports to 45% by 2050.

As part of that plan, the first step is to increase domestic production of potash to 2.2 million tonnes per year by 2030. And by 2050, the government wants that domestic production to be at at least 6.6 million tonnes. Much of which Brazil Potash would be able to provide.

Wrapping it up

All right, we’re getting a bit long in the tooth here so lets wrap it up.

So what currently stands in the way of Brazil Potash? Well, plainly, it comes down to project funding. The company needs to secure the funds to cover that initial capex figure of $2.5 billion. But progress is already being made on that end, with Franco Nevada currently having an option on a royalty for the project.

Specifically, Franco has the option to purchase a perpetual 4.0% gross overriding royalty on all potash sold from Autazes and affiliated properties. But that royalty won’t come cheap, with the purchase price of the royalty being equal to the amount that would return a pre-tax IRR of just 12.5% to Franco. So think nine figures.

While that royalty would not be enough to get the mine into production, it would cover a substantial portion of the costs associated with getting the project off the ground. And there’s also something to be said about the quality of the asset here when the worlds premier royalty provider is interest in the project.

Outside of Franco, funding options include additional offtake arrangements, debt funding, and other methods of raising capital.

But given the quality of the asset, that shouldn’t be much of an issue for Brazil Potash.

FULL DISCLOSURE: Pursuant to an agreement between 2686362 Ontario Corp (“268”) and Brazil Potash Corp, 268 has been paid $50,000 + GST by Brazil Potash for a period from January 10, 2025 to April 10, 2025. We may buy or sell additional shares of Brazil Potash Corp in the open market at any time, including before, during or after the agreement, to provide public dissemination of favorable information about Brazil Potash Corp.