Matica Enterprises (CSE: MMJ) is not a new name for many that have been involved in the Canadian cannabis sector for the last several months. It has a certain level of notoriety associated with it, and who could miss the fact that it has one of the better tickers out of those in the industry. This is a stock that has been mixed in controversy repeatedly. The twittersphere and numerous discussion groups are evidence of this.

The reason Matica is the topic of focus in todays article is related to that of its private placement. This raise took place a few months ago. It was conveniently timed with a spike in the share price, enabling the company to offer a discount on shares once it broke the $0.05 minimum required by the CSE. There was some controversy surrounding this as well, which we’ll get to in a moment.

It should be noted, that shares purchased in this private placement become free trading on November 10th, 2017.

So, whats the scoop on the raise you ask? The raise itself was fine – for a penny stock. Ultimately, 50.5 million shares were handed out, at a price of $0.05 a piece. These were subject to a four month hold period from that date of closing. Also, each share was accompanied by a full warrant, with an exercise price of $0.10. These warrants expire 18 months from the date of closing. That’s a lot of dilution for a pretty small chunk of change. Regardless, it was their only option to raise funds for their purchase of RoyalMax Biotechnology, a late stage ACMPR applicant.

Where the controversy lies for many, is in the timing of the raise.

You see, Matica Enterprises is the definition of a penny stock. For months on end it sat in the sub $0.05 area. It had a run a couple years back with the first cannabis boom, but it fizzled out fairly quick as a result of a poor deal. Aside from that brief moment, its a stock investors have seen little to no value in.

Until, evidently, a day or so after a private placement was announced.

During this time frame, there was nothing of true significance announced. The initial release detailing the raise identified that a letter for Health Canada had been received, however it was only a “request for readiness” letter, that did not materially change the value of the asset. MMJ stated that it was planning to accelerate construction as a result of receiving the letter in June and thus the raise was needed for funding, as well as for general working capital.

And here’s something that will leave investors with a bad taste in their mouths..

During the time of this price run, long time investors were cashing in. After having held for so long, they took what profits they could when they were available. Unfortunately, this included a number of insiders.

There are several issues related to these filings, both ethical and regulation based.

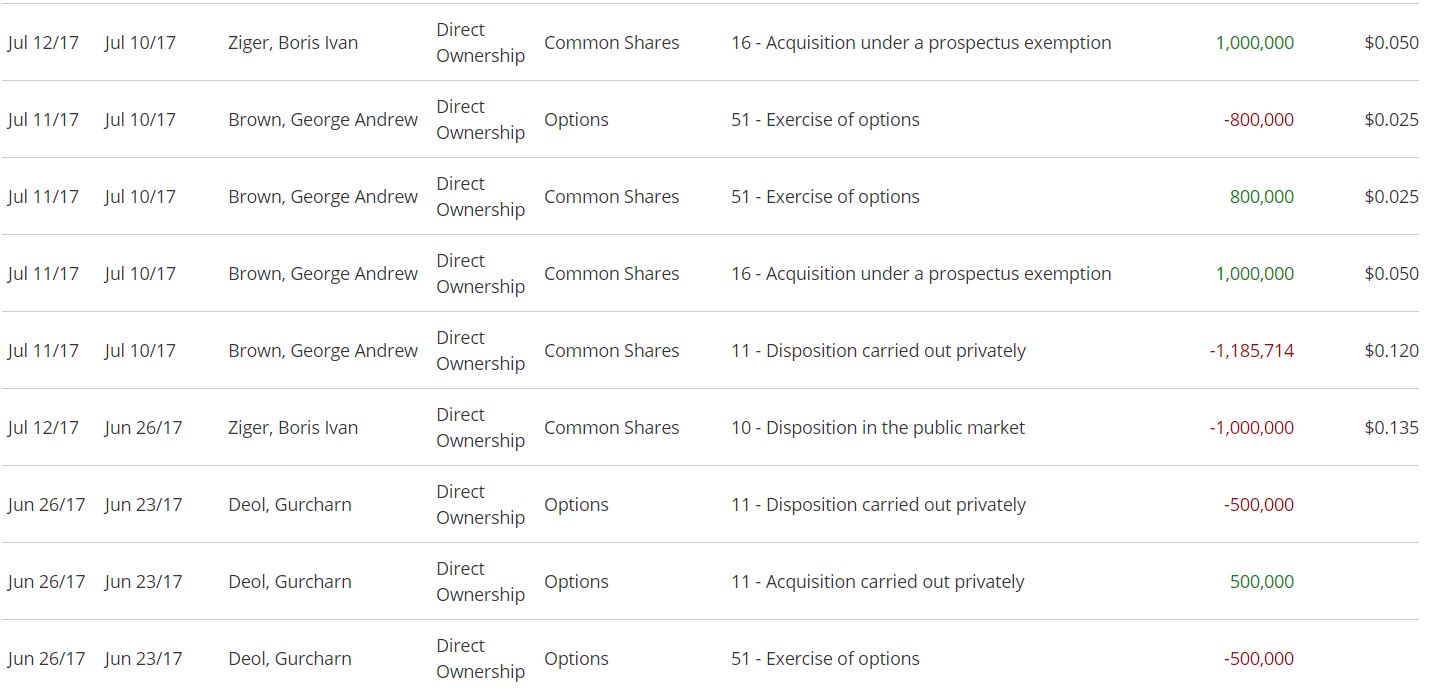

- Three insiders disposed of shares while there was an open private placement for investors, including the CEO and CFO

- CEO Boris Ziger disposed of shares on June 26/17 while the PP was open, and reported it July 12th, after the PP had closed. This exceeded the 10 calendar day insider reporting requirement under the Securities Act.

- CEO Boris Ziger purchased 1M shares in the PP, after disposing 1M on the open market during the raise, effectively giving himself free shares off the backs of investors.

- CFO George Brown sold shares and exercised options on the closing date of the PP, after aquiring 1M in the raise, effectively giving himself free shares.

So, there’s a few questions any investor should have at this point in time. How did the sudden rise in share price happen to be at this exact time? Where did this volume come from? Why were investors suddenly interested, and then disappear without a trace? Why did the CEO delay reporting his disposition of shares by 16 days?

I’ll let readers come to their own conclusions.

Finally, expect some movement this week on the security. Investors in this private placement will have their shares deposited in to their trading accounts this week. Those of whom expected a better return are bound to sell a portion of their position due to the lack of action. At the time of writing, Matica Enterprises sits at $0.09, which is an excellent return for those holding shares at $0.05. Expect some downward pressure on the stock as investors cash out while they can still book a profit.

Expect a full stock analysis on MMJ in the coming weeks.

Read insider reports. Look at the big picture. Think critically. Dive Deep.

Information for this briefing was found via Sedar, and Canadian Insider. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell.