Stompy Bot Corporation (CSE: BOT) is a company that saw an abnormal amount of volume on the market yesterday. While as of late it has had an average daily volume of 1.48 million shares trading hands, yesterday saw a surge in volume to the tune of 14.5 million shares exchanged. This surge in volume comes after a steadily increasing share price for the company, which a few months ago hit a low of $0.01 per share.

Aside from a few select investors making a crazy return on this stock after holding, what does this mean? Typically, it’s an indication of news that is expected to hit the market that has been leaked slightly early. Or, it’s a sign that traders have taken over. With today’s surge in volume, the stock closed above its upper bollinger band seemingly out of nowhere. Seeing market activity such as this has drawn us in to figure out what the likely culprit may be that sent the volume through the roof on Stompy Bot.

Three Positive Indicators for Stompy Bot Corp

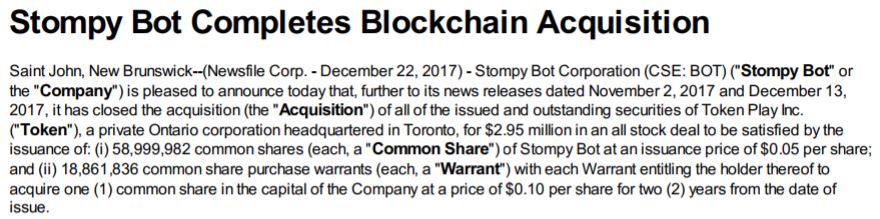

Stormy Bot’s acquisition of Token Play Corp

The key item that relates to the increase in share price as of late for Stormy Bot is undoubtedly the acquisition of Token Play Corp, a company focused in the blockchain sector. Token Play Corp focuses on providing a blockchain based platform for the concept of exchanging in-game currencies and tokens. Although the company currently has no revenues, investors appear to be bullish on the overall acquisition of the company.

Under the terms of the acquisition, Token Play Corp’s current shareholders were offered $2.95 million in an all stock deal. On the date of closing, this translated into Stormy Bot issuing 58,999,982 shares, in addition to 18,861,836 share purchase warrants. These warrants are valid for a period of two years, and contain an exercise price of $0.10. 1,400,000 common shares were also issued in the form of a finders fee related to the acquisition.

With this acquisition, the company has also done some rearranging of its structure. Stormy Bot Productions will now be enlisted as the subsidiary that carries out the production of video games for the company. Meanwhile, Token Play Corp will be a separate subsidiary focused on building its blockchain based platform. Token Play is not currently generating any revenues, while Stompy Bot Productions is generating very minimal revenue figures.

Little information could be found on Token Play outside of news releases issued by Stompy Bot. The company website has minimal details on what exactly it does, and largely contains the same information as that of news releases. In this instance, it appears investors are sold on the rough concept alone that the company currently offers. No estimated date of completion has been provided for the proposed concept.

Management changes to reflect the new company

Within the initial news release issued pertaining to the proposed acquisition of Token Play, it was announced that should the deal occur management would experience a shake up. True to their word, Stompy Bot put this process in to action on January 11, 2018.

Front and center within this news release, is that two new directors had been appointed: Robert Howe and Konstantin Lichtenwald, both of whom have over ten years experience in the financial industry. In the case of Mr. Lichtenwald, he was also appointed the new Chief Financial Officer of the company.

The companies other moves include making the former CEO of the company now the Chief Technology Officer. In his place, Jon Gill, the current chairperson of the board, will serve as the interim Chief Executive Officer.

What does this mean for the company? Likely, it means that change is coming, and fast. Typically when a management shake up occurs to this degree, its a result of new blood coming in to breathe life in to the company. This looks to be no exception, with a completely new Stompy Bot now coming to the market as a result of its recent acquisition in addition to the new management now in place.

Stormy Bot’s financing & new shareholders

Typically, we don’t view financing as a positive item. Financing occurs because companies have either no money, or because they aren’t able to generate the revenues they desire. However there are exceptions to this such as the current pot stock climate, or in cases such as Stompy Bot’s.

So why the positive outlook? Basically, its because not only did the company close the financing, but they also closed it fully subscribed – which isn’t all that common for companies with little attention on them. Furthermore, it closed the financing in under a month which is not common at all for companies of this size, with little previous price action. Being priced as in-the-money certainly helped with this aspect. In addition to this, it picked up some notable investors such as Blackstone Capital Group, and MMCAP International. Safe to say that this is largely due to the potential it held as a blockchain play in a hot sector.

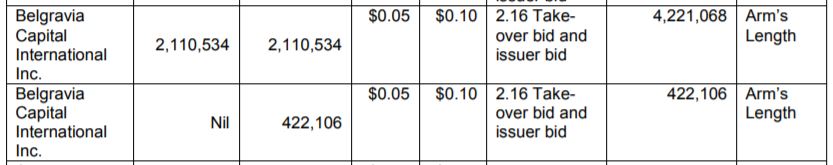

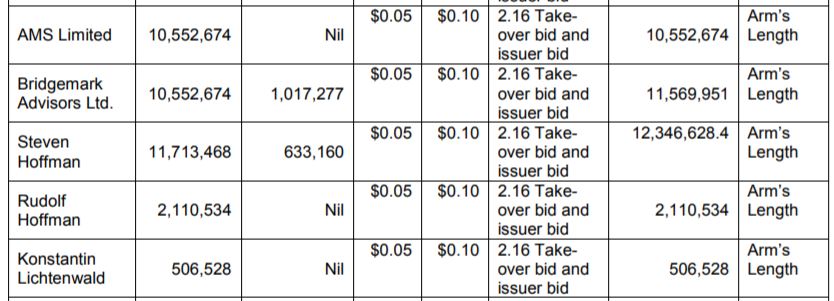

There’s also something to be said about the companies new shareholders as a result of the acquisition of Token Play. Among the names included, are the public company Belgravia Capital International (CSE: BLGV), as well as Bridgemark Advisors Ltd, a company owned and controlled by Token Play founder Steve Hoffman.

Although there is an issue in relation to the cheap price that these individuals received their shares at, it won’t come in to play for a couple months. This is due to the standard four month lock up period that commonly occurs after a financing takes place.

Closing Remarks

Equities related to the blockchain sector have suffered slightly as of late due to the unstable price of Bitcoin. As such, the market has had some of the hype removed from it, except when it comes to the cheap little guys such as Stompy Bot. Strictly on a market cap basis, this is a company that is very cheap relative to some of its peers in the sector. In terms of share price, it’s even cheaper.

As a result of this, don’t be surprised if Stompy Bot trades in a similar fashion to that of something like Data Deposit Box. Due to the cheap nature of the stock, it will likely be taken over by traders as they try to flip it for a few pennies back and forth, as was evidenced yesterday. Depending on your investment style, this might be news to your ears as a result of the high liquidity that the stock will exhibit. For others that wish to take a longer term position on the company, just be aware of the effect that traders can have on a company.

Don’t just follow the hype on a stock. Dive Deep.

Information for this analysis was found via Sedar, The CSE, Token Play, and Stompy Bot Corporation. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.