This morning Cannabis One Holdings (CSE: CBIS) announced they have entered into a letter agreement with Colorado-based cannabis consulting firm Itachi Advisory Group LLC to pursue related assets for cannabis retail, cultivation, and manufacturing operations.

Jeffery Mascio, CEO of Cannabis One

“We believe this new partnership with Itachi will provide CBIS with a profound opportunity to explore the acquisition of a series of accretive transactions designed to rapidly expand our cannabis-related infrastructure.”

Currently in the State of Colorado, it is difficult for public companies to fully own and control dispensaries, instead they own all the key assets associated with the business required for the business to operate. The general idea is that when a bill like HB19-1090 gets passed through, companies like Cannabis One will be able to complete the final stage of the acquisition.

In this case, Cannabis One will be acquiring the key assets of the following:

- 7 cannabis retail locations, which Itachi estimates will generate US$43.5MM in system-wide revenue in 2019. CBIS management projects it can achieve an estimated EBITDA margin of 20% – 30%.

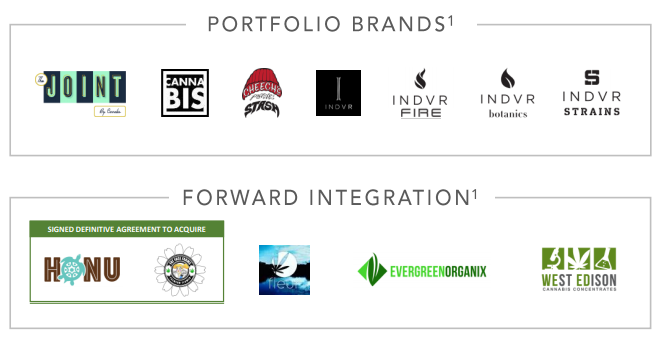

- This pipeline of stores will provide a substantial growth catalyst for the expansion of CBIS flagship asset, The JointTM; rated number one in the state of Colorado on Leafly.

- This pipeline of stores will provide a substantial growth catalyst for the expansion of CBIS flagship asset, The JointTM; rated number one in the state of Colorado on Leafly.

- 7 cannabis cultivation operations, which Itachi estimates will collectively generate US$10.2MM million in system-wide revenue in 2019. CBIS management projects it can achieve an estimated EBITDA margin of 15% – 20%.

- 18,000 sqft medical and recreational cannabis manufacturing facility which the Company anticipates will provide the opportunity for expanded and accelerated throughput of CBIS suite of portfolio brands (INDVR, Fat Face Farms, Honu, Evergreen Organix, EG.O, and Fleur, etc).

The terms of each acquisition will be laid out in the definitive agreements which will be announced in the near future.

FULL DISCLOSURE: Cannabis One Holdings is a client of Canacom Group, the parent company of The Deep Dive. The author has been paid for this work and may or may not own shares of the company. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.