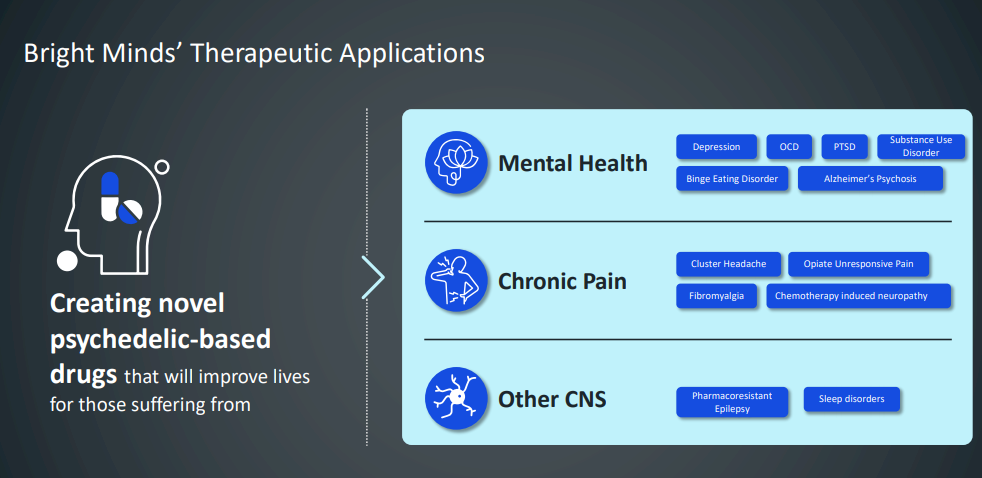

Bright Minds Biosciences Inc. (CSE: DRUG) is a small-cap preclinical biosciences company that is attempting to create the next generation of serotonin drugs that will target specific conditions in the brain which lead to mental health problems and neurological ailments. Serotonin is the key hormone which stabilizes our mood, feelings of well-being and happiness. Even more, it allows brain cells and other nervous system cells to communicate with each other.

Bright Minds’ novel psychedelic and serotonergic compounds are designed to provide substantial therapeutic benefits with minimal side effects. They represent the next generation of more efficacious treatments. First generation psychedelic compounds like psilocybin, which is the psychoactive and psychedelic compound found in magic mushrooms, were somewhat effective against, for instance, major depressive disorder (MDD) but cause major side effects.

The Investment Thesis

The investment thesis for Bright Minds Biosciences is based on the following:

- Bright Minds’ drugs may be able to reset the functional connectivity of brain circuits by selectively affecting a key group of receptors. Compromised connectivity may underlie symptoms of MDD. In contrast, the first-generation drug psilocybin is equally potent at both the “good” and “bad” receptors.

- Bright Minds’ compounds that bind to 5-HT2A and 5-HT2C receptors could likewise have salutary effects on seizures, pain and post-traumatic stress disorder (PTSD).

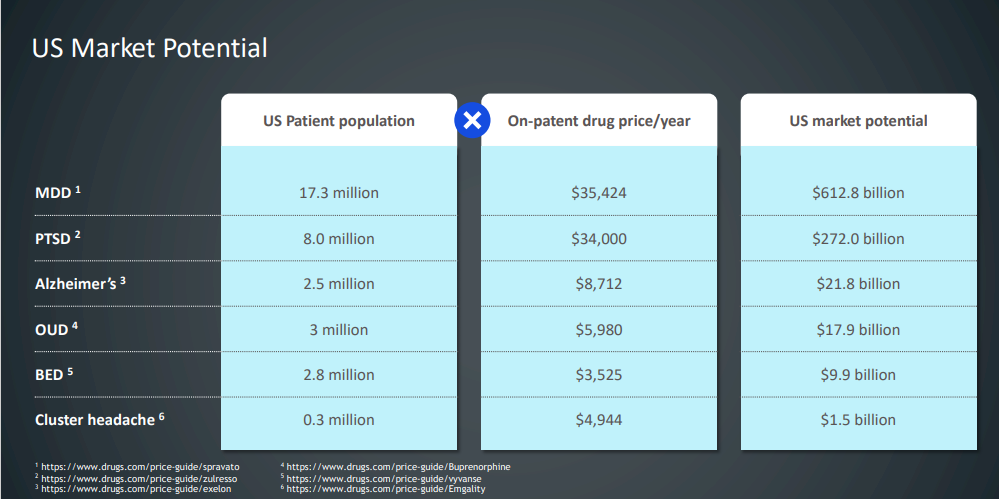

- The potential market for Bright Minds’ drugs is enormous. The size of the U.S. market alone for six afflictions which the company’s compounds may be able to address exceeds US$900 billion.

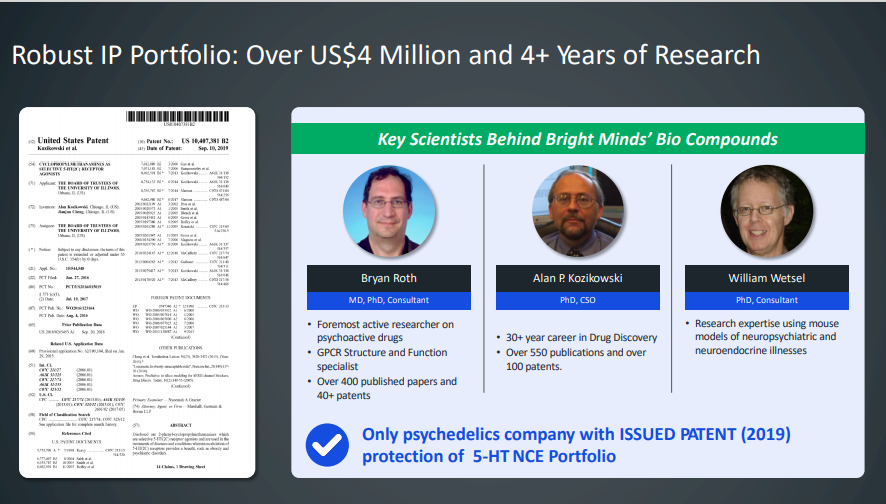

- The company’s research staff (plus advisors) is comprised of a large and accomplished group of scientists and doctors, including at least 13 Ph.Ds. These professionals have decades of experience.

- Bright Minds is the only psychedelic drug company with patent protection for its 5-HT new chemical entity (NCE) portfolio.

- After raising $25.9 million in a public offering of stock and warrants in mid-March 2021, Bright Minds appears to have sufficient cash and liquidity to finance its near- and intermediate-term growth plans. The company had $2.1 million of cash as of December 31, 2020.

Business Model

Bright Minds’ business model consists of the following:

- Neuropsychiatry

- Pain and Seizures

- Pipeline of Compounds

NEUROPSYCHIATRY

Bright Minds’ compounds are designed to treat patients suffering with major depressive disorder, but which is resistant to selective serotonin reuptake inhibitors (SSRIs), more commonly known as antidepressants. Such patients may be treated with nasal ketamine (a strong antidepressant which in higher dosage is used as an anesthetic) or electroshock therapy.

Even for those MDD patients which can be treated with SSRIs, Bright Minds’ drugs could potentially be preferred as they may not cause weight gain, worsening sleep or worsening impulsivity – typical side effects of SSRIs.

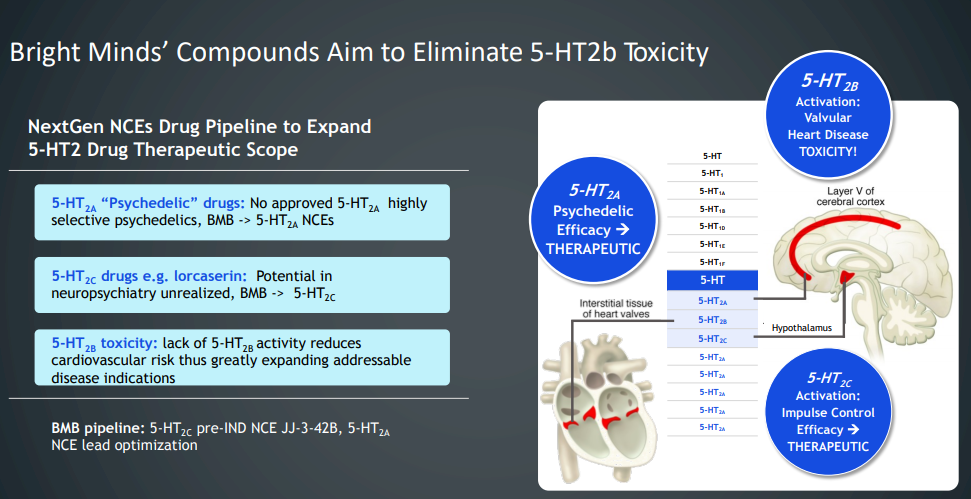

A receptor is a structure on the surface of a cell that responds specifically to a particular neurotransmitter, hormone, antigen, or other substance. A category of 5-HT receptors, or serotonin receptors, are found in the central and peripheral nervous systems. There, signaling molecules are released by nerve cells and bind with receptors on another neuron, a process called neurotransmission. Three members of 5-HT receptor family — 5-HT2A, 5-HT2B and 5-HT2C – are noted for their importance as targets of serotonergic psychedelic drugs, of which mescaline, LSD, psilocybin, and DMT are the best known.

Drugs which have potency at the 5-HT2A and 5-HT2C receptors have a therapeutic benefit. In more detail, compounds which can specifically target the 5-HT2A and 5-HT2C receptors can improve psychedelic efficacy and impulse control, respectively. However, a drug which impacts the 5-HT2B receptor could cause valvular heart disease. Bright Minds’ drugs are designed to target these first two receptors, thereby eliminating the toxicity risk associated with the 5-HT2B receptor.

PAIN AND SEIZURES

Bright Minds’ 5-HT2A and 5-HT2C agonists, or compounds which initiate a psychological response when combined with a receptor, could allow patients to better manage their pain, perhaps without the side effects of other treatments.

The company’s 5-HT2C agonists could also play an important role in the treatment of epilepsy, a disease afflicting 60 million people worldwide. Forty percent of epilepsy patients build up a resistance to the drug treatments they receive, resulting in increased seizures.

PIPELINE OF COMPOUNDS

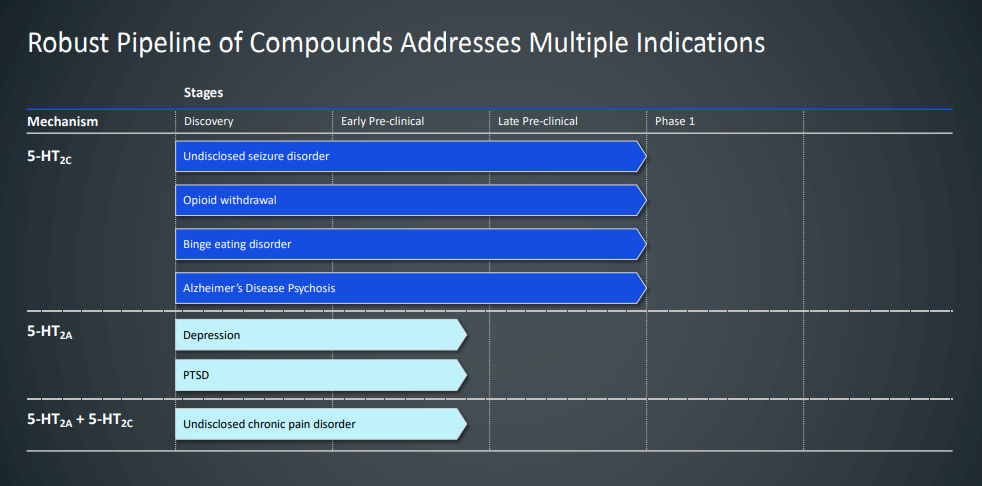

Bright Minds is assessing the efficacy of its drug compounds through seven programs involving its 5-HT2A and 5-HT2C agonists. Four of the programs are in the late preclinical stage.

The Management Team

Ian McDonald, CEO and Director

Mr. McDonald is an entrepreneur and former Investment Banker. Prior to BMB, he served on the management team at a TSX-listed gold mining company. In that capacity, McDonald developed and implemented the corporate strategy as it relates to M&A and capital markets resulting in a $160 million sale within one year.

Previously, he worked in a senior role at a Canadian Investment Bank and in private equity in Vancouver, London and Toronto. Under McDonald’s guidance, clients raised hundreds of millions of dollars in capital. Ian has served as a member of the Board of Directors of several TSX Venture Exchange, Canadian Securities Exchange-listed and private companies.

Dr. Alan Kozikowski Ph.D, Chief Scientific Officer and Director

Dr. Kozikowski, trained at Michigan, Berkeley and Harvard, began his career as an organic chemist at the University of Pittsburgh. Following his interests in the applications of chemistry to biological problems, he moved on to the Mayo Clinic and then assumed a position at the Georgetown University Medical Center as Director of the Drug Discovery Program. After a decade at Georgetown, he led a research group at the University of Illinois at Chicago in the Department of Medicinal Chemistry.

Specifically, Dr. Kozikowski’s continued efforts to identify possible treatments for Alzheimer’s disease have resulted in the advancement of the natural product huperzine A to the clinic. He has also developed a new PET imaging agent for use in prostate cancer diagnosis, which is in the clinic. Other novel inventions have been created, with a number of these moving into the clinical realm. A new company Apotheca Therapeutics Inc. has been founded to advance small molecule kinase inhibitors for the treatment of brain cancers.

Dr. Kozikowski has experience running biotechnology companies including CEO of Starwise Therapeutics developing novel HDAC6 inhibitors for use in Fragile X syndrome, Charcot Marie Tooth disease and Rett therapy. Dr. Kozikowski was also president of Vela Therapeutics focused on rapidly advancing therapies for these orphan indications.

Dr. Kozikowski is world renown for his work on psychoactive substances including novel analogs of PCP and cocaine which showed potential to decrease harm to users.

Dr. Revati Shreeniwas, MD, Chief Medical Officer

Revati Shreeniwas, MD, prior to entering industry, Dr. Shreeniwas was a practicing physician and served as faculty at Stanford and Columbia University. Dr. Shreeniwas has spent the last two decades as a physician researcher in the pharmaceutical industry. She is passionate about bringing novel therapeutics to patients with an unmet clinical need.

Dr. Shreeniwas has served as an executive level clinical expert with operational knowledge in leading complex programs for a range of therapeutics (Phase I-IV studies). She has worked on several drugs that have gone on to be approved and are commercially successful, including Tracleer, Lexiscan, Natrecor, Rytary, Esbriet, Sunosi, and Talzenna.

Ryan Cheung, Chief Financial Officer

Ryan Cheung is the founder and managing partner of MCPA Services Inc., Chartered Professional Accountants, in Vancouver, B.C. Leveraging his experience as a former auditor of junior venture and resource companies, Mr. Cheung serves as a director and officer or consultant for public and private companies, providing financial reporting, taxation and strategic guidance.

He has been an active member of the Chartered Professional Accountants of British Columbia (formerly Institute of Chartered Accountants of British Columbia) since January 2008. Mr. Cheung holds a diploma in accounting from the University of British Columbia and a Bachelor of Commerce in international business from the University of Victoria.

Risks

We would advise investors to consider the following risks:

- Developing Effective, Safe Drugs Is Inherently an Extremely Risky Endeavor. Despite the impressive research work the company has already accomplished and its experienced staff of scientists, it is possible that Bright Minds’ drug compounds will not prove to be efficacious in humans.

- Bright Minds Could Have to Raise More Cash Through Stock Sales. If the company’s drug development plans are successful, many more tests and eventually human trials will be required. In turn, Bight Minds will probably have to raise equity to fund these follow-on tests. In such a scenario, the company would likely be selling new equity at prices much higher than its current valuation (a high-class problem).

Comparables

Below we list a few comparable companies to Bright Minds.

| Company | Ticker | Market Capitalization (C$ in millions) | Comments |

| COMPASS Pathways plc | NASDAQ: CMPS | $1,680 | Develops a psilocybin therapy for treatment-resistant depression. |

| Mind Medicine Inc. | NEO: MMED | $1,390 | Develops psychedelic-inspired medicines based on substances including Psilocybin, LSD, MDMA, and DMT. |

| Bright Minds Biosciences | CSE: DRUG | $55 | The only psychedelic-related firm with patent protection. |

| PsyBio Therapetics Corp. | TSVV: PSYB | $36 | Develops novel formations of psychoactive medications for treatment of mental health and other disorders. |

Catalysts

Some potential catalysts that could have a significant impact on Bright Minds’ share price include:

- Progress of Clinical Trials. As Bright Minds’ clinical trials progress, investors could become increasingly optimistic about the company’s prospects. The markets for its potentially life-changing drugs would be enormous.

- Valuation of Bright Minds Stock Normalizes Versus Peers. Similar psychedelic drug development companies, most notably COMPASS Pathways and Mind Medicine, trade at ten or more times the stock market valuation of Bright Minds. This, despite their having fewer drugs in evaluation programs and most of their potential drugs being generic. All of Bright Minds’ drug programs are for much higher priced new chemical entities.

Conclusion

Bright Minds is developing 5-HT2A and 5-HT2C agonists or drug compounds that could potentially be breakthroughs for patients suffering from MDD and other serious disorders. If these drugs progress positively through a number of future tests, the company’s value could increase dramatically, particularly given the drugs’ huge possible addressable markets and the much higher valuations of comparable companies.

FULL DISCLOSURE: Bright Minds Biosciences is a client of Canacom Group, the parent company of The Deep Dive. The company has been compensated to cover Bright Minds Biosciences on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.