Perhaps the biggest development in the junior miner sector over the past two years has been Great Bear Resources’ (TSXV: GBR) discovery of a high-grade and extensive gold system at its Dixie Project in the Red Lake district of Ontario. The project has produced assay results such as a 20.6-meter intercept containing 31.3 grams of gold per tonne and another separate 104- meter length with a 2.67 gram-per-tonne gold concentration.

In turn, this discovery has triggered literally an exponential increase in GBR’s share price. Prior to the first discussion of the discovery in August 2018, Great Bear traded at just over $0.50 per share; today the stock trades 3,300% higher at around $17.75 per share, or an equity capitalization of around $900 million.

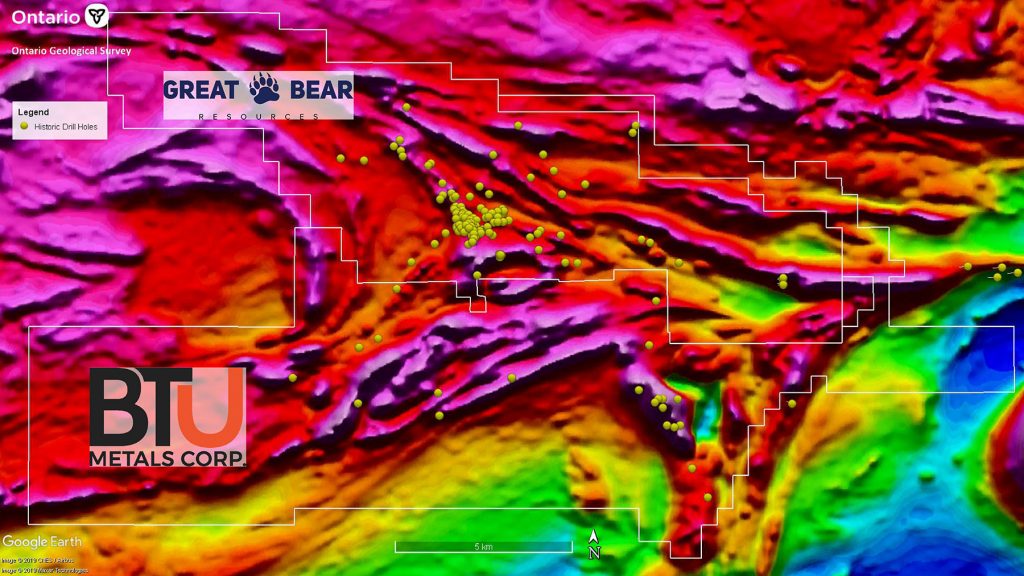

We point out that another company, BTU Metals Corp. (TSXV: BTU), which has an equity market cap of just $19.5 million, owns nearly 20,000 hectares of land which is contiguous with and surrounds GBR’s Dixie Project. In addition, BTU’s underexplored Dixie Halo Project shares remarkable geological symmetry and the same structural trends as GBR’s Dixie Project.

Only about 25 holes have ever been drilled on Dixie Halo versus about 150 at Dixie before Great Bear bought that property. Furthermore, assay results from a November 2019 drilling program in another sector of Dixie Halo suggest that the property might contain a large Volcanogenic Massive Sulfide (VMS) system. VMS deposits typically comprise 100 million tonnes or more of mineral resources and hold substantial quantities of copper, as well as smaller amounts of gold and silver.

Given these attributes and the sharp underperformance of BTU’s shares thus far in 2020 compared with the average junior minor – BTU shares are down 37% while The VanEck Vectors Junior Gold Miners ETF (NYSE: GDXJ) is up 44% – BTU may represent an interesting speculative play. If BTU were to announce any significant exploration success, the value of shares could potentially reset dramatically higher.

Dixie Halo Drilling Program

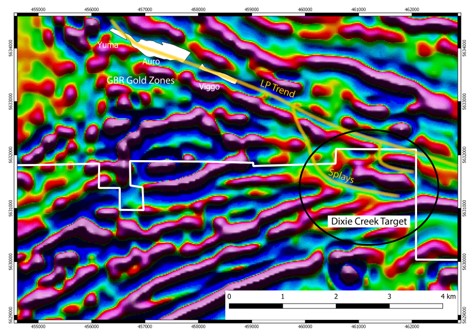

Great Bear’s key gold discovery is in the LP Fault. The LP Fault marks a contact between mafic and felsic/intermediate rocks. A mafic rock is rich in magnesium and iron, while a felsic rock contains significant amounts of feldspar and silicon. Note especially that all three of BTU’s Dixie Halo target areas are along mafic-felsic contact areas.

The below figure shows GBR’s LP Fault Trend, as well as its gold zones and gold occurrences, and their spatial relationship to BTU’s Dixie Creek Target. Note that many of the gold occurrences are found in splays, or fault branches, off a major fault, and that many of those splays are on BTU’s property. In greenstone belts like the Red Lake district, history has shown that splays may contain as much gold as the main faults.

Potential VMS Discovery

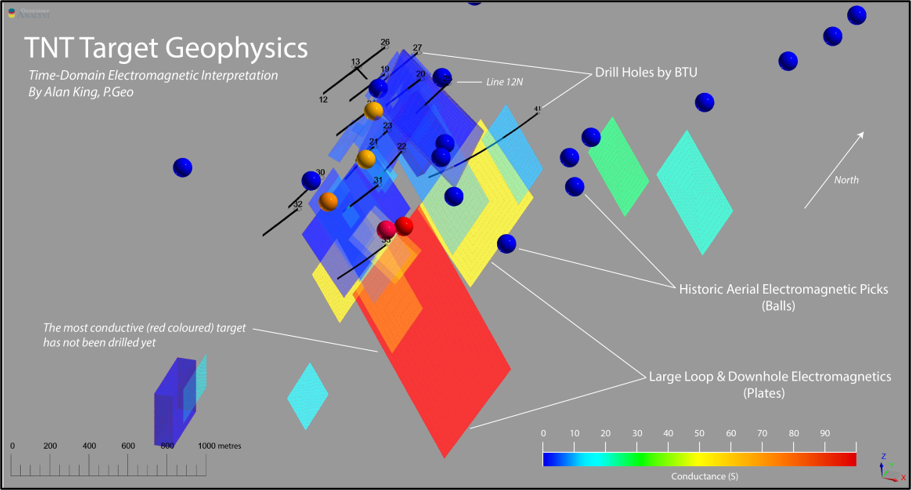

A depiction of the conductance, measured in Siemens (S), found in BTU’s potential VMS discovery, termed the TNT Target, is shown below. The degree to which a rock formation conducts electricity is historically a key indicator of the presence of a VMS system; such deposits typically have conductance readings of 25-200 S or more. The red (and, to this point, completely undrilled) section in the figure below is well within that conductance target range.

VMS deposits represent one of the richest sources of copper (Cu), lead (Pb), zinc (Zn), and other metals. Indeed, VMS deposits comprise a cumulative 22% of the world’s Zn’s deposits, 10% of the Pb, 6% of the Cu, 9% of the silver, and 2% of the gold.

Gold In Till Target Area

A third promising area in the Dixie Halo region is the Gold in Till target. There the company has uncovered many till samples with high concentrations of gold grains, some with more than 40 grains, equivalent to about three grams of gold. (One gram of gold equals 15.43 grains.) An expanded till sampling program is ongoing.

Conclusion

BTU could prove to have very valuable mineral resources, as the same gold trend that runs through GBR’s Dixie property may very well extend into BTU’s. Also, BTU’s TNT Target could be a large VMS deposit. Of course, it is also possible that these positive scenarios do not fully play out.

However it appears that the market may be reflecting only a very small probability that either (very plausible) positive scenario prevails. As an aside and a constructive factor for its exploration program, BTU has $1.2 million in cash and no debt, so that it has sufficient cash to continue its exploration programs.

Information for this briefing was found via Sedar and BTU Metals Corp. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.