On March 30th, BMO Capital Markets raised their rating and 12-month price target on Cameco (TSX: CCO). BMO raised their rating from market perform to outperform, and increased their price target from $33 to $42. The analyst indicated that the lift was due to the limited number of listed producers, the rise in countries wanting low carbon nuclear generation, and the security of supply becoming a forefront issue.

“Cameco’s advantageous geographical production base and its position as the largest and most liquid uranium stock means there should be further upside to its stock price.”

Cameco currently has 13 analysts covering the stock with an average 12-month price target of C$38.53, which represents a 6% upside to the current stock price. Out of the 13 analysts, 4 have strong buy ratings, 7 have buy ratings while the last 2 analysts have hold rating on the stock. The street high sits at C$45 from TD Securities, which represents a 24% upside to the current price.

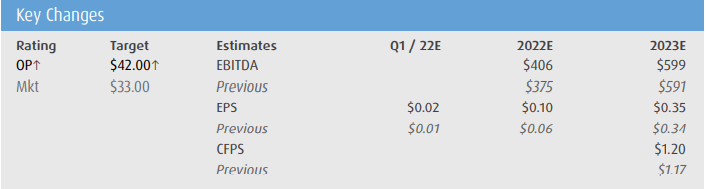

BMO has gone ahead and increased its near-term uranium prices by 13% for 2022 and 3% for 2023, to an average of US$51/lb and US$46/lb respectively. For the company, this means that they now expect “a modest” increase in Cameco’s near-term cash flow as well a their EBITDA.

The analyst at BMO says that the change in global sentiment will work out for Cameco, as the support for nuclear power continues to grow in countries all around the world, which means governments are looking at either increasing the lifespan of working nuclear facilities or reopening previously closed nuclear power plants. Either option will increase the near-term demand, which is “underpinning increasingly positive sentiment in the sector.”

Lastly, they add that the tragic events in Ukraine “has brought security of supply into sharper focus,” which includes many commodities such as Uranium, as it offers a low carbon alternative to fossil fuels. BMO believes that due to Cameco’s “advantageous location” as it’s close to the world’s largest nuclear fleet in the U.S, “we believe Cameco is increasingly likely to benefit from positive contracting discussions with utilities following on from the promising start reported this year.”

Below you can see BMO’s updated 2022 and 2023 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.