Last week, Medipharm Labs (TSX: LABS) reported their second-quarter earnings. Revenue came in at $13.9 million, a 25% increase quarter over quarter but down 56% year over year. The quarter over quarter increase was due to higher bulk selling and higher shipments of formulated products throughout Canada. Cash and equivalents were $27.9 million.

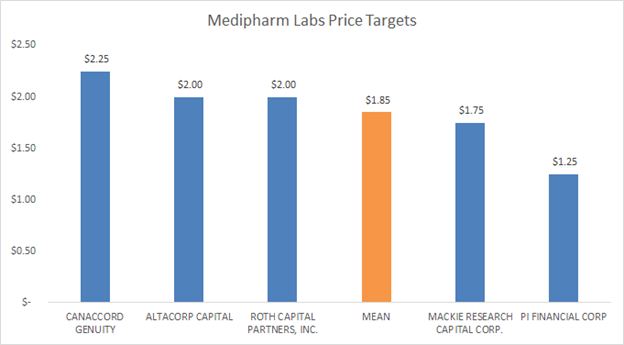

Medipharm Labs has five analysts who have price targets or recommendations. One analyst has a strong buy, another one has a buy, and the remaining two analysts have hold recommendations. The mean 12-month price target is C$1.85, with the highest target coming from Matt Bottomley at Canaccord Genuity.

Bottomley has a C$2.25 price target, or a 165% upside on the stock and currently holds the only strong buy recommendation on the stock. The lowest price target comes from Devin Schilling at PI Financial with a C$1.25 price target, or a 47% upside and currently holds a hold recommendation.

Matt Bottomley from Canaccord reiterated their Speculative Buy and C$2.25 price target in their note. He states, “LABS domestic markets undergoing revenue transformation while international ops secure first revenues.” Bottomley says that 2020 for Medipharm Labs will be a transition year while the company builds out new services, but believes the second half of 2020 to be the inflection point for when the new services will bear fruit and Medipharm sales will pick up.

Medipharm revenues did beat Canaccord’s estimate of C$12.8 million, Their 15.9% gross margins however came in a lot lower than Canaccords 19.5% estimate. Canaccord chalks the miss up to a higher inventory cost and is in a weaker pricing environment. Adjusted EBITDA came in better than Canaccords estimate of -C$3.4 million as well.

Although Canaccord reiterated their C$2.25 price target and Speculative Buy recommendation, Bottomley has updated their 2020 and 2021 revenue estimates to C$63.1 million and C$118 million, respectively.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.