Antibe Therapeutics Inc. (TSX: ATE) recently reported their full-year 2022 results, wherein the company reported it ended the year with $55 million in cash and equivalents, which provides the company with “over 2 years of runway.” The company reported a net loss of $25.1 million, or an earnings per share of ($0.50) for the year. SG&A was $5.4 million, while R&D was $14.4 million for the year ending March 31, 2022.

The CEO commented, “Our data suggest that the drug can deliver the onset of action and pain relief required for commercial success in acute pain indications – an exciting prospect in a massive market that’s seen minimal innovation over the last 20 years.”

Additionally, the company said that it signed a binding agreement to sell Citagenix for $6.5 million, including milestones in an all-cash transaction. They also filed a patent for “specialized pain indication for ATB-352, with potential for IP protection to extend into the 2040s,” and are revaluating, “two promising molecules to select a lead candidate for inflammatory bowel disease program.”

Antibe Therapeutics currently has 6 analysts covering the stock with an average 12-month price target of C$4.86, or an upside of 683%. Out of the 6 analysts, 4 have strong buy ratings while the other 2 analysts have hold ratings on the stock.

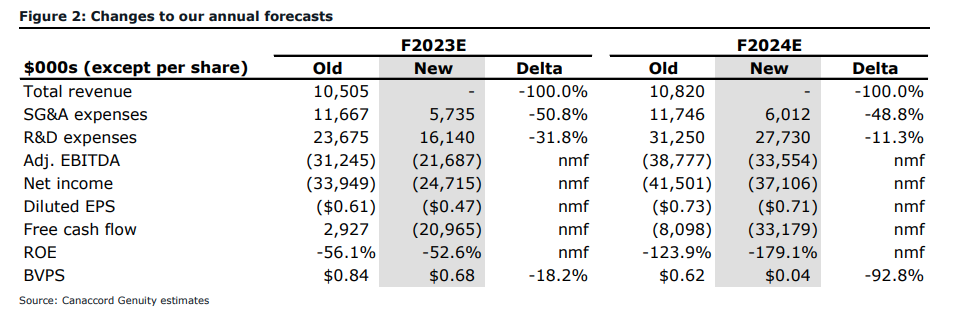

In Canaccord Genuity’s note on the results, they reiterate their hold rating but lower their 12-month price target to C$0.70 from C$1.20, saying that the price target cut was due to the sale of Citagenix.

On the updated development pipeline, Canaccord says that the delayed Phase 2 bunionectomy trial for otenaproxesul that was supposed to start in the fourth quarter of 2022 is now being delayed to happen sometime during the first half of 2023 due to changes in the program.

The company will be replacing the healthy volunteer PK/PD studies with a Phase 2 wisdom tooth extraction study, which the company believes “should provide a more informative data set of the targeted postoperative patient group at no additional cost.”

On the sale of Citagenix, Canaccord does not have much to say other than that though this was unrelated to the biotechnology vertical of Antibe, it was generating between $9 and $10 million of revenue for the business to help fund the R&D. While the sale consists of $3.5 million in cash, distributed in four equal annual payments, the other $3 million is in earnouts.

Lastly, Canaccord says, “Despite the encouraging data out of otenaproxesul’s PK/PD studies, we still believe it is too early to add the acute pain program to our valuation and would prefer to wait until the commercial Phase 2 trial begins.”

Below you can see their updated estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.