On August 31, Alimentation Couche-Tard’s (TSX: ATD.B) will be reporting its fiscal first quarter financial results. Then the webcast will be held the following day at 8:00 AM EST. Canaccord Genuity released their estimates while reiterating their hold rating and $48 12-month price target. They say that they hope to see “signs of normalization point to improving fuel volumes and same-store sales.”

Alimentation Couche-Tard has 16 analysts covering the stock with an average 12-month price target of $55.40, or just an 8% upside. The street high sits at $65 while the lowest comes in at $45. Out of the 16 analysts, 3 have strong buy ratings, 10 have buys and 3 have hold ratings.

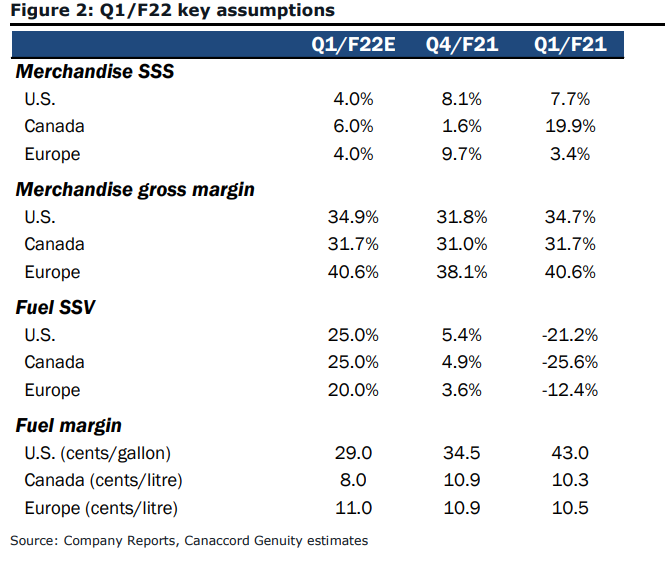

Canaccord’s estimates are slightly ahead of the street consensus. They are forecasting EBITDA to come in at $1.272 billion and an EPS of $0.67. This is slightly higher than the streets $1.221 million EBITDA estimate but below the streets $0.71 EPS estimate.

They also believe that the company has soft comparables for fuel volume due to COVID-19 but believe that margins will show that they are normalizing. Travel volumes were down “21.2%, 25.6% and 12.4% YoY in the US, Canada, and Europe respectively relative to pre-pandemic levels.” They are fairly bullish on management’s ability to deliver robust same-site fuel volume as they forecast growth to be 25% in the US and Canada while 20% in Europe.

Canaccord is not as bullish on fuel margins, which will be offset by the fuel volume. They write, “Market data indicate margins remain high relative to pre-pandemic levels, although we expect margins to compress YoY as supply-side dynamics (such as the ongoing transport truck driver shortage) normalize.”

Below you can see Canaccord’s first quarter 2021 key assumptions.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.