This morning Canaccord Genuity resumed their coverage on Xebec Adsorption (TSXV: XBC) with a Speculative Buy rating and a C$6.00 12 month price target. Yuri Lynk, Canaccord’s analyst, comments, “gas utilities are badly trailing their electric peers in the race to decarbonize to meet stringent environmental standards.”

In Lynk’s view, renewable natural gas that comes from upgraded methane via biogenic waste can be a part of the solution. Assuming no pipeline leaks, renewable natural gas can be produced in a way where it is carbon neutral and possibly carbon negative. It is also, “completely interchangeable with conventional (fossil-based) natural gas, allowing distribution through existing natural gas pipelines,” he says.

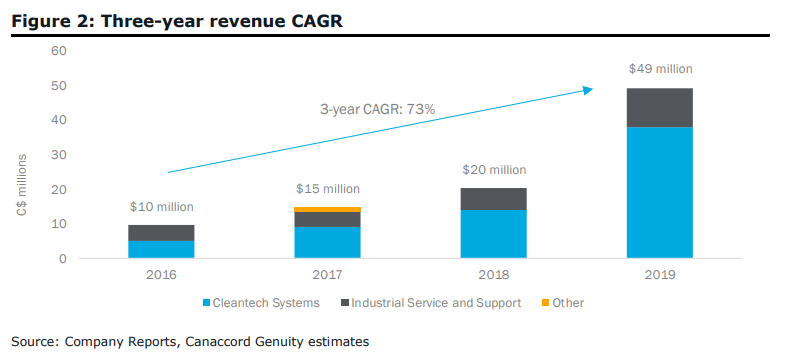

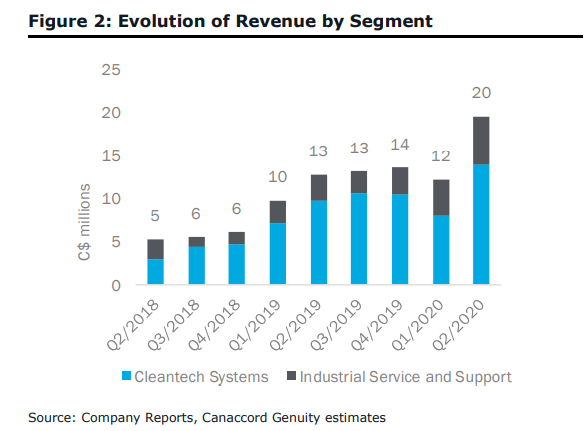

Lynk sees renewable natural gas demand increasing exponentially in some regions, most specifically North America and Europe. Xebec’s trailing-twelve-month revenue increased 71% year over year to almost $60 million, only a fraction of the $11 billion addressable markets for its biogas upgrading equipment.

“Xebec trades at 3x EV/Sales (2022E) vs. peers at 5x,” says Lynk and gives the reason for resuming coverage with a speculative buy rating as, “reflecting the company’s modest profitability at this stage, its small size, and the “lumpiness” of order intake.”

Lynk’s investment highlights that reportedly make this company a buy is how Xebec is a profitable and fast-growing renewable energy equipment provider. Their Cleantech Systems segment, which does 77% of their sales, designs and manufactures equipment that separates and purifies biogas, recovers hydrogen, separates air, and enriches oxygen for medical applications.

The second highlight is that the rest of their sales comes from their legacy Industrial Services & Support and has an “attractive roll-up opportunity that can build a stream of highly recurring revenue.” Lynk believes that as the footprint grows, it should position Xebec to secure O&M contracts on the back of equipment sales from the Cleantech segment.

The last crucial investment highlight is that Xebec is led by an experienced management team aligned with shareholders as the CEO, President, and Co-founder Kurt Sorschak owns 7% of the company.

Lynk forecasts revenue to increase 67% this year to $82 million, which is in line with management’s guided $80 – $90 million. He says that to be compliant with the new regulations to limit the spread of COVID-19 when installing equipment ,and higher ERP implementation and R&D expenses, it will likely destroy margins. Still, he sill expects Xebec to be profitable this year and generate $12 million in EBITDA in 2021.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.