This morning, Canaccord Genuity initiated coverage on Else Nutrition (TSXV: BABY) with a C$6.50 price target and a speculative buy rating. This is the first bank to cover Else Nutrition.

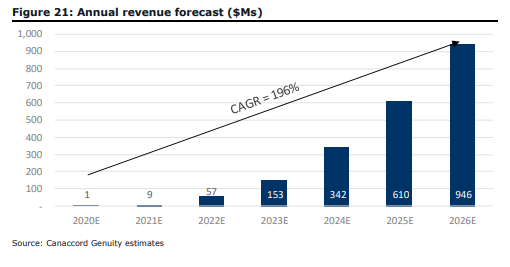

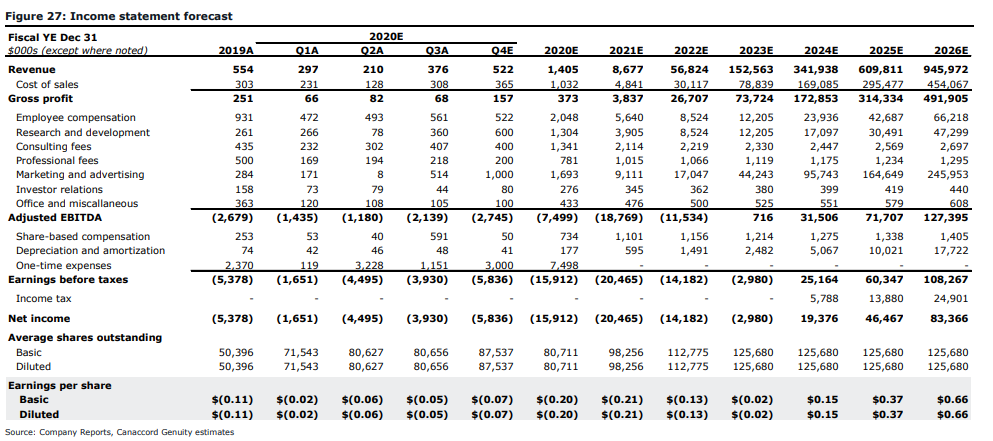

Tania Gonsalves, Canaccord’s analyst, says that “Else is building out a portfolio of products centered on this novel nutrition formula. Including sales of infant formula, toddler/children complete nutrition drinks, and complimentary nutrition baby food,” and is forecasting Else’s revenues to go from $1.4 million today to almost $1 billion in 2026, which is roughly a 200% CAGR.

Else Nutrition has developed the first 100% plant-based non-dairy and non-soy formula that mimics breast milk. It’s made up of 92% almonds, buckwheat, and tapioca.

Tania first talks about their balance sheet and cash going forward; she estimates that Else has $29.6 million in cash currently following the raise conducted in October, and estimates that two $30 million equity raises will occur in the future – one each in the fourth quarters of 2021 and 2022. She says that “Based on our forecast burn rate of just under $6.0M per quarter until 2025, when FCF turns positive, we estimate Else has sufficient liquidity to fund operations until Q1/22.”

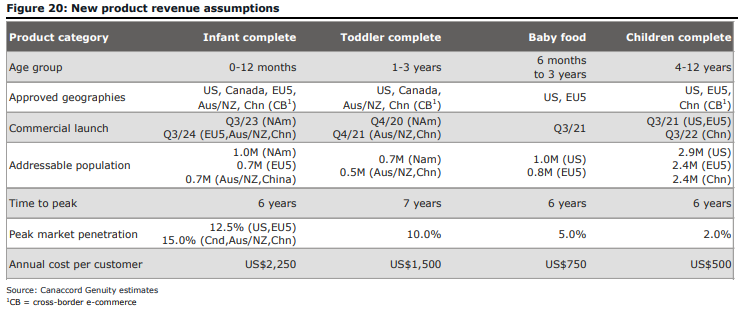

The next thing she discusses is that their financial forecast leaves room for upside. She breaks down Else’s market share, “At peak, we forecast Else wins 15% of specialty infants, 10% of toddlers, 5% of babies and 2% of children,” in the U.S, EU, Canada, Australia / New Zealand, and/or China.

Gonsalves states, “The global baby food market is worth ~US$75.0B today, with infant formula representing two-thirds of this and growing at 8% Y/Y.” Else will start by selling specialty formulas, and eventually, it will start trying to take market share off the broader organic/vegan population. She adds, “We don’t believe the industry incumbents are working on a comparable non-dairy non-soy formula. If Else’s infant formula is approved, it would likely become a takeout candidate for larger peers, in our view.”

The last thing she talks about is that the management team has deep expertise. The founder Hamutal Yitzhak was previously Head of Consumer Goods at the Neopharm Healthcare Group and Head of Infant Nutrition at Abbott Labs Israel, while the COO Uriel Kesler managed the production of Super Kosher infant formula and baby foods at Shaked Tevel. Lastly, the CTO, Michael Azar co-founded and served as CEO of Materna, a leading infant formula producer in Israel. She says that management owns 47% of the fully diluted shares and as a result are aligned with shareholders.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.