Canaccord Genuity has initiated coverage on Skeena Resources (TSX: SKE) with a C$5 price target and a Speculative Buy rating. Their mining analyst Kevin MacKenzie comments on the story as “revitalizing a Canadian classic.”

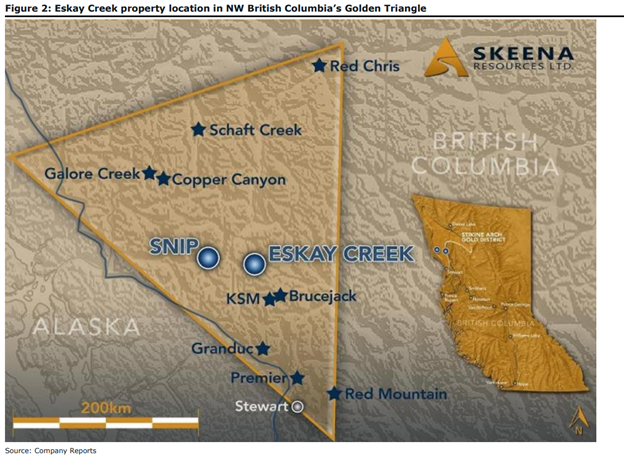

MacKenzie said that this is “a clean and clear story.” Back in 2017, Skeena and Barrick Gold signed an option agreement for Skeena to earn 100% interest in the Eskay Creek gold mine for ~$21 million cash and a one-time clawback. For the longest time, this created uncertainty in Skeena’s valuation as people were waiting to see what Barricks’ intentions were.

It was announced on August 4th that after renegotiation, an updated definitive acquisition was signed, which upon closing Barrick would own ~12.4% of Skeena’s outstanding shares with no clawback agreement. The transaction is expected to close in the fourth quarter of 2020. MacKenzie says, “in our view, this new agreement underscores the ability of Skeena’s management team to ensure that maximum value is created/realized for Skeena shareholders.”

Canaccord believes that there is material upside to the Eskay Creek gold mine with ongoing drilling, which will be extending the projects known mineralized zones. This will allow for the potential for Skeena to uncover more centers of new mineralized zones and that the drilling is happening with imposed buffers that take into account historic workings and stopes where high-grade mineralization is known to exist.

MacKenzie also says that this is an attractive project based on the economics. They will have an estimated internal rate of return of 82%, an all-in sustaining cost of U$753 per gold equivalent ounce, while Canaccord has their long term metals prices estimate at U$2,105 per gold ounce and U$25.83 per silver ounce.

MacKenzie forecasts that there will be an initial CAPEX of $394 million and a start date of 2026, which he says is conservative. This being his base case, he also provides their bull case to be an additional ~1 million ounces in realized exploration upside, which bumps the internal rate of return to 95% and an all-in sustaining cost of U$747 per gold equivalent ounce.

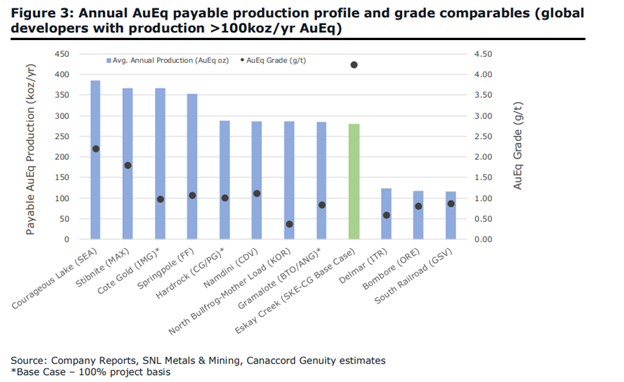

In his finishing remarks, MacKenzie says that Skeena is a “A standout amongst its peers,” where it could be one of the highest grade open-pit gold development projects, and has a relatively low CAPEX.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.