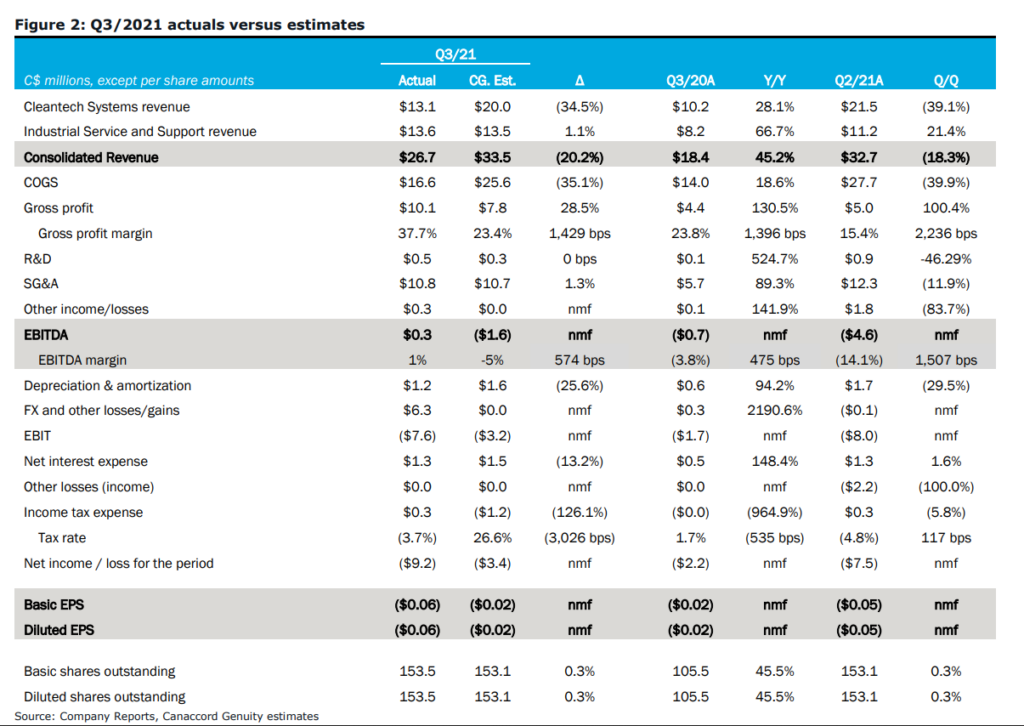

On November 11th, Xebec Adsorption (TSX: XBC) announced its third quarter financial results. The company announced quarterly revenues of $26.71 million, down from the $32.66 million last quarter while the cost of goods sold doubled from $4.99 million last quarter to $10.08 million this quarter. That puts gross margins at $10.1 million or a 38% gross margin percent.

The company reported a tighter operating loss than in previous quarters at ($1.23) million, while also updating its guidance. Xebec now expects 2021 full-year revenue to be between $120 and $130 million with EBITDA margins being -3% to -5%.

Xebec Adsorption currently has 13 analysts covering the stock with an average 12-month price target of C$4.48, or a 52% upside to the current stock price. Out of the 13 analysts, 1 analyst has a strong buy rating, 4 have buys and the last 8 analysts have hold ratings on the stock. The street high sits at C$6 from Craig Hallum while the lowest comes in at C$3.

In Canaccord’s third quarter review they reiterate their buy rating and raise their 12-month price target to C$5.00 from C$4.50, saying that this quarter is the inflection point for the company as the company has about $100 million in backlog orders. They write, “Backlog growth reflects acquisitions done over the last year.”

For the quarterly results, the company came in below most of Canaccord’s estimates. They expected revenues to be $33.5 million while the company beat their EBITDA estimate of ($1.6) million. They say that the reason for the miss was due to less RNG contract revenue, which they call “loss-making RNG contracts.” The better margins are due to lower legacy contracts being done and a positive impact from the company’s acquisitions.

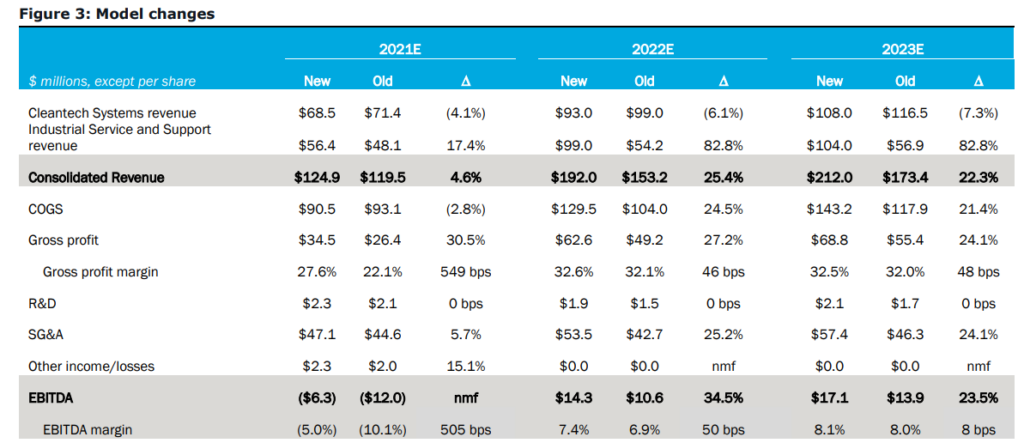

Below you can see Canaccord’s updated full year 2021 – 2023 estimates, they write, “We increase our estimates for revenue and EBITDA to reflect UEC’s $43 million TTM revenues, partially offset by lower revenue forecasts for Hygear.”

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.