On October 25th, Facebook (NASDAQ: FB), now called Meta Platforms, reported their 2021 third quarter financial results. For the third quarter, the company reported revenues of $29.01 billion, representing flat quarter over quarter sales, but up from $21.47 billion last year.

The results came in below the $29.56 billion consensus estimate. The company reported gross margins of 80.1%, flat year over year and quarter over quarter, while operating margin came in at 35.9%, down quarter over quarter but in line with last year’s margin. Lastly, the company reported a net income of $9.19 billion, or 31.7% and earnings per share of $3.22. Slightly higher than the $3.19 consensus estimate.

After the results, many analysts lowered their 12-month price targets, bringing the 12-month average price target to $402.76, down from $417.22 before the results. Meta Platforms currently has 58 analysts covering the stock with 18 analysts having a strong buy rating, 30 have buys, 8 have hold ratings and 2 have sell ratings on the stock. The street high sits at $466 from Tigress Financial Partners while the lowest sits at $250.

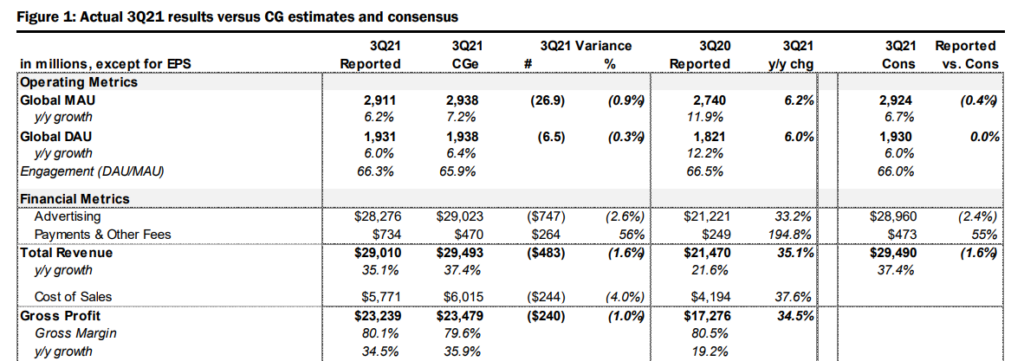

In Canaccord Genuity’s third quarter review, they reiterated their $420 12-month price target and buy rating saying that the near-term headwinds are already reflected in the stock. For the results, Meta Platforms came in slightly below Canaccord estimates with Global MAU/DAU missed by 0.9/0.3% respectively. Revenue was anticipated to come in at $29.5 billion, which means Meta missed by about 1.6%.

Canaccord says that Apple’s iOS 14.5 update, which includes changes to their user’s privacy settings has hit “critical mass” and that Meta’s management should be able to start to create betting targeting under this new system into the year-end.

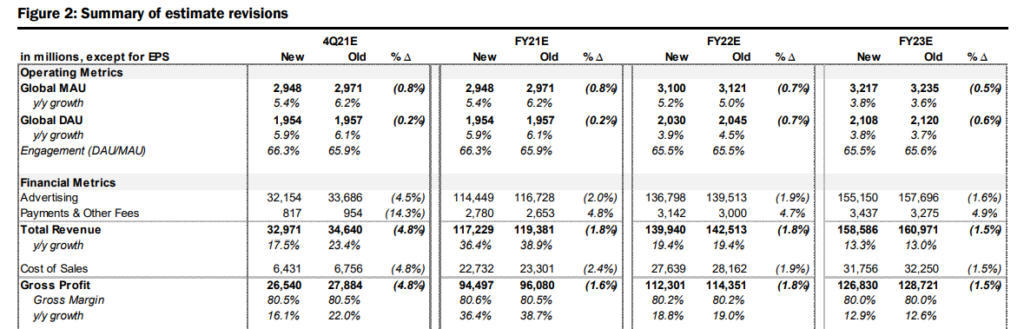

Below you can see Cannaccord’s updated fourth quarter, 2021 to 2023 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.