Yesterday, CloudMD Software & Services (TSXV: DOC) closed a $20.79 million financing lead by Canaccord Genuity and Beacon Securities. The financing saw 15.065 million shares issued at a price of $1.38 each. The deal was oversubscribed, with underwriters taking the full over-allotment option. On the back of CloudMD closing their financing, Canaccord’s analyst Doug Taylor has upgraded his 12-month price target from C$1.75 to C$2.50 and reiterated his Speculative Buy rating on the company.

Taylor headlines the note with “raising target following equity raise, iMD, and high profile industry transaction.” Taylor says that including iMD, which is a C$10 million transaction announced two weeks ago, CloudMD has announced six acquisitions since May, which combine to an annualized revenue run rate of roughly $12.4 million, and this number is before any synergies. Taylor estimates that after this C$20.8 million equity raise, CloudMD has approximately C$23 million in net cash and expects the company to continue the aggressive pace of M&A.

Taylor comments that “Loblaw investment in telehealth peer Maple reflects rising demand for digital health technologies.” On September 15, Loblaw’s invested $75 million in virtual care provider Maple in exchange for a minority stake, which values Maple at above 12x EV/sales. According to media sources, Maple is growing 10-15% month over month and currently has a $25 million revenue run rate.

Taylor then goes on to say that this investment, “validates a key analog for CloudMD’s pharmacy telehealth pilot.” Back in May, CloudMD launched a telehealth pilot program with select British Columbia Save-on-Foods location where patients can use CloudMD’s telehealth kiosks to conduct virtual care appointments. This turns those Save-on-Foods locations into a convenient one-stop-shop for prescription fulfillment as they can get serviced for the prescription virtually at the store.

Taylor also states that this investment, “supports the strong valuation climate,” as this $75 million investment would value Maple between $300-$375 million or 12-15x the next twelve months EV/sales. This also gives weight to what Taylor calls the “looming presence of large potential consolidators of hybrid healthcare and digital health technologies.” He believes that this investment highlights the potential for other large peers to “extend their roles as deep-pocketed hybrid healthcare consolidators with the scope to extend digital care technologies across pharmacies, insurance, and corporate health and wellness services.”

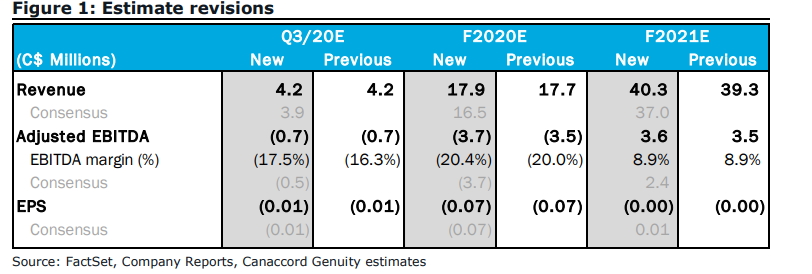

Taylor has revised his estimates for the third quarter, the fiscal year 2020, and the fiscal year 2021. Below you can see the full changes, but the highlights are that he now estimates that revenue for the fiscal years of 2020 and 2021 to be $17.9 million and $40.3 million, respectively.

Information for this briefing was found via Sedar and CloudMD Software & Services. The author has no securities related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

Full Disclosure: CloudMD Software & Services is a former client of Canacom Group.

2 Responses

Big fan of CloudMD and team. I predict down the road, CloudMD gets acquired by Rogers or Bell.

Im not so sure about this, they might not be able to afford CloudMD. I predict a stable stock price of $3.00 within the next 12 month and possibly $50 in the forseable future.