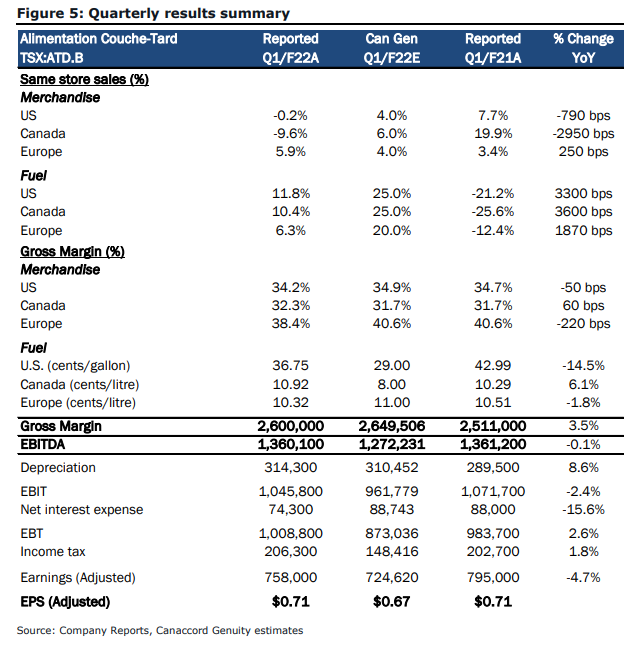

Last week, Alimentation Couche-Tard Inc. (TSX: ATD.B) reported its fiscal first quarter financial results. The company reported revenues of $13.57 billion, up 11% sequentially. Gross profits grew 15.4% to $2.6 billion or a 19.1% gross margin. The company reported a net income of $764 million or earnings per share of $0.71. Total merchandise and service revenues came in at $4.1 billion, while same-store merchandise revenues dropped 0.2% in the US and 9.6% in Canada.

Many analysts raised their 12-month price targets on Alimentation Couche-Tard after the results, bringing the average price target to $57.33, up from $54.93 last month. There are 16 analysts covering the stock with the street high sitting at $65, while the lowest comes in at $45. Out of the 16 analysts, 3 have strong buy ratings, 10 have buy ratings and 3 have hold ratings.

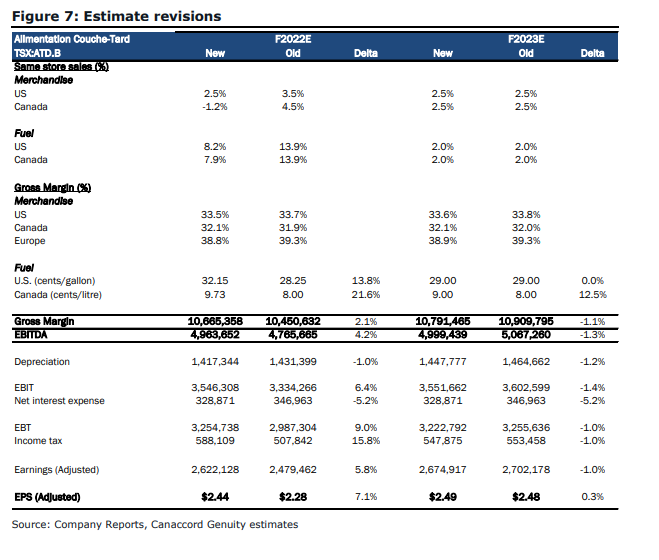

Canaccord Genuity was one of the firms to raise its 12-month price target. They raised their $48 price target to $51 while reiterating their hold rating saying, “Weaker traffic offset by fuel margin strength; retail headwinds point to cautious near-term outlook.”

Alimentation Couche-Tard reported very mixed results, with merchandise, fuel, and gross margins coming either in-line or missing. Gross margin came in roughly $50 million behind Canaccord’s estimates while EPS came in $0.04 higher than estimates.

For the fuel and merchandise estimates, Canaccord says that the company is still facing COVID-19 headwinds with the Delta variant pushing case counts up and causing “softer-than-anticipated traffic trends.”

Canaccord calls the near-term outlook Alimentation Couche-Tard provided “cautious” as it is factoring in both accelerations in Delta COVID cases and cost inflation. They say that these two factors, “are likely to challenge margins modestly over the near term, as the company works through this dynamic.”

Below you can see Canaccord’s updated fiscal 2022 and 2023 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.