Medmen Enterprises’ (CSE: MMEN) reported their fiscal third quarter 2021 financial results on May 11th after market close. The company reported revenue of $32.03 million, a profit margin of 41.6%, and an operating margin rate of (120.9%).

Much to our surprise, Medmen has four analysts covering the company, with a weighted 12-month price target of $0.12. Roth Capital is crowned with having the street high, with a price target of $0.20, while Canaccord sits firmly at the low with a solid $0.00 price target. Out of the four analysts, one has a hold rating, two have sell ratings and another has a strong sell rating.

In Canaccord’s note, their analyst Matt Bottomley reiterates his sell rating and $0 price target, calling Medmen’s quarter a “fairly stagnant quarter,” with Medmen’s numbers missing Canaccord’s estimates. Bottomley adds, “With the company taking a step back towards profitability and a cash balance that remains razor-thin compared to its current liabilities and longer-term debt obligations, we reiterate our SELL rating and C$0.00 PT for MMEN.”

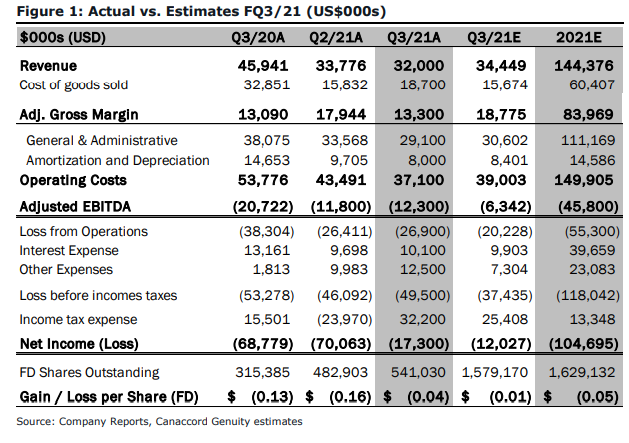

Below you can see how Medmen’s earnings came in compared to Canaccord Genuity’s estimates. Although the company missed expectations, that is without discounting its discountinued NY operations, which when adjusted for, Medmen’s revenue would be up a modest 3.8% quarter over quarter. Bottomley notes that even after the adjustment, things don’t look to be good.

In their core market, California, they only saw same store sales up 2.2% because of COVID headwinds combined with seasonality. Medmen reported a lower gross margin of only 42%, which is down from 53% the quarter prior, while SG&A ballooned 19% due to litigation costs.

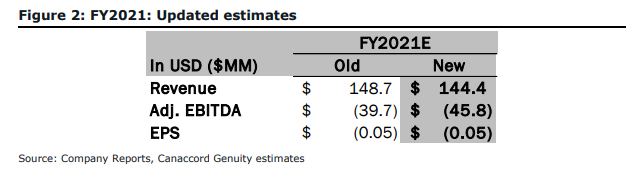

Below you can see Canaccord’s revised 2021 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.