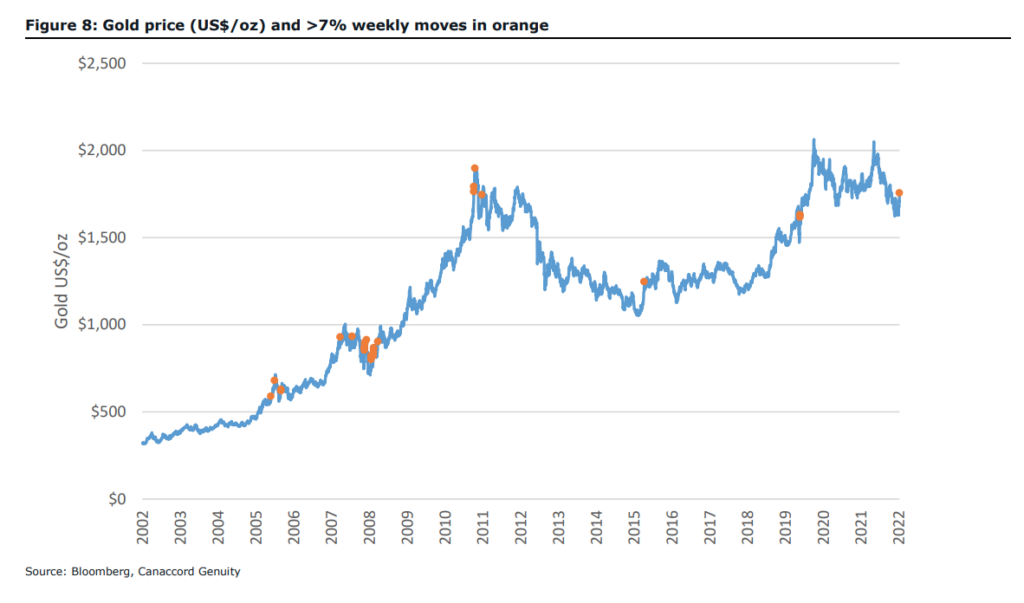

Canaccord Genuity Capital Markets on Monday issued an industry update on precious metals, where they indicate that they are seeing signs of gold bottoming. They point to gold and silver’s recent 8% and 11% move last week after the FOMC rate hike, CPI, and Fed Chairman Jerome Powell’s hawkish press conference.

Canaccord’s analysts say that the rise in precious metals such as gold and silver coincides with an almost 5% drop in the U.S Dollar. These “outsized moves” in gold, “generally occur near market tops and bottoms.” They add that Powell’s latest remarks included a hint that the U.S Federal Reserve is looking at lowering the pace of interest rate increases.

Powell stated that the focus is now on shifting to how high the rates will go and for how long. With core inflation still in the 6% range, Canaccord does not believe that the Federal Reserve will outright stop hikes but believes the Federal Reserve is now “recognizing the increased risk to financial stability.”

Canaccord provides some great context, saying that it’s only been eight months since the Federal Reserve started raising rates. They believe that this isn’t enough time for the economy to see the full effects, pointing to key economic factors, including recent employment, PMI, and housing data.

The most recent employment data beat expectations though Canaccord says it looks like the data is decelerating, as it was the lowest monthly increase over the past year. At the same time, the household survey suggests that the unemployment number has increased to 6.06 million Americans, the highest since February 2022.

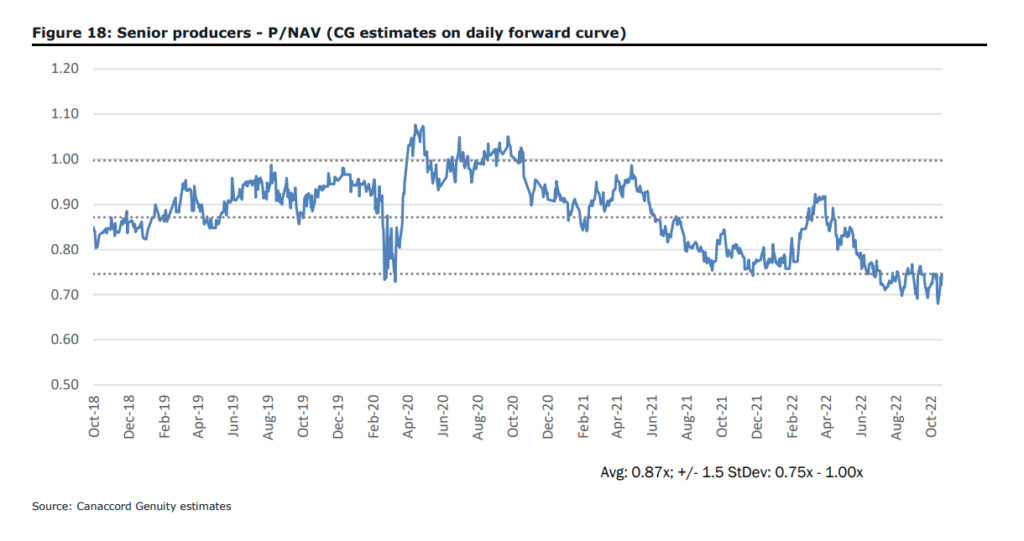

Lastly, Canaccord says that gold equities are still inexpensive even after the 8% run in gold and 24% move in gold equities since September. They point to the average senior gold company trading at 0.75x P/NAV, which is “~1.5 standard deviations below the historical average of 0.87x.” They also point to the royalty companies that are currently trading at 1.38x versus the historical average of 1.55x.

Information for this briefing was found via Edgar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.