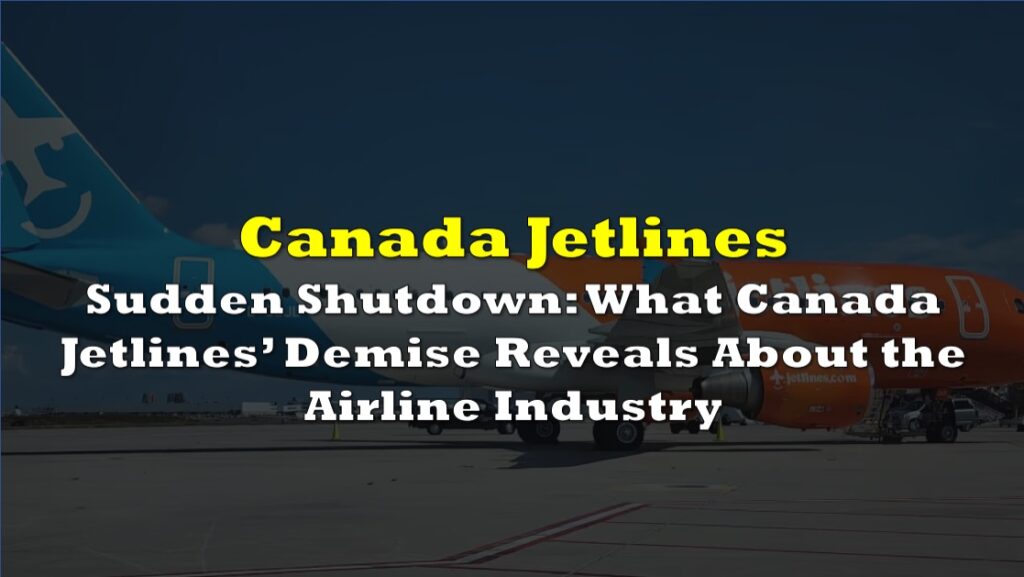

Canada Jetlines Operations Ltd. (Cboe CA: CJET), a Mississauga-based airline that launched operations in 2022, has officially declared bankruptcy. This announcement on Wednesday signals the culmination of the airline’s financial struggles and the end of its brief attempt to carve out a space in Canada’s competitive airline market.

The company made a voluntary assignment in bankruptcy under section 49 of the Bankruptcy and Insolvency Act (BIA) of Canada. The act allows insolvent companies to liquidate their assets for the benefit of their creditors.

While the official declaration came this week, Canada Jetlines’ financial difficulties have been brewing for months. The first major public signal occurred on August 21, 2024, when the airline announced it had filed a notice of intention (NOI) to restructure under the Bankruptcy and Insolvency Act. This move was an effort to stay afloat, but the airline’s fortunes failed to turn around.

In a statement at the time of the NOI, Canada Jetlines expressed hope of “restructuring its affairs” in order to meet obligations to creditors. Despite these intentions, further attempts to stabilize the business fell through. In an industry often defined by thin margins and costly operations, these challenges proved insurmountable.

Then, in a critical blow to leadership, four of the airline’s top executives, including CEO Eddy Doyle, resigned from their positions in late August 2024. The resignations were a harbinger of the airline’s eventual closure, marking the dissolution of its core leadership team and casting serious doubt on the future of the company.

Short-lived rise

Canada Jetlines was originally founded in 2013 with a vision of offering ultra-low-cost carrier (ULCC) services, a model that had found success in other parts of the world. However, delays and changes to the company’s operational strategy led to a nearly decade-long delay before it finally took flight in 2022. By then, it was facing an already saturated market dominated by larger players like Air Canada, WestJet, and the now-defunct Flair Airlines.

Despite the challenging environment, Jetlines attempted to differentiate itself by focusing on key international leisure destinations. The airline offered flights from Toronto Pearson International Airport to popular vacation spots such as Orlando, Florida; Cancun, Mexico; and Montego Bay, Jamaica, using a fleet of Airbus A320-200 aircraft.

The airline also operated domestic routes, including flights from Halifax to both Toronto and Orlando, tapping into the often underserved Atlantic Canada market. In the summer of 2024, Jetlines announced plans to expand with a new route from Toronto to Miami, and even entered into an ACMI (Aircraft, Crew, Maintenance, and Insurance) leasing agreement with Air Arabia Maroc for summer operations in Casablanca, Morocco.

The low-cost challenge

The ultra-low-cost carrier (ULCC) model that Jetlines tried to emulate has historically been a challenging one to sustain, especially in a country as large and sparsely populated as Canada. ULCCs typically rely on high volumes of passengers and lean operational costs to remain profitable. The airline’s management had hoped to tap into the growing demand for affordable leisure travel to sunny destinations, especially in the wake of the COVID-19 pandemic when many Canadians sought budget-friendly options for their travel plans.

However, Jetlines struggled with several of the same issues that have plagued other low-cost carriers. For instance, fluctuating fuel prices, operational delays, and the costs associated with airport fees—especially at major hubs like Toronto Pearson—made it difficult for the airline to keep ticket prices low while maintaining profitability. Moreover, the post-pandemic recovery in air travel has been uneven, with many consumers opting for well-established airlines with more extensive route networks and frequent flyer perks.

Industry expert Robert Kokonis of AirTrav Inc. noted that “Canada is a tough market for low-cost carriers to survive in, given the country’s geography, weather disruptions, and high operational costs. Jetlines faced an uphill battle from day one.”

BDO Canada Limited has been appointed as the Licensed Insolvency Trustee and is responsible for managing the sale of the company’s remaining assets. Legal counsel for the company is being provided by Dentons Canada LLP. Creditors will soon receive formal notice of the bankruptcy and details of an upcoming meeting.

Information for this story was found via Pax News and the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.