On February 25, Tesla’s CEO, Elon Musk, reiterated his concerns about whether Tesla can procure enough nickel to satisfy the expected explosive demand for the silvery-white metal in electric vehicle (EV) batteries. The world’s second richest man tweeted that, “nickel is our biggest concern for scaling lithium-ion cell production.” This follows his July 2020 quote: “Tesla will give you a giant contract for a long period of time for you to mine nickel effectively and in an environmentally sensitive way.”

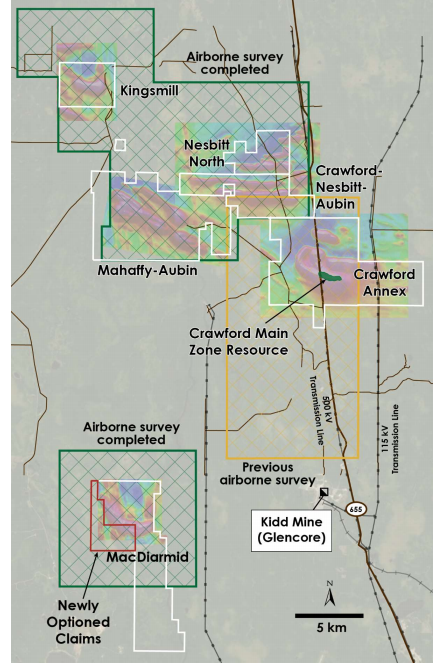

Canada Nickel Company (TSXV: CNC), a pre-revenue junior nickel miner, could in time satisfy a significant portion of the EV industry’s nickel demand if it can develop its flagship Crawford Nickel Cobalt Sulfide Project, as well as the promising MacDiarmid property, both located in an Ontario mining camp.

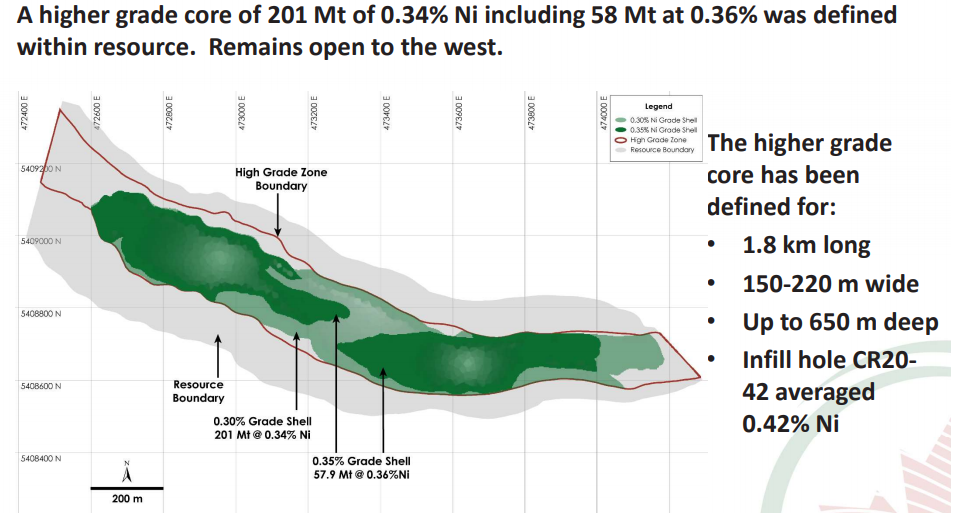

Indeed, in mid-February 2021, Canada Nickel reported that the MacDiarmid nickel target — 1.8 kilometers long and an average of 400 meters wide — is 15% larger than the original Crawford Main Zone discovery. The company believes that a recently completed geophysics study, along with a review of historical drilling results on the MacDiarmid property, supports this view. Canada Nickel has applied for exploration permits and plans to begin drilling on the property in March.

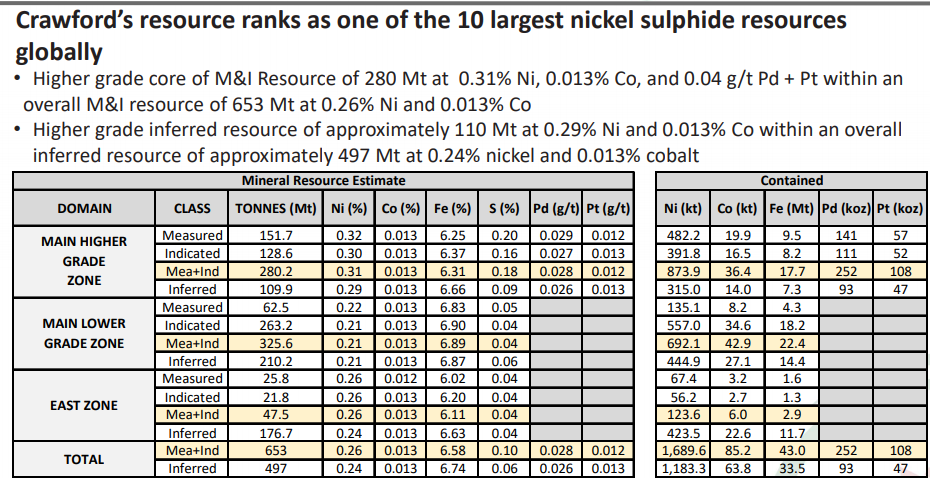

Flagship Crawford Property

Crawford is considered one of the ten largest nickel sulfide resources in the world. It contains an estimated 2.9 million tonnes of nickel, including measured, indicated and inferred resources. To put the size of this resource in perspective, and to quantify potential future nickel demand, the analysis firm CRU estimates that by 2025, worldwide annual nickel demand may be 0.9 million tonnes higher than 2018 levels.

Canada Nickel is expected to release a Preliminary Economic Assessment (PEA) on Crawford in April of 2021, as well as a Feasibility Study by year-end 2021. The timeline for the PEA has now been delayed twice as a result of continuous developments at the property that positively impact the economic study.

Cash Requirements Build

Canada Nickel’s operating cash flow shortfall widened considerably in the quarter ended October 31, 2020. As the company continues to develop its properties, that deficit will likely expand further. Canada Nickel had $11.2 million of cash and no debt as of October 31, 2020. It will probably be required to sell equity in fiscal 2021 to fund exploration and drilling programs at the Crawford and MacDiarmid properties.

| (in thousands of Canadian $, except for shares outstanding) | 4Q FY20 | 3Q FY20 | 2Q FY20 | 1Q FY20 |

| Operating Income | ($2,526) | ($942) | ($769) | ($429) |

| Operating Cash Flow | ($3,263) | ($1,599) | ($126) | $707 |

| Cash – Period End | $11,167 | $71 | $237 | $178 |

| Debt – Period End | $0 | $0 | $0 | $0 |

| Shares Outstanding (Millions) | 79.9 | 68.0 | 57.3 | 28.4 |

If EV adoption were to prove slower than generally expected, or if Canada Nickel’s future drilling programs were to prove unsuccessful, the company’s stock would also be negatively affected. Furthermore, the company is not expected to begin generating cash flow for some time.

Canada Nickel’s properties contain substantial quantities of high-grade nickel resources. Since that material will likely be in great demand by EV battery manufacturers, which itself could force nickel prices even higher, the company could generate strong cash flows when commercial production begins at its Crawford and MacDiarmid properties.

A micro-cap copper exploration company, Spruce Ridge Resources (TSXV: SHL) owns 8.1 million shares of Canada Nickel. Spruce Ridge acquired these shares when it sold the Crawford Nickel Cobalt Project to Canada Nickel in February 2020. The 8.1 million shares are worth $28.4 million, equivalent to 101% of Spruce Ridge’s stock market value. As a result, any significant appreciation in Canada Nickel’s share price would likely positively affect Spruce Ridge’s shares as well.

Canada Nickel Company and Spruce Ridge Resources are trading at $3.32 and $0.175, respectively, on the TSX Venture Exchange.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.