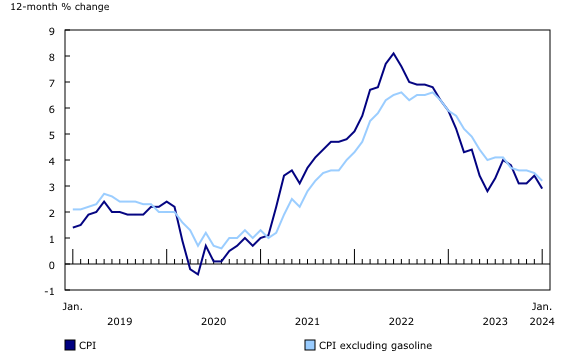

The Consumer Price Index in Canada experienced a notable deceleration in January, rising by 2.9% on a year-over-year basis, a drop from December’s 3.4% increase. This slowdown was primarily influenced by a significant drop in gasoline prices, which decreased by 4.0% year over year in January, contrasting with a 1.4% increase the previous month.

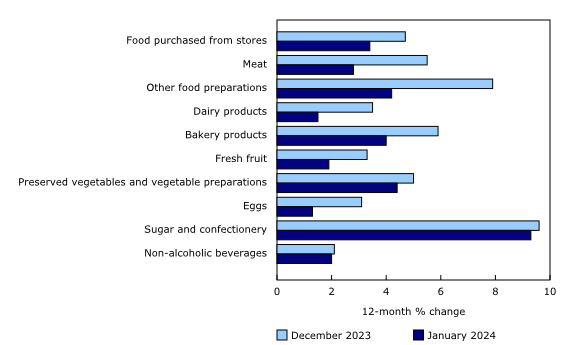

The deceleration in inflation was further supported by a slowdown in food price growth at grocery stores, which saw a year-over-year increase of 3.4% in January, a decrease from December’s 4.7%. This slowdown, coupled with lower prices for airfares and travel tours, contributed significantly to the overall deceleration of the CPI.

On a month-to-month basis, the CPI remained unchanged in January following a 0.3% decline in December. Notably, January marked the first month since May 2020 that the CPI, on a seasonally adjusted monthly basis, fell by 0.1%.

Diving deeper, the year-over-year decline in gasoline prices was partly attributed to a base-year effect stemming from refinery closures in the southwestern United States after Winter Storm Elliott in January 2023. Monthly, gasoline prices continued their downward trend for the fifth consecutive month in January 2024, falling by 0.9%, with significant price drops in regions like Manitoba, influenced by a temporary suspension of the provincial gas tax.

The grocery sector saw a broad-based deceleration in price growth, with notable slowdowns in the prices of meat, dairy products, bakery products, and fresh fruit. Conversely, some food items like soup, bacon, and shrimps and prawns experienced year-over-year price declines in January, indicating a mixed bag for consumers navigating the grocery aisles.

Information for this story was found via Statistics Canada. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.