It appears that the rules for mortgage deferrals have changed once again. The Office of the Superintendent of Financial Institutions (OSFI), which is Canada’s banking regulator, announced that it will no longer honour special capital treatment for loan deferrals as a result of an improvement in the country’s economic conditions.

Back in March, the OSFI unveiled two major emergency programs for loans due to the unprecedented financial volatility posed by the coronavirus pandemic. Given that millions of Canadians suddenly found themselves unemployed and lacked income to make their debt obligations, the OSFI introduced special treatment for loan deferrals, allowing them to be categorized as “performing” instead of “non-performing.” This in turn granted banks leniency in providing loan deferrals for clients struggling to make credit card, mortgage, and business loan payments.

However, according to the OSFI, market conditions have improved since the coronavirus slump, and as a result the banking regulator is rescinding its COVID-era rules. The return to previous regulations will occur through a phase of several steps: any loans that were the subject of a deferral before August 31 will be treated as “performing” for a duration of six months. Any loan deferrals granted before September 30 will come affixed with a grace period of three months before they are considered “non-performing.” Lastly, any loan deferrals granted in October and onward will automatically fall under the “non-performing” category.

Also during the height of the pandemic, the OSFI put a freeze on profitability transfers for pension plans. This safeguarded pension plans from insolvency during unprecedented market volatility, and prevented pension plan participants from allocating funds from their defined benefit plan into a second plan, or use the funds to purchase annuities. However, the OSFI is now revoking the pension plan restrictions, given that solvency ratios have been the subject of improvement over the recent months.

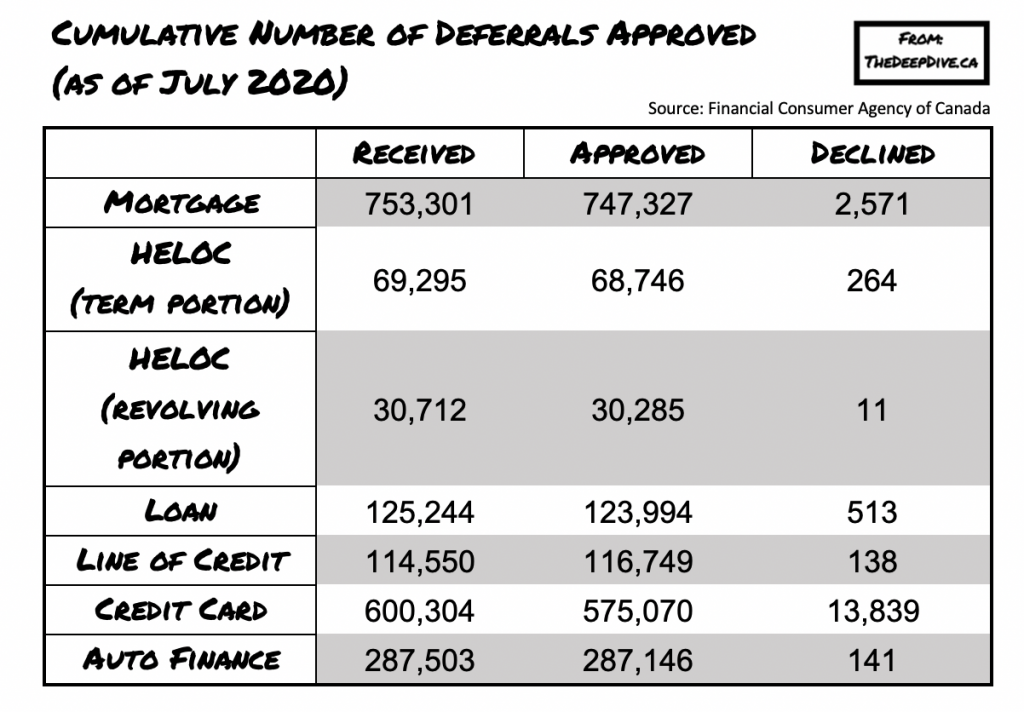

According to the OSFI, improving market conditions and a recent sharp declines in mortgage payment deferrals are behind the move to reinstate prior regulations. The OSFI believes that Canadian banks are now sufficiently capitalized to offer their own loan deferrals for clients, while returning to business as usual. At the end of July, there was nearly $170 billion in outstanding mortgage deferrals across Canada’s six major banks, with a large portion nearing their maturity date between September and October. However, the number of new deferrals has been tapering off.

Information for this briefing was found via OSFI and the Financial Consumer Agency of Canada. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.