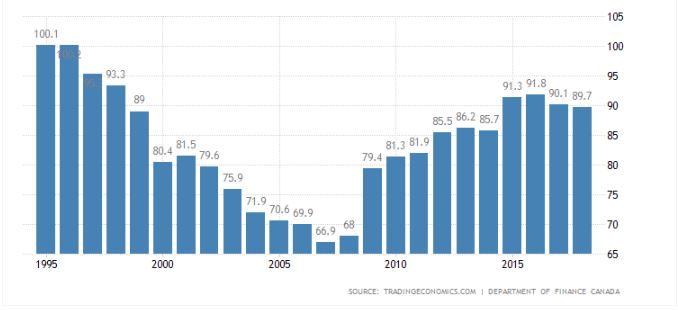

As a result of the mounting federal government spending on coronavirus mitigation efforts, Canada has had its credit rating reduced from AAA to only AA+ alongside a stable outlook for the medium term.

Fitch Ratings Inc is anticipating Canada’s debt to increase from 88.3% of GDP in 2019, to 115.1% of GDP in 2020, with debt-to-GDP becoming more stable in the medium run. The sudden increase in debt comes amid a sudden and significant increase in federal government spending on the coronavirus pandemic. Since the onset of the pandemic, spending on coronavirus relief measures has surpassed $150 billion.

As a result of the increased spending on pandemic measures, Fitch has downgraded the country’s credit rating to AA+ in response to the country’s respective debt increase. The rating downgrade is certainly a blow to the federal government, which has prided itself with Canada’s exceptional AAA credit rating, and even made it a point on their 2019 election platform. However, Canada’s parliamentary budget officer Yves Giroux is not surprised by the credit rating reduction in wake of a global pandemic. According to Giroux, so as long as other credit rating agencies do not follow suit in downgrading, then Canada does not have much to worry about.

Information for this briefing was found via Bloomberg. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.