The CMHC recently updated its June 2022 Supply Gaps Estimate (SGE) report that assesses the quantity of additional housing necessary to revert affordability to its 2004 standard by the year 2030 and spoiler alert: Canada still has a long way to go before housing demand and supply reach equilibrium.

Canada doesn’t have a housing shortage – they have an IQ shortage.

— Don Johnson (@DonMiami3) August 11, 2023

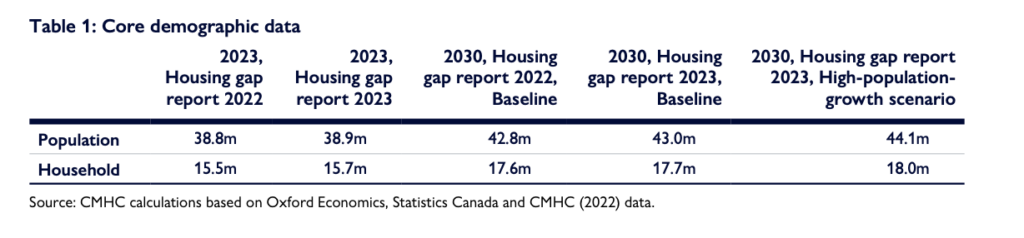

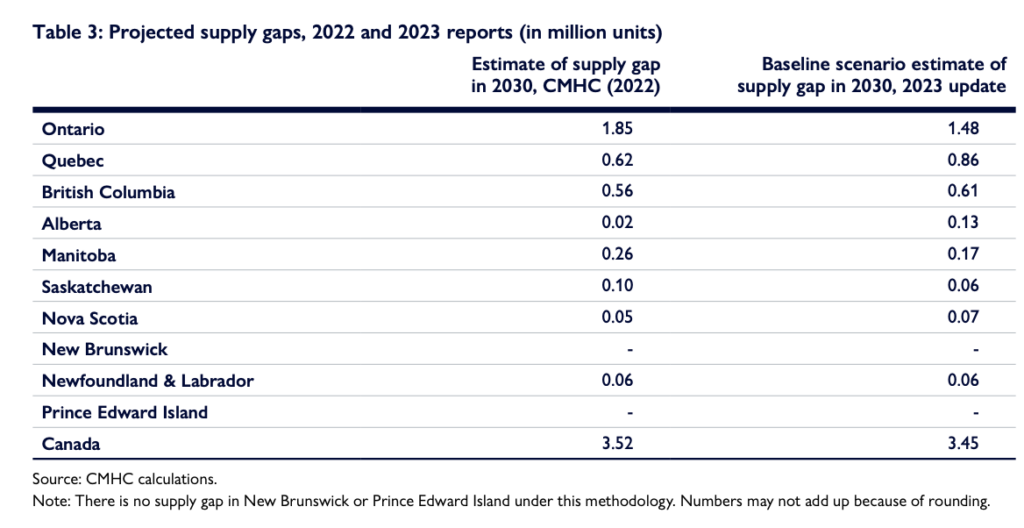

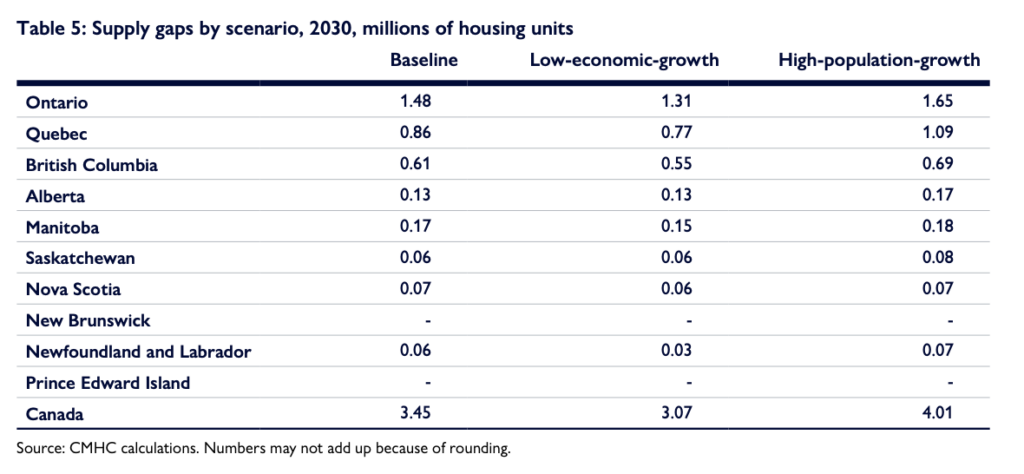

Notably, the national supply gap still demands around 3.5 million additional housing units by 2030, beyond what’s already anticipated to be constructed by then. In 2022, analysts didn’t anticipate the current year’s economic deceleration, and, as a result, projections for 2030 household incomes are adjusted downwards, subsequently affecting housing demand forecasts.

As the CMHC explains, demand for housing is influenced by household growth, which in turn, is affected by factors like population growth, immigration rates, and family formation dynamics. Recent population boosts stem from policies targeting higher immigration and non-permanent residency levels; many of these immigrants would have arrived later, but were accelerated due to faster application processing.

International students resort to sleeping under bridges due to housing shortage in #Canada #worldnews #cdnpoli #bcpoli #onpoli https://t.co/BeuAjprozi

— GlobeNewsWire (@BCNewsWire) September 13, 2023

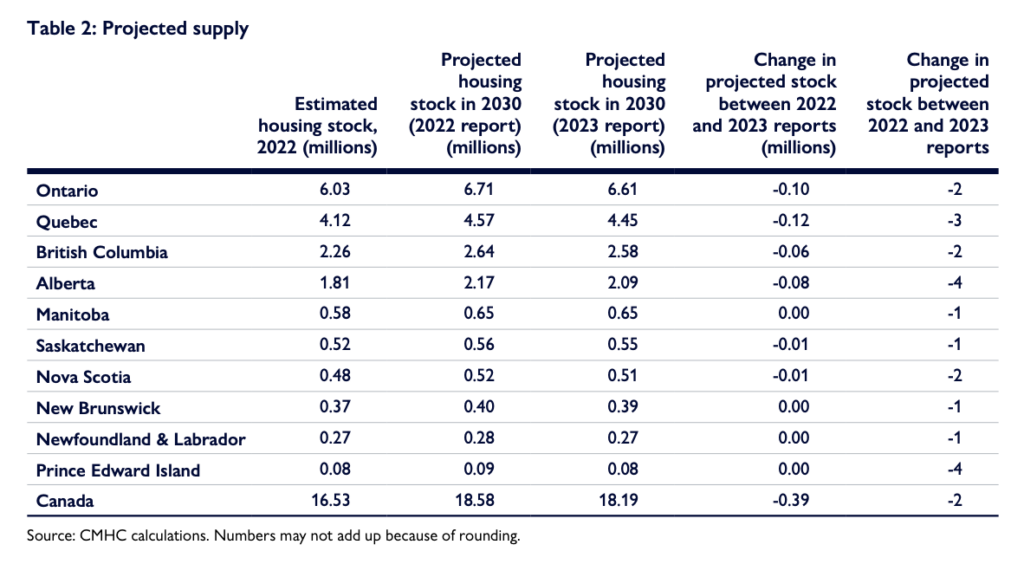

As such, the CMHC reduced the forecast for the number of housing units built by 2030 from the previous year’s 18.6 million to 18.2 million, thanks to challenges in housing construction: rising material costs, labor shortages, and financing difficulties.

The demand for those units will largely stem from household numbers, household income, and interest rates, with each province responding differently. However, the figures also vary drastically by province. For instance, Ontario’s housing demand is highly responsive to income changes. Therefore, reduced income growth forecasts will majorly impact Ontario’s housing demand.

With respective factors affecting housing demand and supply in mind, the CMHC estimates Canada’s housing market will continue to face a significant supply gap in 2030, with projections varying across provinces due to differences in economic and population patterns. In 2022, the national housing body estimated that there will be a shortage of 3.52 million by the end of the decade; fast forward to now, and those projections aren’t looking much more optimistic.

The CMHC also examined two alternative 2030 scenarios: one with low economic growth and another considering high population growth. The low-growth scenario anticipates weak consumer demand due to factors like higher interest rates and substantial household debt, resulting in a mortgage rate of 5.7%. The high population growth scenario envisions an annual immigration level of 600,000 to 700,000 people.

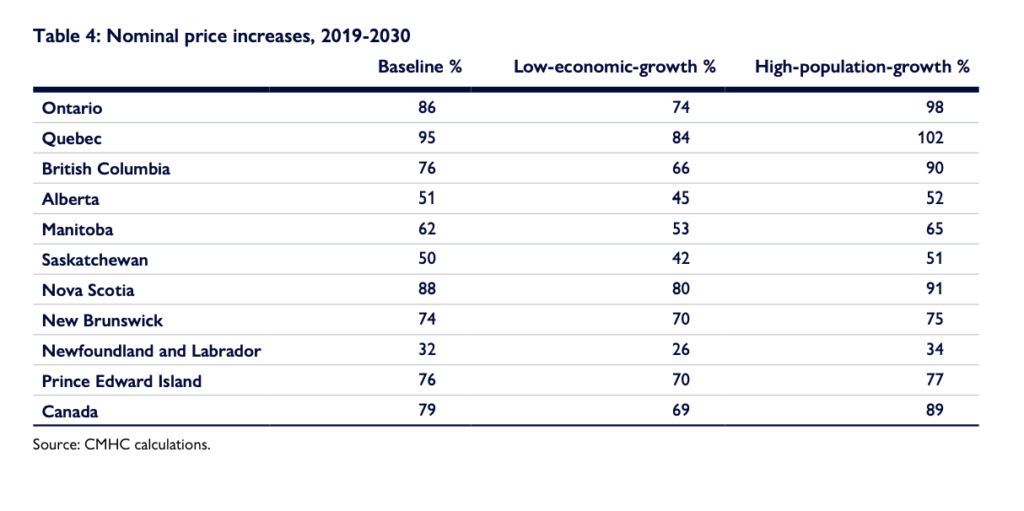

In terms of home prices, the low economic growth scenario will see lower price increases, while the high population-growth picture will cause home prices to increase more substantially.

When it comes to narrowing the housing supply gap, slower economic growth will drop the 2030 shortage to 3.1 million units, while the high population-growth scenario will need an additional 4 million housing units to meet baseline supply.

Still, the CMHC stressed that the government’s macroeconomic models may not accurately forecasting trends in Canada’s housing market due to specific household challenges that tend to get overlooked. For instance, low economic growth would deter higher-income households from purchasing homes, which would further strain the rental market, which is already suffering from low vacancy rates and historically high rents. Furthermore, economic downturns could disrupt traditional household formations, with more young adults staying with parents.

Information for this story was found via the CMHC. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.