Canada’s largest real estate market has not been faring too well since the Bank of Canada embarked on the most hawkish tightening cycles among its G7 counterparts.

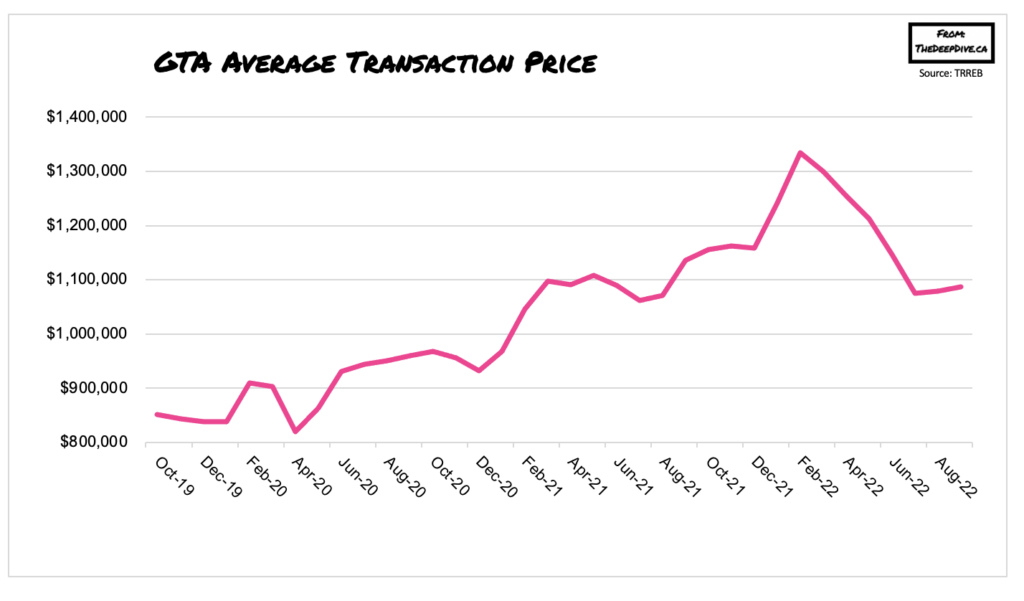

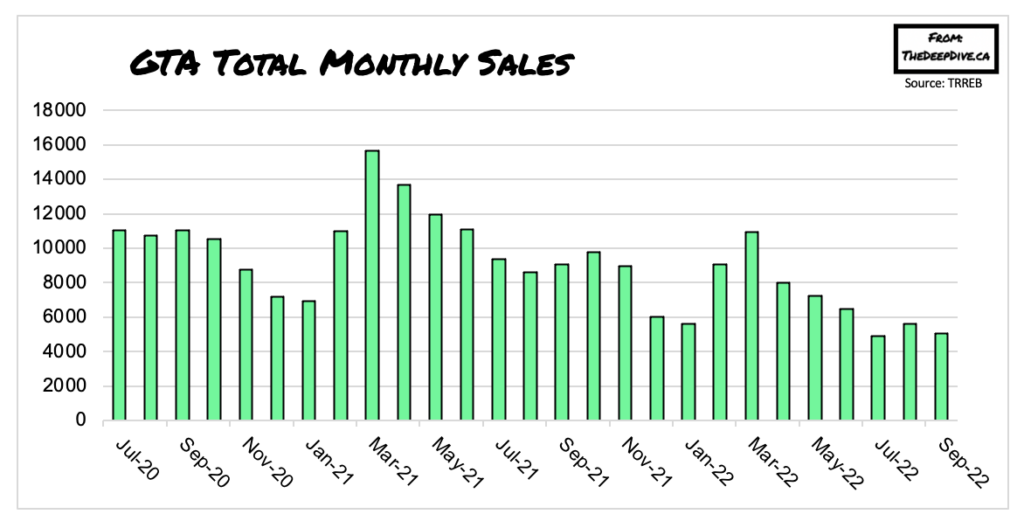

Latest data from the Toronto Regional Real Estate Board (TRREB) showed Toronto home prices fell 1.2% between August and September, marking a 17% decline since the spring peak. The benchmark price now sits at $1.086 million, the lowest since October 2021, as only 5,038 properties traded hands last month— a stark 44% decline compared to September of last year.

The Bank of Canada has shown no mercy in bringing inflation down, even if it comes at the cost of the country’s real estate market. The benchmark rate has risen from 0.25% to 3.25% since March, with markets anticipating a further increase to at least 4% in the coming months, particularly in wake of the Liberal government’s $4.5 billion inflation relief package, which will likely stoke core inflation higher.

Not only are rising mortgage rates sending buyers to the sidelines, but sellers are also retrieving. New listings slumped 16.7% year-over-year to 11,237 units— the lowest since September 2002. “October generally represents the peak of the fall market, so it will be important to see where price trends head over the next month,” said TRREB market analyst Jason Mercer.

Information for this briefing was found via the TRREB. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.