The Canadian government is set to unveil a ban on foreign homebuyers within their budget that is to be released on Thursday, as has been reported by CTV News. While the headline may sound great, the content and loopholes contained within the proposal appear to make this new rule pointless, unless you’re a government that wants to claim that something is being done to tackle the problem of housing being unaffordable and unattainable for many Canadians – while really doing nothing at all.

The new rule is said to make it so that foreign buyers are unable to purchase residential properties within the country for a period of two years. The trouble, however, is that the ban already appears to be full of loopholes.

Perhaps the largest issue surrounding the ban that is to be proposed, is that it does not apply to permanent residents, foreign workers, students or, perhaps most significantly, foreigners that are buying their primary residence within the country. No word on what happens when that “intent” to buy a primary residence changes, resulting in yet another vacant or investment property.

Effectively, rather than a ban on foreign homebuyers, it appears that this will in fact be a ban on foreigners buying investment property within the country, or buying properties that will sit vacant.

It was also revealed that other measures to assist in housing affordability are to be included in the budget, including $1.0 billion set aside for the construction of affordable housing units, $1.5 billion in loans and funding for co-op housing, and finally, $4.0 billion that is to be used to assist in updating municipal zoning and permit systems to enable faster residential construction.

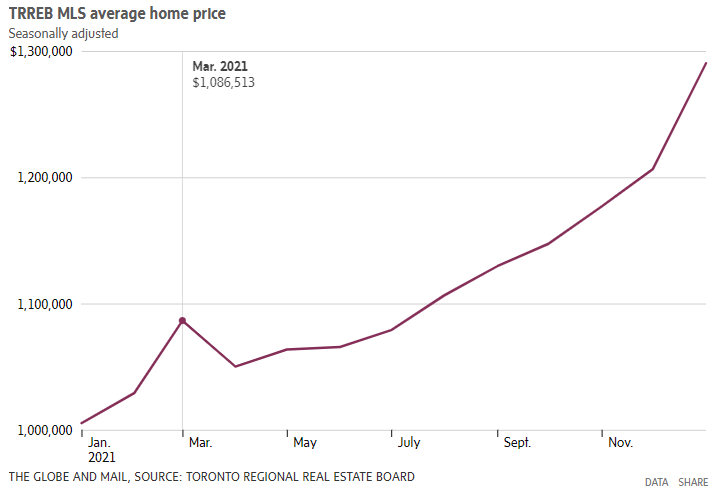

The budget announcement is to come two months after the average detached home price in Toronto crossed the $2.0 million mark, a 23% increase, while the average price in the surrounding suburbs of Toronto surpassed $1.3 million.

The budget is set to be released at 4:00 PM on Thursday afternoon.

Information for this briefing was found via CTV News, the Globe and Mail, TREBB, and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.