Canada’s manufacturing sector continued to expand last month, as the lifting of Covid-19 restrictions and a general increase in demand prompted industries to increase output. At the same time, though, firms continued to face steep input prices, many of which they passed down to consumers in in an effort to protect margins.

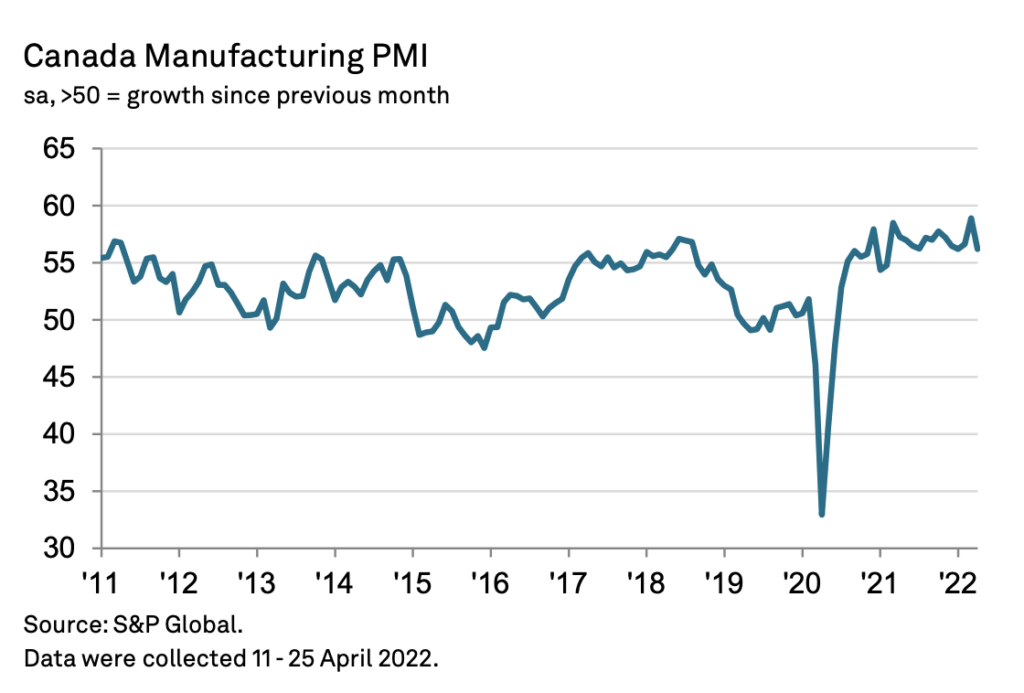

The seasonally adjusted S&P Global manufacturing PMI slumped from a record-high of 58.9 in March to 56.2 last month, as output growth remained robust for the twenty-second month in a row, despite dipping to the lowest in 14 months. Much of April’s expansion in operating conditions was the result of a strong improvement in new orders from both domestic and international markets, with the consumer goods sector noting the highest increase in output levels, followed by investment and intermediate goods firms.

S&P Global also noted widespread reports of declining vendor performance, amid input material and truck shortages as well as logistics delays, which caused a sharp uptick in backlogs. Although input price inflation slightly subsided from March’s record-high, the increase in input expenses was still among the fastest in the series history. Firms cited rising fuel, material, transportation, and labour costs as among the main contributors to the increase in input costs, as well as the military conflict in Ukraine.

In response, firms substantially boosted their selling prices in an effort to preserve profit margins and pass on some of the elevated material and transportation expenses. As a matter of fact, S&P Global reported that cost-push inflation was at the second-highest on record.

Information for this briefing was found via S&P Global. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.