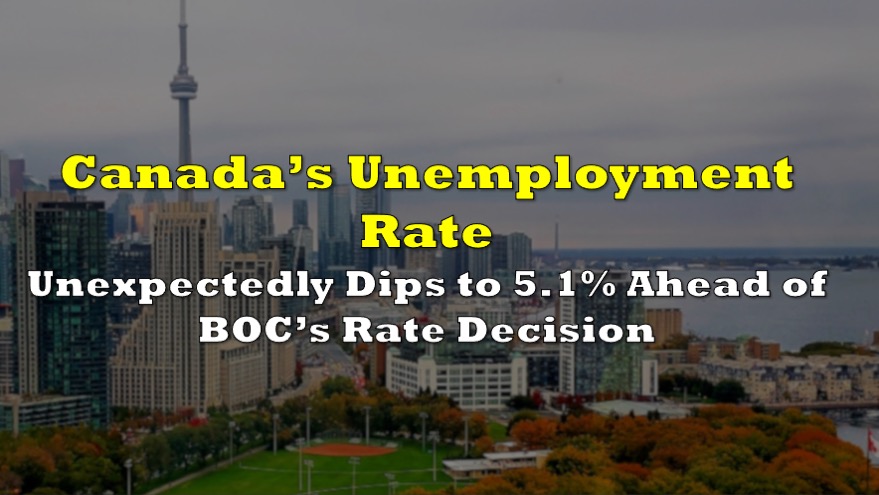

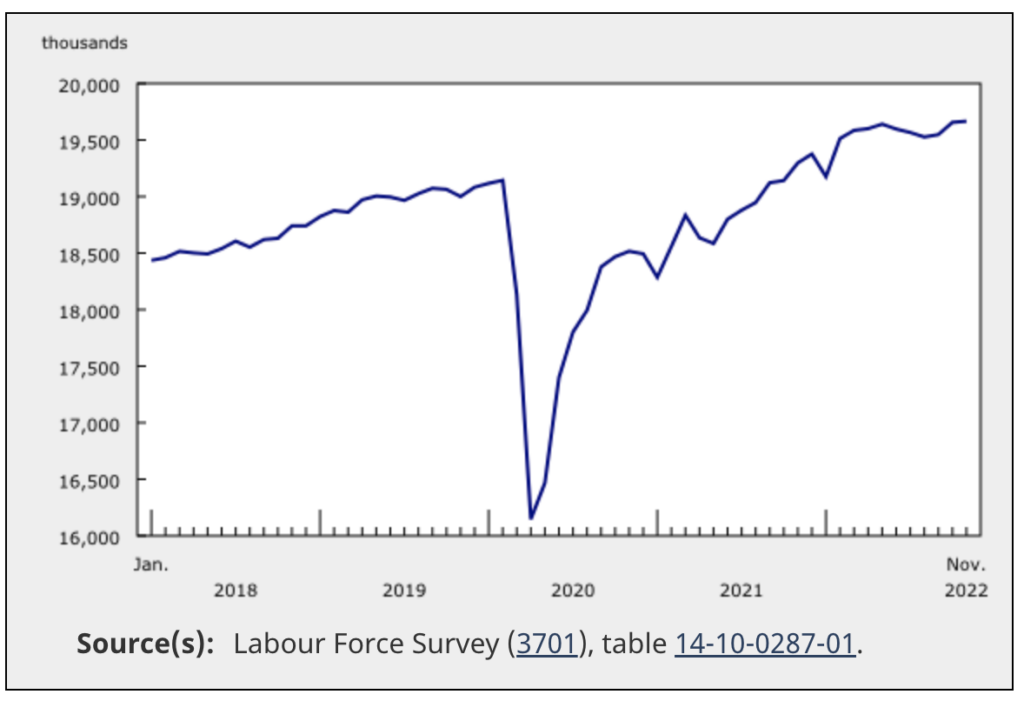

Employment levels across Canada remained relatively unchanged in November, but the unemployment rate did unexpectedly dip one week before the Bank of Canada is set to deliver another interest rate hike.

Canada’s economy added about 10,000 new jobs last month, substantially less than the 108,000 added in October, while the unemployment rate fell 0.1 percentage points to 5.1%. Economists polled by Reuters forecasted an unemployment rate of 5.3%. Employment levels predominantly rose across the finance, insurance, real estate, manufacturing, and information, culture, and recreation sectors, but slumped across several other industries, including wholesale and retail trade, and construction.

Meanwhile, average hourly wages rose 5.6% from November 2021, marking the sixth straight month of wage growth exceeding 5%. However, with the current annual inflation rate sitting at 6.9% as per Statistics Canada’s October data, wage growth continues to significantly lag behind the rising cost of living. The Bank of Canada is set to deliver another policy decision come next week, but given that Governor Tiff Macklem has repeatedly pointed to an overheating labour market as the culprit behind record-high inflation, it is likely that another rate hike is en route.

BMO Capital Markets economist Doug Porter said the latest labour force survey results aren’t surprising, but suggest that “the labour market remains tight and in solid shape overall,” cementing expectations for another 50 basis-point rate increase next Wednesday.

Information for this briefing was found via Statistics Canada and Reuters. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.