Both consumers and businesses are feeling the pressure of persistently high inflation, causing a sharp deterioration in sentiment in an economy that is barreling towards a recession as early at next year.

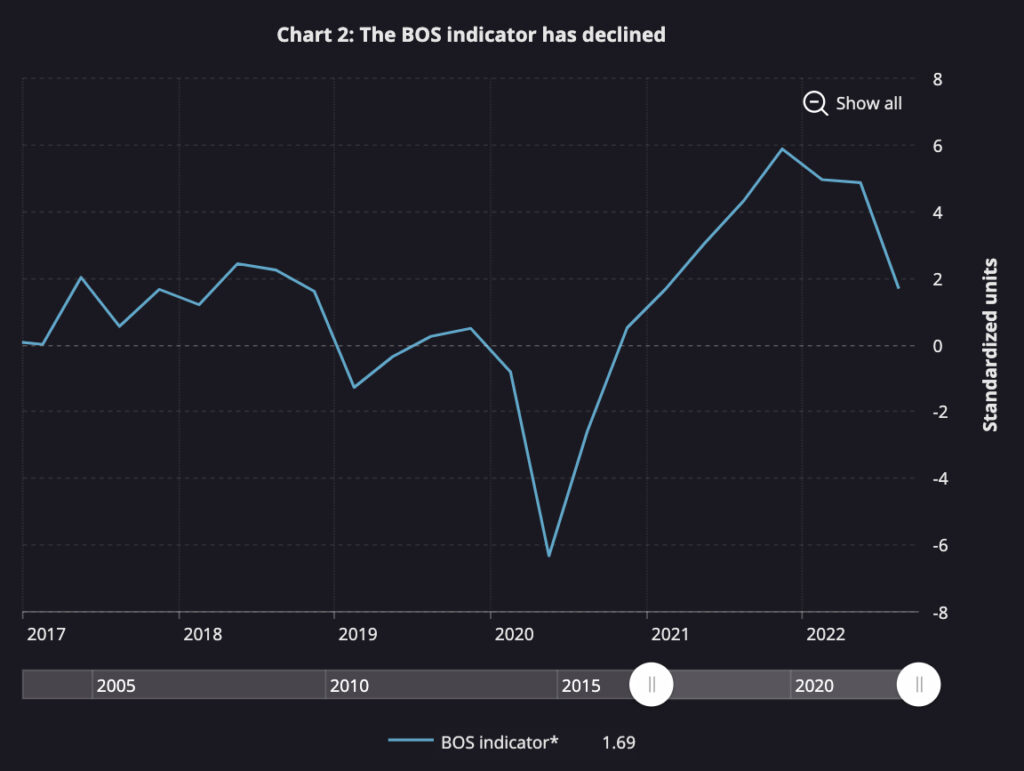

The Bank of Canada’s quarterly surveys of business and consumer expectations show that sentiment continues to trend downwards as inflation expectations have yet to abate. The central bank’s business outlook indicator slumped from 4.87 to 1.69 in the third quarter, marking the biggest decline since the second quarter of 2020. “Many firms expect slower sales growth as interest rates rise and demand growth shifts closer to pre-pandemic levels,” policy makers wrote.

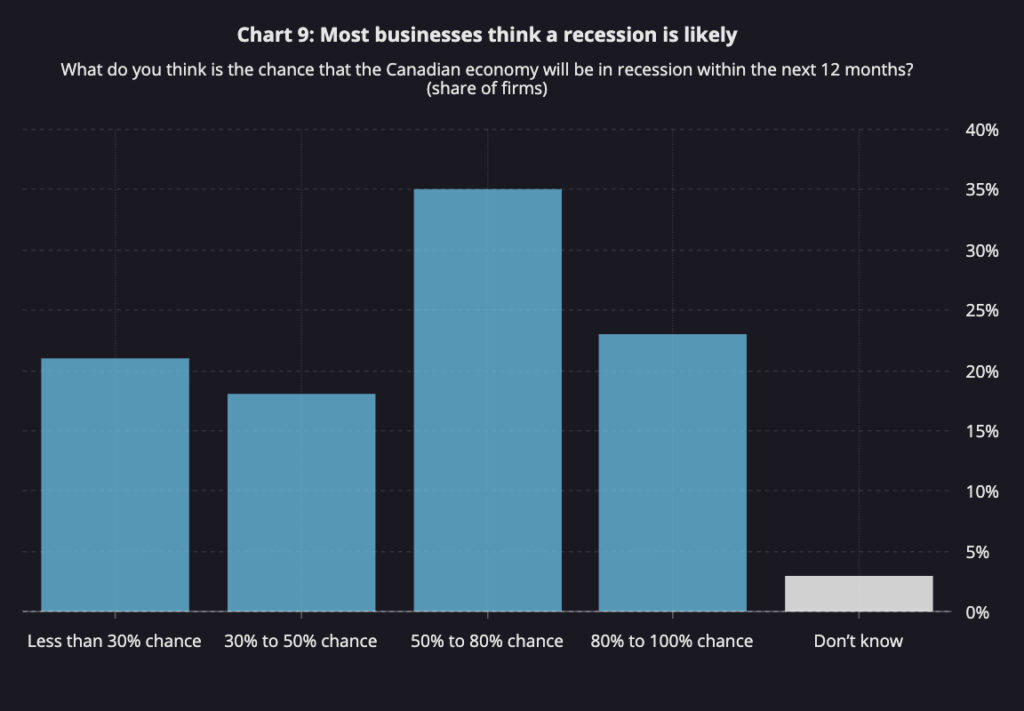

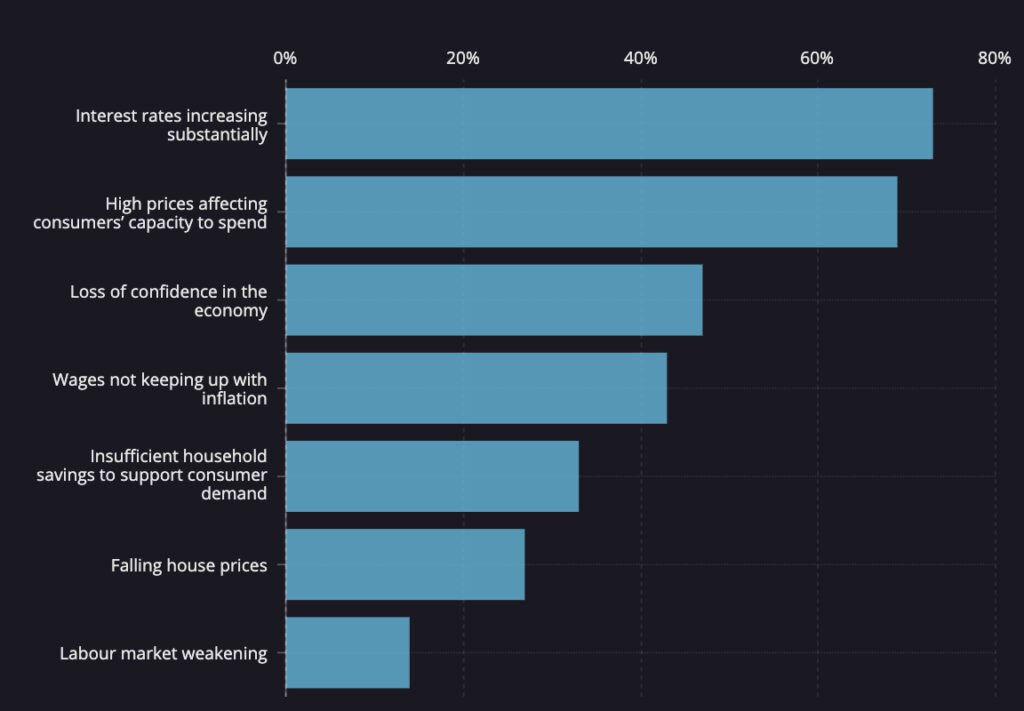

Although Canadian businesses said they anticipate their input and output prices will subside, they still expect overall inflation to remain entrenched and substantially higher than 3%. At the same time, firms said their sales levels will likely slow over the next 12 months, particularly those focused in the real estate and household consumption sectors as rising interest rates dampen growth. As such, most businesses think there is a 505 chance the Canadian economy will slump into a recession in the next year, largely due to a large increases in borrowing costs and high prices.

Businesses also indicated they don’t foresee substantially high wage growth persisting over the next 12 months, which diverges from a separate Bank of Canada Survey of Consumer Expectations, where 40% of respondents anticipating pay increases of over 4% by the third quarter of next year. While firms are forecasting a slowdown in demand and subsequently holding back on large wage hikes, consumers believe their incomes aren’t keeping up with inflation, and are ultimately adjusting their shopping and spending habits.

Information for this briefing was found via the Bank of Canada. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.