FULL DISCLOSURE: This is sponsored content for Canadian Copper.

Canadian Copper (CSE: CCI) has delivered a much-anticipated preliminary economic assessment. The PEA focuses on what the company calls a “combined strategy,” assessing the economics of mining their Murray Brook Deposit at the Caribou Process Plant, the rights to which the company recently obtained.

The study, headlined by a net present value of $171 million and an internal rate of return of 36% on an after-tax basis using a 7% discount, envisions a 13 year life of mine that would see 30 million pounds of copper equivalent produced annually. Annual production is expected to amount to 8 million pounds of copper, 47 million pounds of zinc, 783,000 ounces of silver and 10 million pounds of lead.

Payback is estimated at just 2.0 years on an after-tax basis.

“This is an important milestone for Canadian Copper. Today’s PEA provides the first independent evaluation of our vision to combine two separate and complementary assets into a possible near-term, Canadian-based, critical metals producer,” commented Simon Quick, CEO of Canadian Copper.

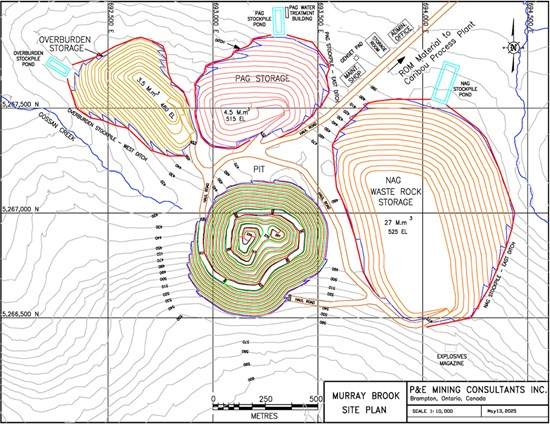

The current model outlines an operation that would see the Murray Brook deposit mined using open pit mining methods at a rate of 3,300 tonnes per day. Ore would then be trucked along a 13 kilometre dedicated haul road to the Caribou Process Plant for processing.

Processing, after a handful of upgrades to the current 3,000 tpd plant to boost output to 3,300 tpd, would ultimately produce three concentrates – copper, zinc, and lead – which would then be trucked 83 kilometres to a deepwater port for transport to European and Asian markets for smelting.

Initial capital costs for the operation total just $64 million, which includes $6 million for the purchase of the Caribou Plant and a further $7 million for upgrades to the facility, while sustaining capital costs over the life of mine are estimated at $49 million.

Cash costs on a co-product basis are estimated at US$2.95 per pound, while all in sustaining costs are estimated at US$3.14 per pound. The estimates assume a process feed average grade of 1.91%.

Total revenue over the life of the mine is estimated at $2.3 billion, which translates to $171 million in revenue on an average annual basis. EBITDA over the life of mine is estimated at $690 million, or $52 million annually, while free cash flow is estimated at $353 million over the life of mine.

In terms of next steps, required environmental baseline studies are expected to be completed this year, with environmental registration expected to be completed by Q1 2026. On the ground, Canadian Copper intends to complete step out drilling to define the final open pit limit, while completing metallurgical drilling and testwork in an effort to improve process plant operating costs and recoveries. Engineering activities are also expected to take place this year in an effort to push the project forward.

“In the last 18 months, we have closed the purchase of Murray Brook, which is the largest VMS open pit amenable deposit in New Brunswick, updated its NI 43-101 Mineral Resource Estimate, secured exclusive rights to acquire the adjacent Caribou Processing Complex. At 2024 year-end, our total capital raised is less than $5 million dollars, demonstrating disciplined capital allocation and our daily effort to respect Canadian Copper shareholders,” continued Quick.

Canadian Copper last traded at $0.16 on the CSE.

FULL DISCLOSURE: Canadian Copper is a client of Canacom Group, the parent company of The Deep Dive. Canacom Group is currently long the equity of Canadian Copper. The author has been compensated to cover Canadian Copper on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.