FULL DISCLOSURE: This is sponsored content for Canadian Copper.

Positive results were released this morning from an ongoing metallurgical testwork program being conducted by Canadian Copper (CSE: CCI). The study is being conducted in advance of a preliminary economic statement that is to be released later this year.

The study was conducted on 600 kilograms of historical diamond drill core materially that was collected from four separate regions of Canadian Copper’s Murray Brook copper-zinc-lead-silver deposit. The program consisted of froth floatation tests that simulated a bulk copper/lead float scenario, which occurred prior to zinc flotation.

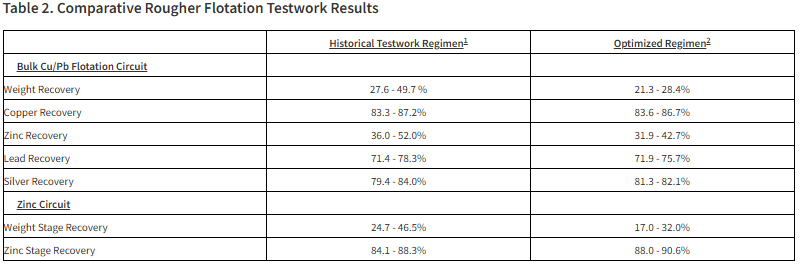

Early results from the program, conducted on one of the four samples, have seen copper recoveries of up to 86.7%, with zinc recoveries of up to 42.7%, lead recoveries of up to 75.7% and silver recoveries of up to 82.1% within the bulk copper/lead floatation circuit. A secondary zinc circuit meanwhile increased zinc recoveries to 90.6%.

The results were compared to an earlier test program conducted in 2013, after which flotation conditions were modified from baseline to optimize metallurgical results. Metal recoveries to the bulk and zinc rougher concentrates were largely equal to or slightly improved compared to the reagent regime from 2013.

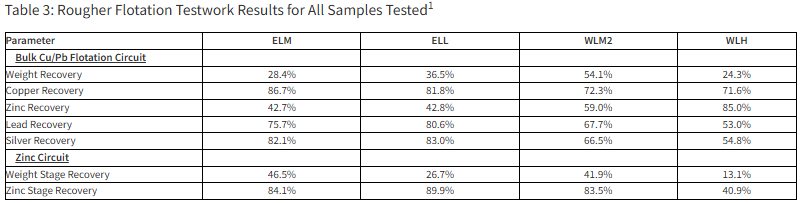

The program was then conducted on all four samples, after which it was determined that WLH represented oxidized material from the upper layer of the deposit, which is excluded from the resource statement. Results from the separate samples are as follows.

Next steps for the program will see cleaning flotation testworking conducted using the products from these tests, which is planned for March and April. The study is expected to confirm reagent regimes for these circuits along with probable concentrate grades. Locked cycle tests will then be conducted to predict overall metal recoveries versus concentrate grade targets.

“These positive rougher flotation results are a key step to the integration of the Murray Brook Deposit and the Caribou Process Plant. Composites selected for this program targeted early mine life material indicative of the planned plant feed grades and lithologic characteristics, which is designed to achieve three objectives. First, to forecast the Murray Brook Deposit recovery performance using the existing Caribou Process Plant circuits. Second, to identify and refine any needed Caribou Process Plant flotation circuit changes to execute our fit-for-purpose strategy under the Combined Scenario. Third, to develop accurate cost and design inputs for our upcoming PEA due in the H1, 2025,” commented Canadian Copper CEO Simon Quick.

Canadian Copper last traded at $0.19 on the CSE.

FULL DISCLOSURE: Canadian Copper is a client of Canacom Group, the parent company of The Deep Dive. Canacom Group is currently long the equity of Canadian Copper. The author has been compensated to cover Canadian Copper on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.