FULL DISCLOSURE: The Deep Dive is long the equity of Canadian Copper.

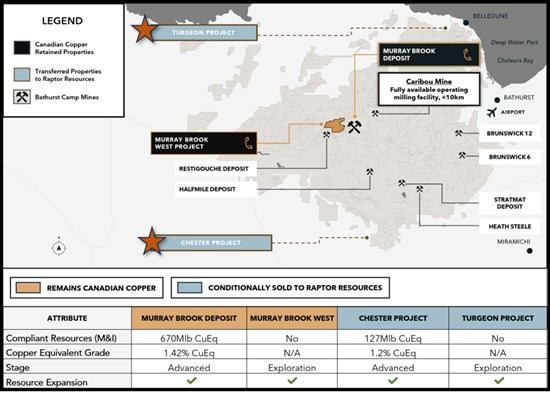

Canadian Copper (CSE: CCI) has disclosed it intends to center its focus on its Murray Brook project, which it says is New Brunswick’s largest undeveloped open pit polymetallic resource. The company as a result has entered into sales agreements for two of its option agreements, with consideration to be provided in the form of cash and shares.

The sales arrangements will see its option agreement rights for the Chester Project sold for $1.4 million, while similar rights for the Turgeon Project will be sold for $0.7 million. Total consideration under the two arrangements will provide the company with up to $2,160,000 in cash and shares.

Both of the sales agreements have been entered into with Raptor Resources, with cash payments totaling $1.35 million being contingent on Raptor listing its shares on the Australian Stock Exchange. Canadian Copper meanwhile is slated to receive 4.0 million shares in Raptor under the terms of the agreement.

“Focus is essential when navigating the current capital markets situation for most junior miners in Canada today. We believe this strategic divestment achieves two objectives for us. First, it enables Canadian Copper to allocate capital exclusively on the advanced large open pit Murray Brook deposit and surrounding exploration ground, while still participate in Chester and Turgeon resource growth through Raptor Resources shares. Second, this transaction will strengthen Canadian Copper’s balance sheet without shareholder dilution,” commented Simon Quick, CEO of Canadian Copper.

Canadian Copper last traded at $0.085 on the CSE.

FULL DISCLOSURE: Canacom Group, the parent company of The Deep Dive is long the equity of Canadian Copper. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.