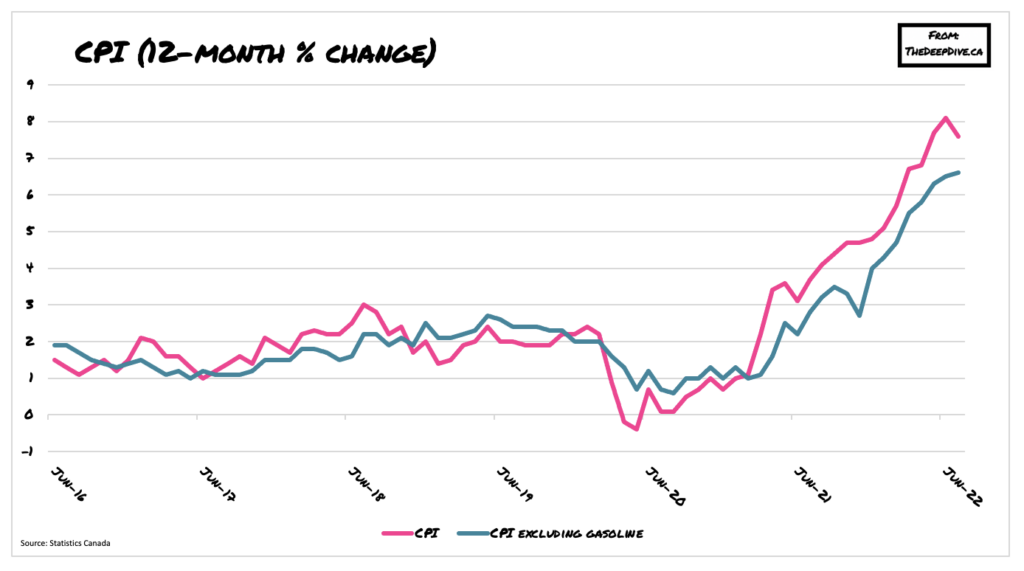

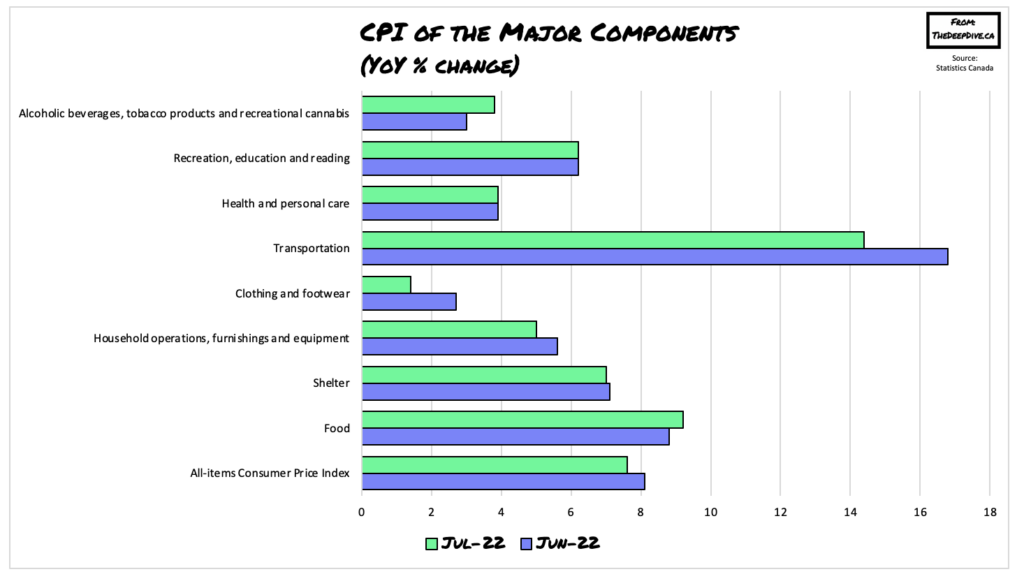

Hurrah! Canadians are finally getting a break from surging consumer prices, as the latest CPI print decelerated from a jaw-dropping 8.1% annual gain in June to only 7.6% in July. What a relief! Well, not so fast. The deceleration was only the result of a slower year-over-year gain in gasoline prices, as consumers paid 9.2% less for fuel compared to the previous month.

Excluding gasoline, prices jumped 6.6% from July 2021, following a 6.5% increase in June, as upward inflation pressure remained broad-based across all categories, namely groceries, natural gas, and in-person activities related to the lifting of Covid-19 restrictions.

When compared on a monthly basis, CPI was up 0.1% in July, marking the seventh straight month of gains. In fact, there was essentially zero relief for Canadian consumers’ wallets, because price increases continued to surpass the year-over-year increase in hourly wages, which rose by a paltry 5.2% last month. The cost of groceries appear to be rising endlessly, and jumped by an annual 9.9%, following a 9.4% increase in June.

In-person services and various activities related to the lifting of Covid-19 restrictions and higher demand for summer travel also saw prices substantially increase. Airfares jumped 25.5% between June and July, accommodation costs rose 47.7% from July 2021, and it cost travellers 7.3% more to eat out at restaurants from the month prior.

Keeping a roof over one’s head also did not get any price relief last month. In unison with rising interest rates, the mortgage interest cost index increased 1.7% in July— the first such increase since September 2020. Higher borrowing costs are paving the way for an increased demand for rental units, and as such, landlords raised rent prices 4.9% compared to July of last year.

Although it appears that annual inflation may have reached its peak, the persistent increase in core consumer prices will likely keep the Bank of Canada on track of raising interest rates. “It is the third-highest print in the past four decades,” said Rosenberg Research & Associates economist David Rosenberg, as cited by Bloomberg. “There’s nothing here— even when you look through the various components— that’s going to knock the Bank of Canada off its aggressive posture.”

Information for this briefing was found via Statistics Canada. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.