As opposed to the economic chaos south of the border, Canada’s financial system has remained strong, according to Bank of Canada’s annual Financial System Review.

As Canada quickly imposed lockdown measures across the county during the onset of the coronavirus pandemic back in March, resulting in some economic damage. However, Canada’s banks have remained robust throughout the lockdowns, with credit markets functioning appropriately. Prior to the pandemic, Canada had a strong economy to begin with, with a resiliant mortgage insurance system, and well capitalized banks. Then, when the coronavirus pandemic did hit Canada, the government was able to respond swiftly with appropriate fiscal and monetary policy implementation. Although the economy is still in one piece, compared to the 2008 financial crisis, it still ranks worse.

There is however, pessimism regarding some of Canada’s lower-rated businesses and lenders, as well as those businesses focused in the country’s energy sector. Some of these businesses are grappling with added funding costs, in addition to potential downgrades- thus increasing the risk to Canada’s financial stability. The companies that do fall under the higher-risk category are finding it more challenging to secure US leveraged loans, meanwhile the alternative lenders have been grappling with lack of liquidity.

Then there are the Canadian households, which have been struggling to make ends meet. When coronavirus restrictions and lockdowns were imposed, many Canadians suddenly found themselves without employment- and with the current downturn in the housing market, many of those households are finding it increasingly difficult to boost their liquidity position.

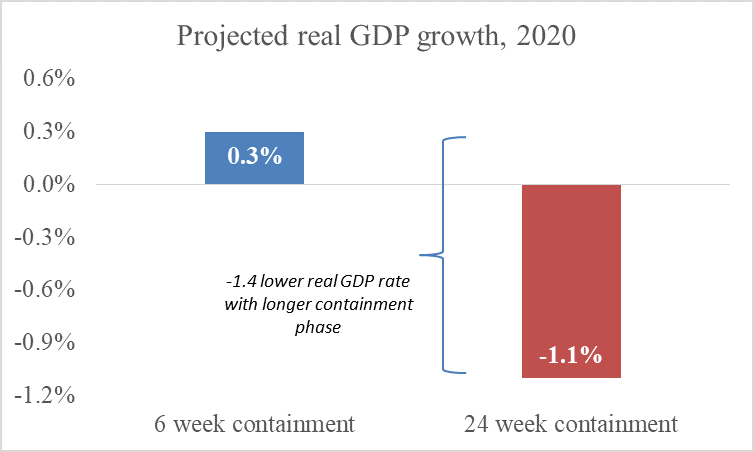

Thus far, Canada’s central bank, along with the government, has been implementing a variety of monetary and fiscal policies as a means to softening the negative economic impact. The bank of Canada has been actively purchasing a variety of assets including government bonds, commercial paper, and bankers acceptances, thus increasing the balance sheet by $270 billion. However, if the economy continues with lockdown measures for a longer period of time, or there is a resurgence of the virus, then further damages could ensue, causing the policy makers to implement more aggressive action.

Information for this briefing was found via Bloomberg, Bank of Canada, and Conference Board of Canada. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.