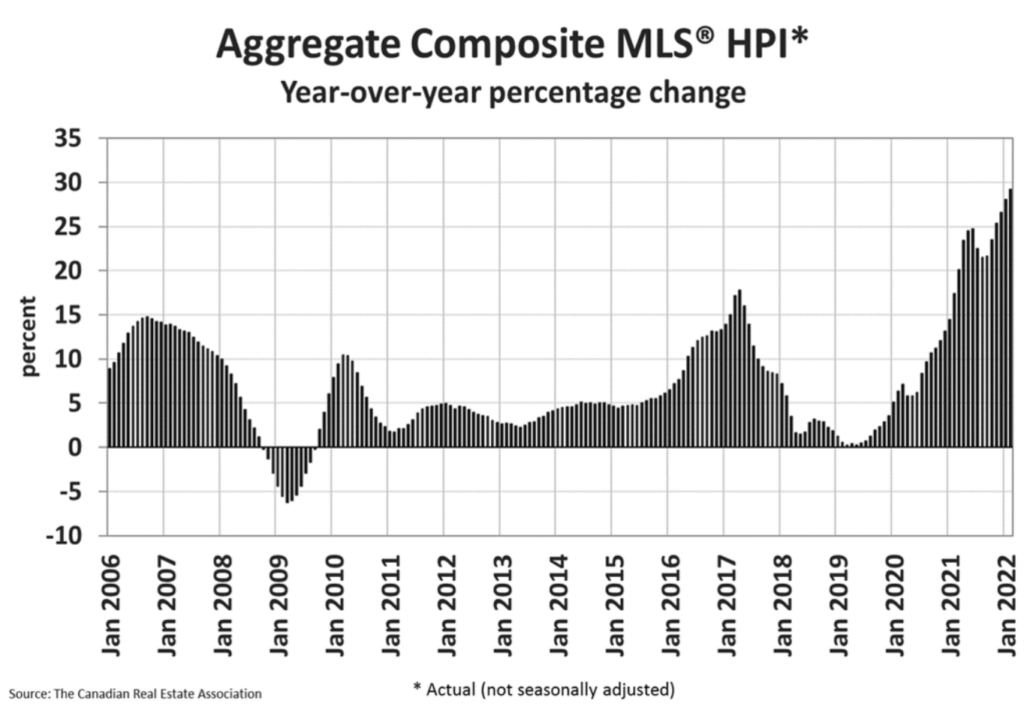

Canadian housing prices jumped by yet another record in February, as buyers took advantage of historically low borrowing costs ahead of the central bank’s planned series of interest rate increases which kicked off in March.

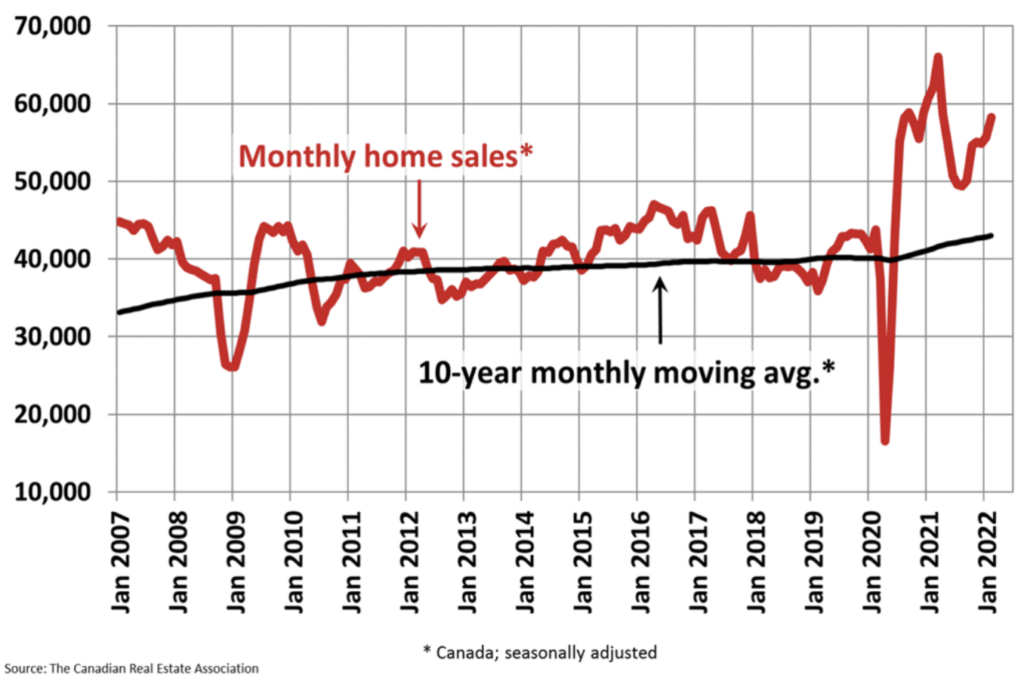

National home sales were up 4.6% month-over-month in February, as the number of listings modestly rebounded following a sharp decline in the month prior. Nearly 60% of the country’s housing markets reported an increase in sales, particularly in Calgary, Edmonton, and the GTA.

“As expected, after a bit of a lull in January, we saw the first batch of spring 2022 listings come to market in February, and they were quickly scooped up by buyers,” said Canadian Real Estate Association Chair Cliff Stevenson. “It’s unclear if this is the beginning of a re-emergence of some of the many would-be sellers who have been dormant for the last two years, or if the supply will fade towards the summer like it did in 2021.”

Following a decline of 10.8% in January, the number of new listings were up 23.7% last month, with majority of the gains noted across the GTA, Calgary, and Fraser Valley. CREA reported that there were just 1.6 months worth of inventory left at the end of February, marking the lowest level on record.

Meanwhile, benchmark home prices leaped by a record 3.5% last month, to an annualized record increase of 29.2%. The non-seasonally adjusted average home price in Canada sat at $816,720— also the highest on record.

Information for this briefing was found via CREA. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.