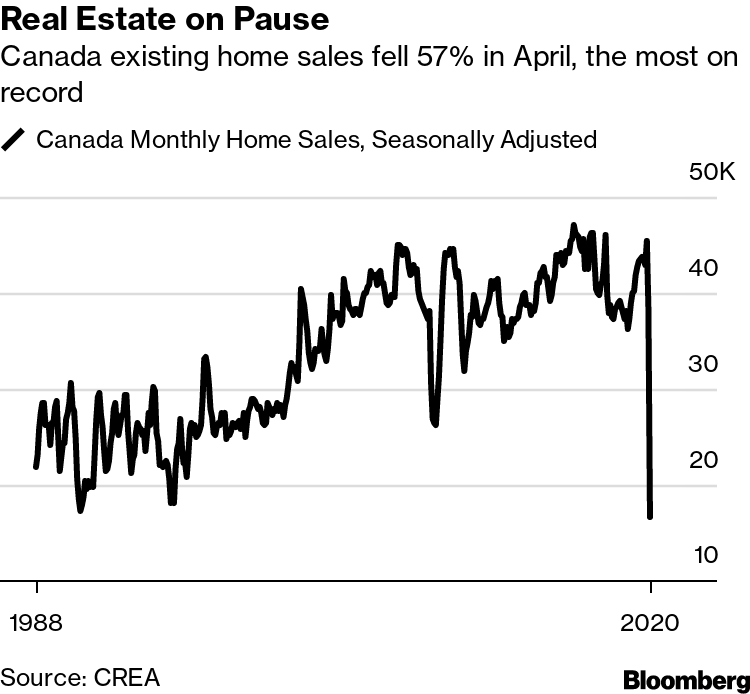

According to a recent report released by the Canadian Real Estate Association, home sales have dropped by a historic amount, exposing further damages stemming from the coronavirus pandemic.

In the month of April, existing home sales fell by 56.8%, while prices decreased by a slight margin of 0.6%. These numbers suggest that a large portion of sellers and buyers opted out of the housing market while nation-wide lockdowns were imposed. While social distancing rules were being strictly imposed, many homeowners refrained from listing their properties, meanwhile buyers put their house-hunting on pause. In fact, in some of Canada’s larger cities, open houses were banned altogether, as a means of abiding by health regulations.

Although early housing results for the month of May suggest the market is beginning to rebound and restrictions in some provinces are being slowly lifted, Canadians still do not have quite an optimistic view of the housing market. According to a consumer survey conducted by Nanos Research, a total of 47% of Canadians foresee a decrease in housing prices in the next six months, suggesting the drop in demand may linger for awhile longer.

Furthermore, according to Bank of Canada’s Financial System Review, there is in fact a slow-down of activity in the housing market, as many consumers are valuing future spending amid a fog of income uncertainty. The reduction of liquidity in the housing market will most likely put further stress on household balance sheets, as there is a decrease in selling options.

Information for this briefing was found via Bloomberg, the Canadian Real Estate Association, and Bank of Canada. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.