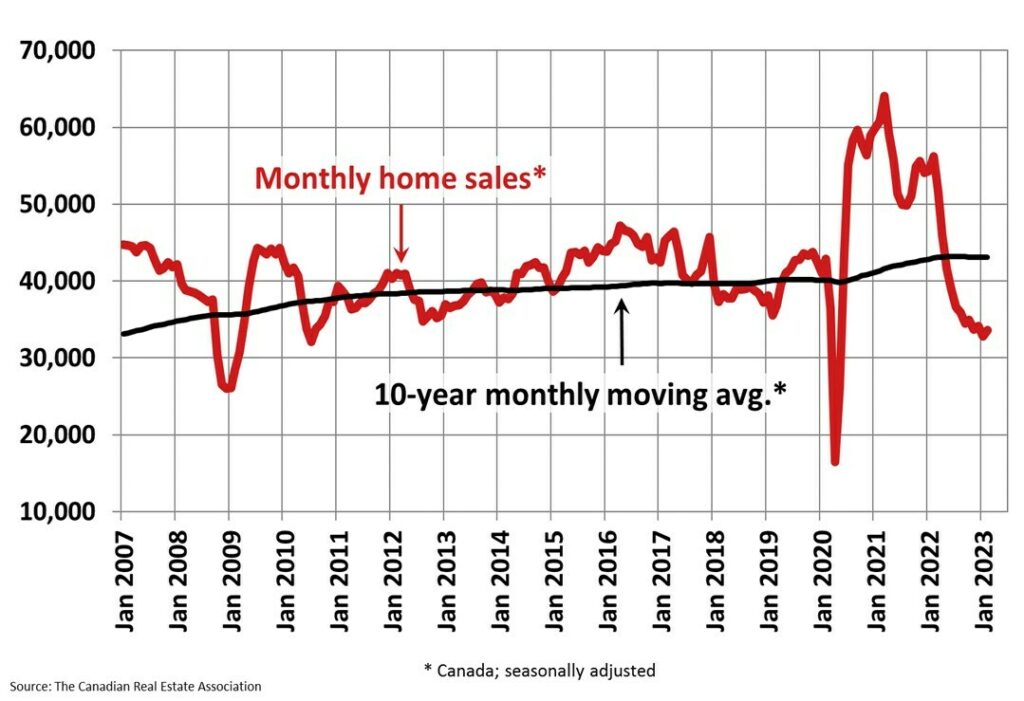

High interest rates aren’t sending potential homebuyers to the sidelines.

Latest data from the Canadian Real Estate Association shows that national home sales were up 2.3% between January and February, largely led by transactions in the Greater Toronto and Greater Vancouver areas. However, sales were 40% lower compared to February 2022, and are rather now on par with the number of transactions seen for that month in 2018 and 2019.

Meanwhile, the national average home price stood at $662,437, marking an 18.9% drop from the record set in February 2022; still, the average price was up over $50,000 from January, thanks to substantial gains in the GTA and the GVA. “The similarities between 2023 and the recovery year of 2019 continued to emerge in February, with sales up, the market tightening, and month-over-month price declines getting smaller,” said CREA economist Shaun Cathcart.

The number of newly listed homes fell 7.9% month-over-month in February, causing inventory to decline from 4.2 months in January to 4.1 months— an entire month below the long-run average. “Future sellers, many of whom will also be buyers, are likely biding their time until the optimum time to list and buy something else. For most, that’s in the spring. Will buyers jump off the fence to snap homes up in 2023 once they finally start to hit the market? They did in 2019,” added Cathcart.

Information for this briefing was found via the CREA. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.