Home prices across Canada fell for the first time in two years last month, as an increasing number of buyers remain on the sidelines amid rising borrowing costs.

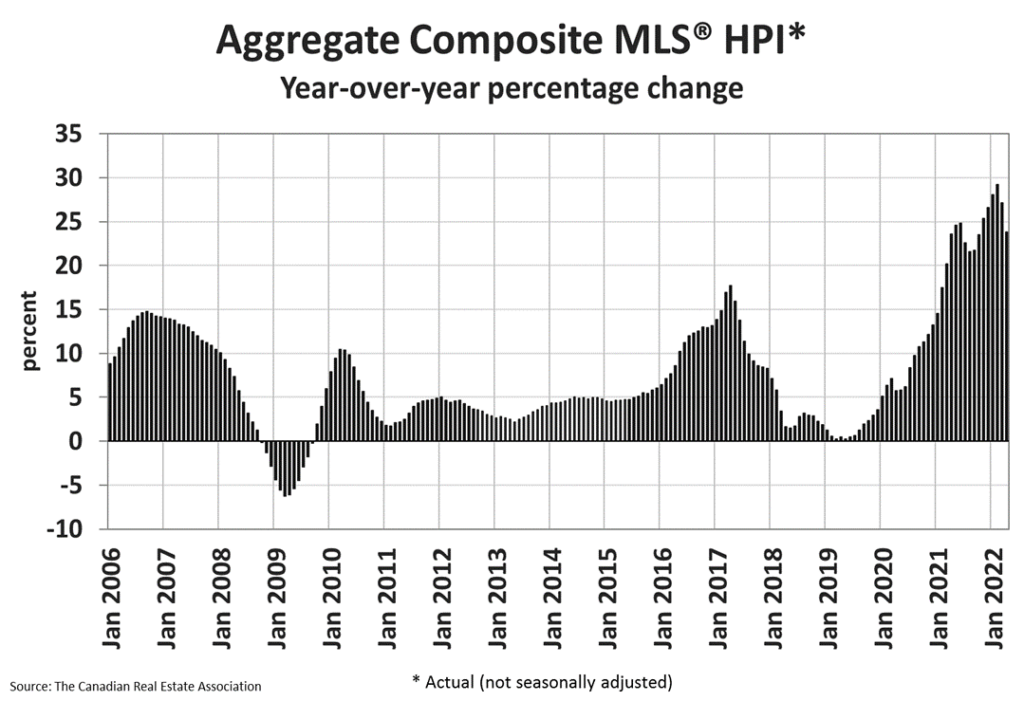

Latest data from the Canadian Real Estate Association showed that the national home price slumped 0.6% between March and April, marking the first decline since April 2020, while still remaining 23.8% above last year’s levels. The majority of last month’s declines were concentrated in Ontario real estate markets, namely smaller communities surrounding Toronto— which, just up until recent, saw some of the sharpest price gains and subsequent demand surges for housing.

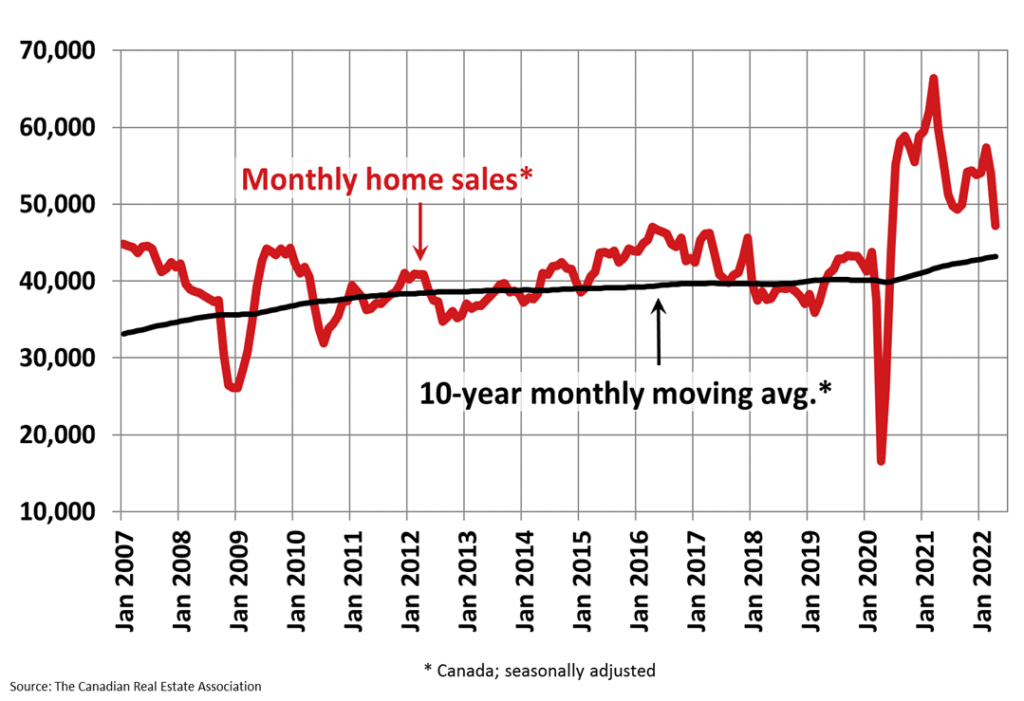

The total number of home sales were also down in April, indicative of a real estate market beginning to cool off in response to the central bank’s shift towards a more hawkish monetary policy stance amid surging inflation. The CREA data showed that home sales fell 12.6% month-over-month, putting real estate activity at the lowest level since the summer of 2020. Last month’s sales drop was led by the Greater Toronto Area, with 80% of local markets reporting declines.

“Following a record-breaking couple of years, housing markets in many parts of Canada have cooled off pretty sharply over the last two months, in line with a jump in interest rates and buyer fatigue,” explained CREA chair Jill Oudil. The inflationary environment is being exasperated by ongoing supply chain disruptions and a global surge in commodity prices, prompting policy makers to reign in ultra-accommodative monetary policies and quickly flush out stimulus from the economy.

But, even despite a slowdown in home price gains and sales levels, there were still just 2.2 months worth of inventory in April, compared to the long-run average of five months. “After 12 years of ‘higher interest rates are just around the corner,’ here they are,” said CREA senior economist Shaun Cathcart. “But it’s less about what the Bank of Canada has done so far. It’s about a pretty steep pace of continued tightening that markets expect to play out over the balance of the year.”

Information for this briefing was found via the CREA. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.