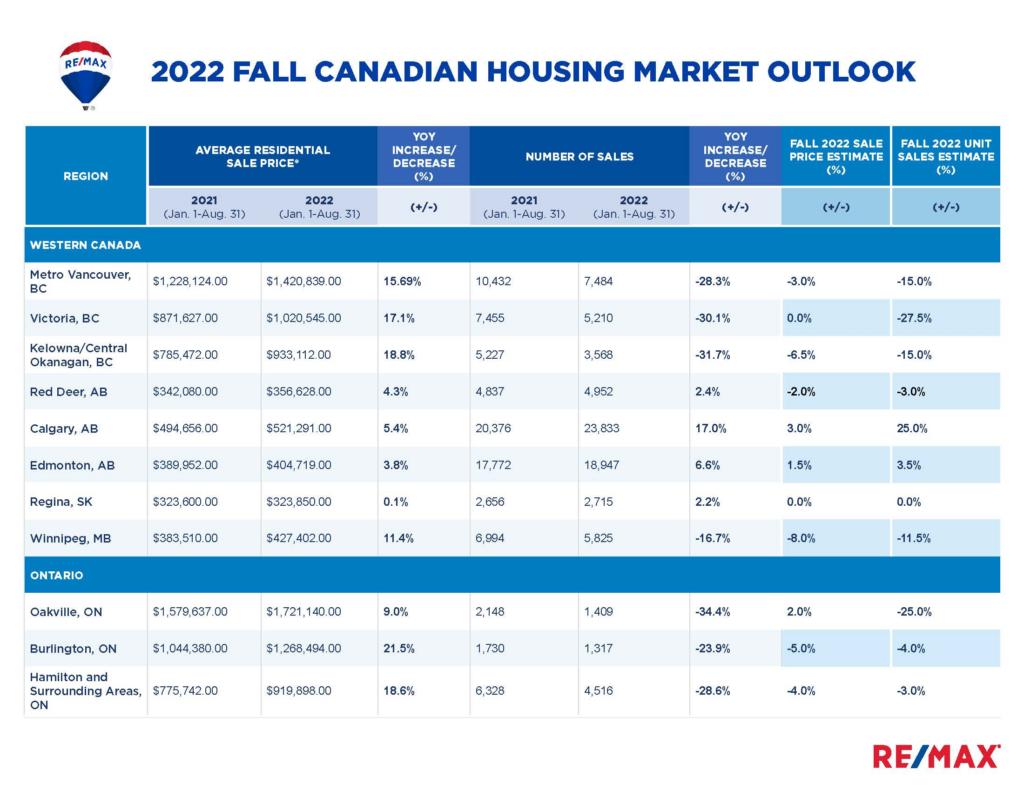

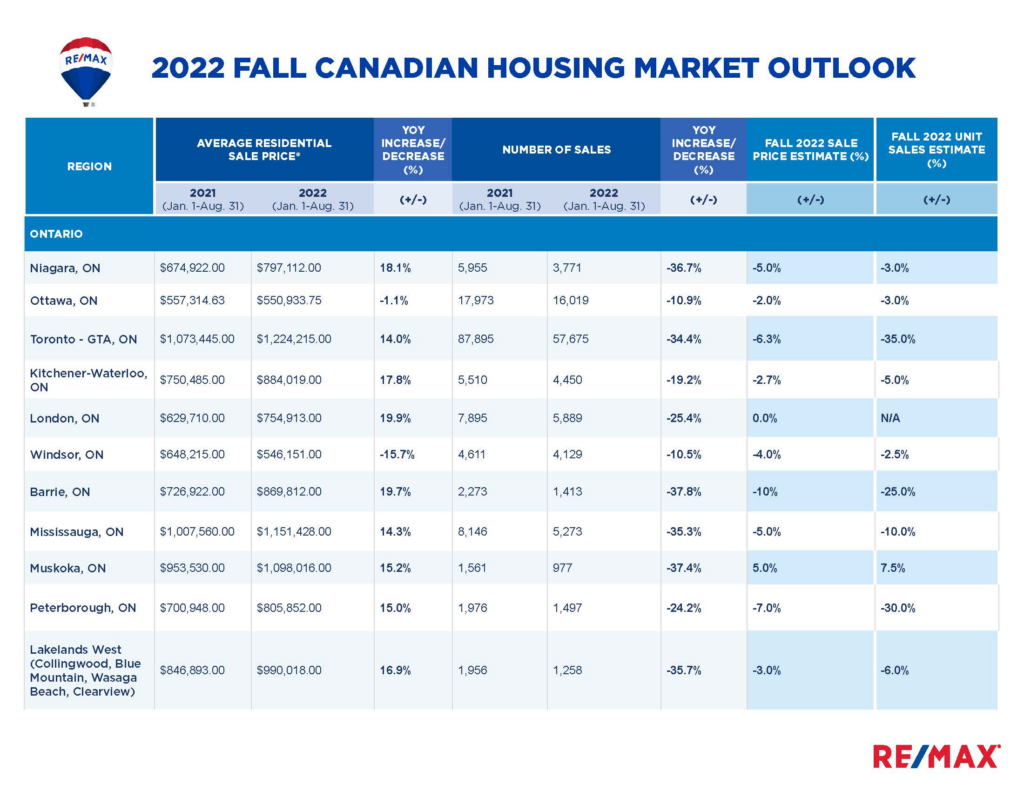

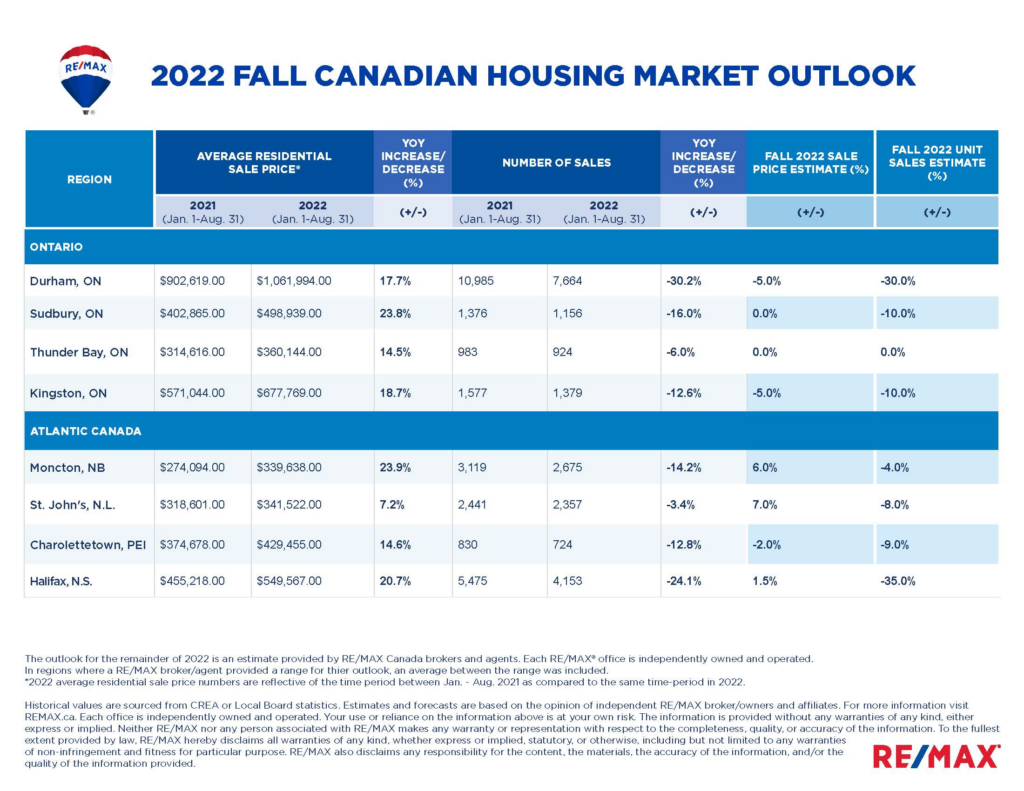

In the last months of the year, the national average residential sale price in the Canadian housing market is expected to fall by 2.2%, according to RE/MAX’s 2022 Fall Canadian Housing Market Outlook Report.

RE/MAX brokers and agents anticipate a drop in sales this fall in 18 of the 30 markets questioned. This market easing follows rising interest rates, record-high inflation, and broader global and economic uncertainty, all of which have damaged consumer confidence and market activity.

Contrary to the declining trend, however, seven of the thirty Canadian home markets studied are anticipated to witness small price increases ranging from 1.5 to 7%.

“While we are still facing significant housing supply shortages across the Canadian housing market, many regions are experiencing softer sales activity given recent interest rate hikes. This provides some reprieve from the unprecedented demand and unsustainable price increases we’ve seen across Canada through 2021 and in early 2022,” said Christopher Alexander, President at RE/MAX Canada.

However, the organization added that “the current lull in the market is only temporary.”

The biggest sales price decline is expected in Barrie, Ontario, pegged at 10% decrease, while St. John’s, Newfoundland and Labrador is anticipated to have the highest sales price increase at 7.0%.

According to a survey of RE/MAX brokers and agents, 25 out of 30 said rising interest rates have impacted activity in their local residential market this year, with some indicating that this has been the most significant factor influencing homebuyer and seller confidence – a trend that is expected to continue through the rest of 2022.

These findings are confirmed by a new Leger study commissioned by RE/MAX Canada, which finds that 44% of Canadians think that rising interest rates are driving them to postpone purchasing a home this fall, while 34% say they will not.

Corollary, the Canada Mortgage Housing Corporation recently stated in September that housing starts totaled 267,443 units in August, a 3% decrease.

Information for this briefing was found via the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.