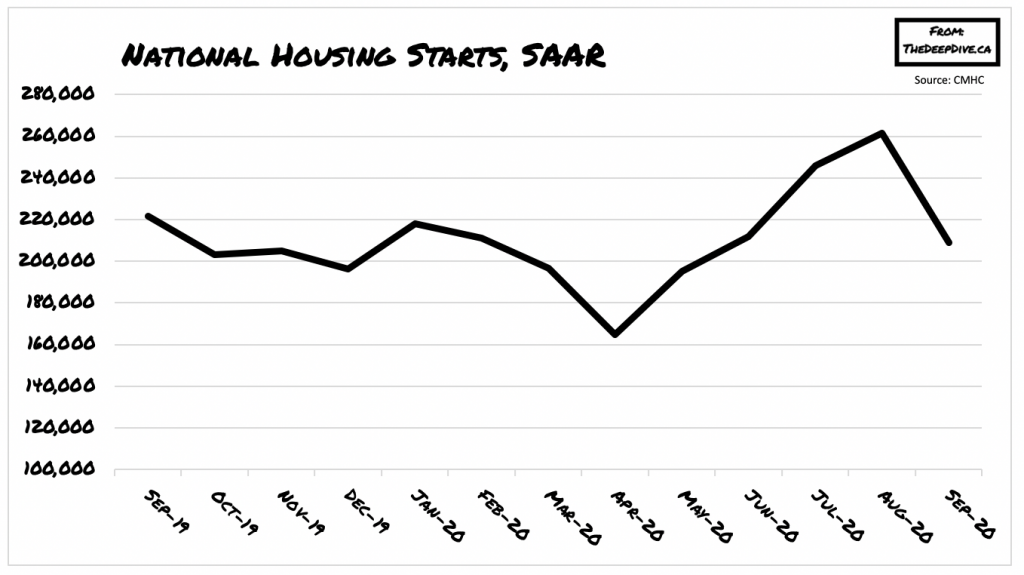

As the economy transitions into the fall and winter season, there has been a consensus among economists that output will likely decline from its optimistic summer highs. Indeed, Canada’s construction sector, which has remained significantly resilient despite the recession, is beginning to succumb to downward economic pressures.

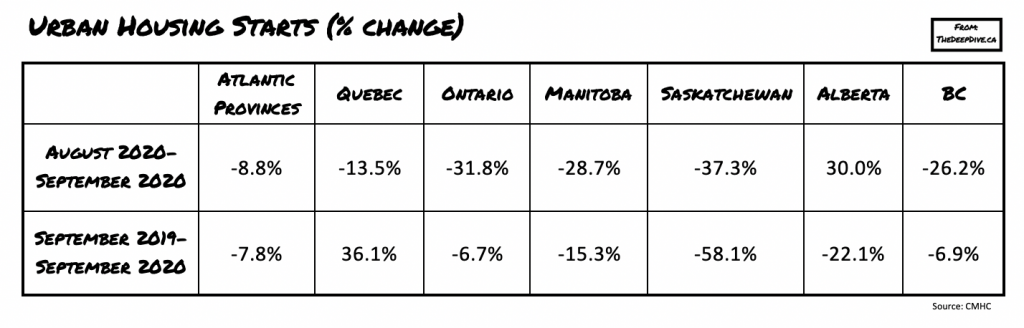

According to the latest data released by the Canada Mortgage and Housing Corp (CMHC), homebuilding across the country still continues to relatively remain strong, but in September housing starts plunged by an alarming 20% from the prior month. The seasonally adjusted annual rate (SAAR) of urban housing starts dropped from 261,547 units to 208,980 units in September, but still remained aligned with the average readings recorded in 2019.

However according Refinitiv, economists were anticipating an annual rate of 240,000 units for the month. The primary weakness in housing starts came from British Columbia and Ontario, which each saw housing starts fall by 26% and 31%, respectively. According to CMHC chief economist Bob Dugan, the pace of housing starts across Canada will likely continue declining towards the end of 2020 due to the continued negative impacts from COVID-19 on housing and economic indicators.

Information for this briefing was found via CMHC. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.