Home prices across Canada edged even higher in November, as persistently low inventory levels fail to meet rising demand that is being fuelled by expectations of an interest rate hike come next year.

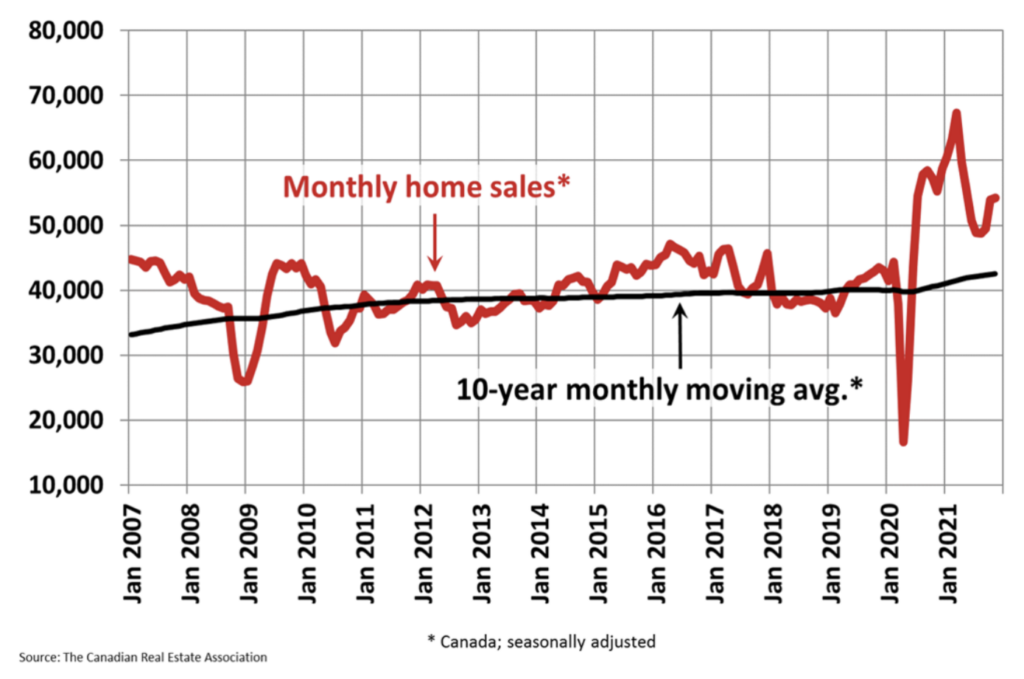

The Canadian Real Estate Association on Wednesday reported that home sales rose 0.6% month-over-month in November, following an increase of 9% in the prior month. Since the beginning of the year, a total of 630,634 properties traded hands, significantly surpassing the annual sales record of 552,423 for the entirety of 2020.

“The supply issues we faced going into 2020, which became much worse heading into 2021, are even tighter as we move into 2022,” explained CREA chief economist Shaun Cathcart. he warned that tighter inventory levels, coupled with a potential interest rate hike next year will exasperate current demand, and make it even less affordable for potential homebuyers to enter the real estate market.

The number of newly listed properties was up 3.3% between October and November, while the sales to new listings ratio edged lower from 79.1% to 77% last month. There were a total of 1.8 months worth of inventory at the end of November— the lowest on record aside from March 2021.

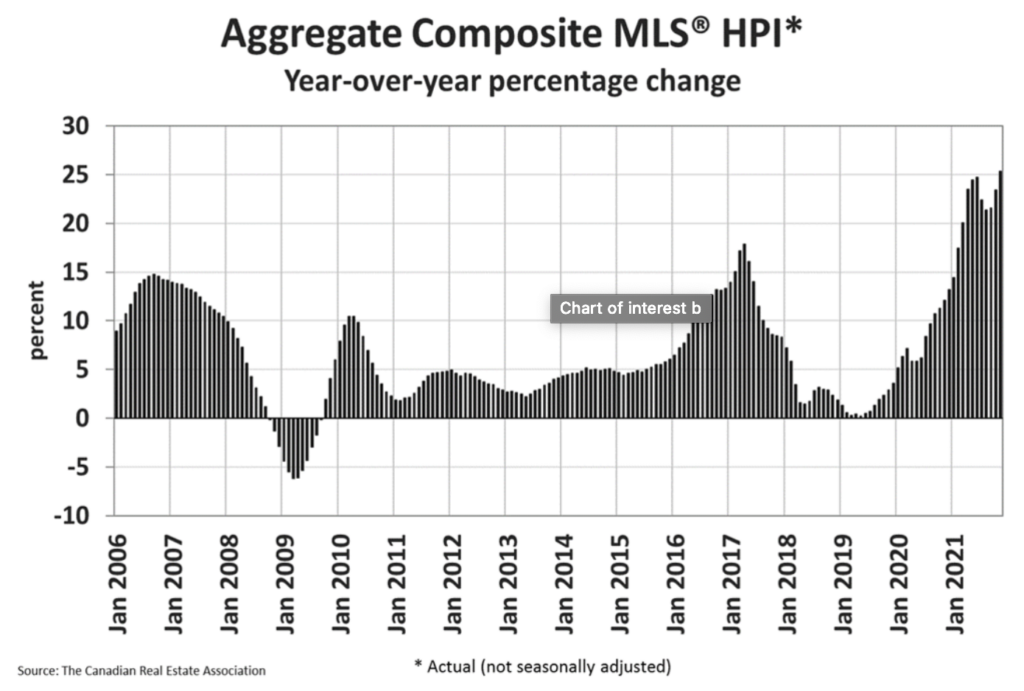

The rising disparity between housing supply and demand has caused prices to increase by a record 25.3% from November 2021, with the benchmark sale price hitting $790,600.

Information for this briefing was found via the CREA. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.