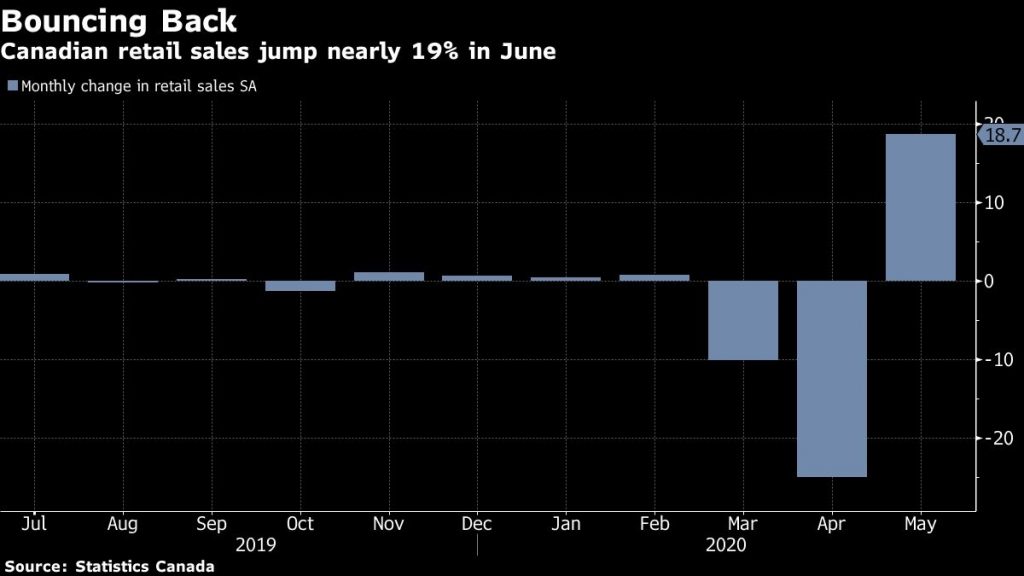

As restrictions continue to be lifted across Canada’s provinces and the economy enters a modest recovery period, it appears that retail sales have been rebounding sharply to near pre-pandemic levels.

According to the latest Statistics Canada data analyzed by Bloomberg, receipts increased by 18.7% in May, followed by a June flash estimate of a further 25% gain. As a result, the the total sales for the previous month amounted to approximately 100% of February’s levels. This data suggests that initial consumer confidence has been soaring, with Canadians eager to spend following several months of restrictions and stay-at-home orders.

Although there exists a significant level of pent up demand among consumers, the initial bout in retail spending could quite possibly only be short-lived. Given that the boost in sales is being fueled by the federal government’s various COVID-19 income support programs, the second half of 2020 could very well be subject to declining demand, according to CIBC World Markets economist Royce Mendes.

The report also found that almost all retail sub-sectors posted increases in May, except for beverage and food stores, which had surpassed record increases back in March. In the meantime, gains in auto sales amounted to a 66% increase, as many dealerships were able to reopen with safety precautions and social distancing measures in place.

Statistics Canada’s retail data has thus far been consistent with spending data compiled by several Canadian banks. According to a report released by TD Bank, the growth in consumer spending for the beginning of July has finally entered positive territory since the onset of the pandemic. Moreover, it also appears that the main provinces driving the positive growth in Canada’s consumption have predominantly been Ontario, Alberta, and British Columbia. However, economists continue to warn that the boost in consumer spending is most likely to be on the short-term, and will eventually subside as many Canadians continue to struggle with unemployment and businesses with continued restrictions.

Information for this briefing was found via Statistics Canada and Bloomberg. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.