Thanks to persistently high inflation rapidly eroding away at their wallets, Canadians are avoiding shopping, particularly for food.

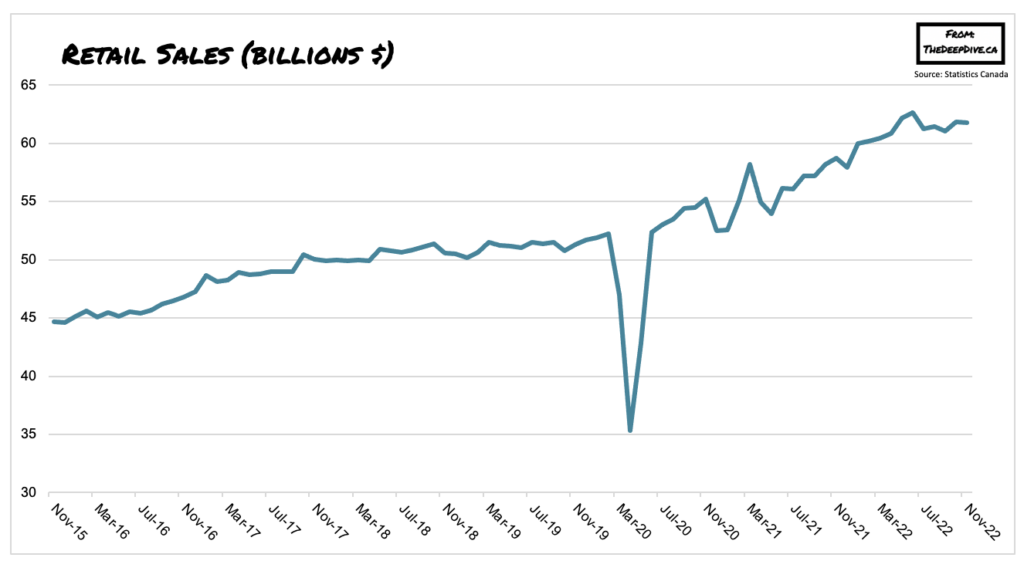

Consumers are forced to make some tough sacrifices in the current inflationary environment. So much so, they are cutting spending even on necessities such as groceries. Latest data from Statistics Canada shows retail sales slumped 0.1% to $61.8 billion in November, with declines noted across six of the 11 subsectors. Core retail sales, which don’t account for goods consumers purchased as gasoline stations and motor vehicle and parts dealers, fell 1.1%, marking the biggest drop in 11 months.

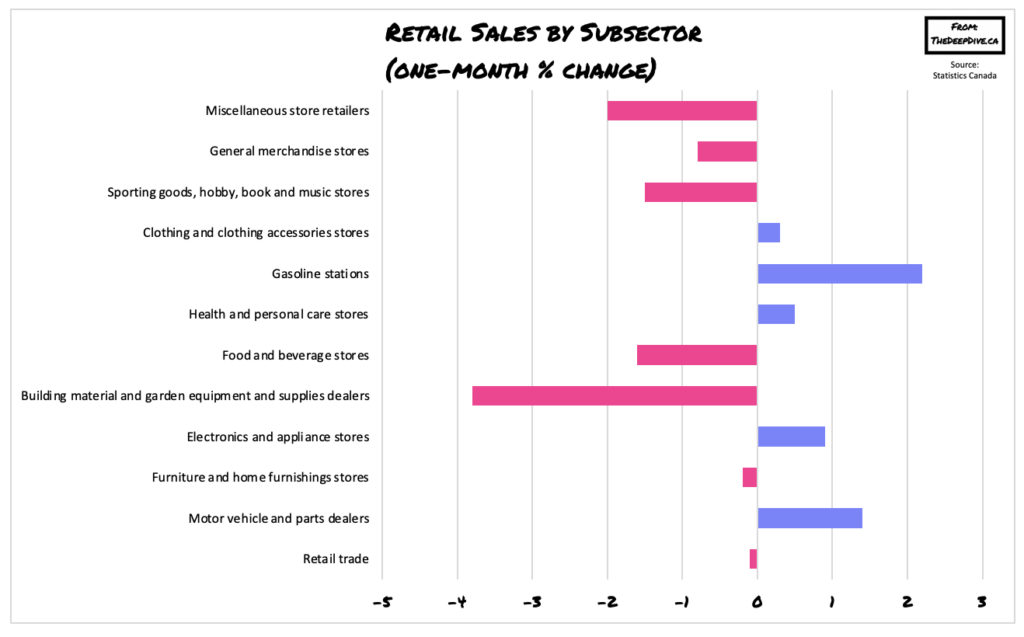

Much of November’s decline was due to lower sales at food and beverage stores, predominantly led by fewer sales in the supermarkets and other grocery stores subsector. The drop in grocery shopping accompanies persistent price increases for grocery items, with CPI figures showing food purchased from stores increased 11.4% year-over-year in November. Sales of building materials and garden equipment were also down that month, falling 3.8%— the largest decline in seven months and in line with the broader cooling of Canada’s housing market.

On the other hand, sales at gasoline stations increased 2.2% in November, as fuel prices fell 3.7% during that period thanks to a number of refineries reopening in the US. Statistics Canada also reported a 3.5% drop in e-commerce sales from November 2021, to a total of $4.4 billion. Regionally, overall retail sales were down in eight of the 10 provinces, led by declines in Quebec and New Brunswick.

Information for this briefing was found via Statistics Canada. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.