Last week, Pablo Zuanic from Cantor Fitzgerald released his second-quarter estimates and updated his 12-month price targets on multiple names within the cannabis sector. Summaries of these estimate updates and price target changes can be found below.

- Cresco Labs (CSE: CL): $13.50 down from $21.50, reiterates Overweight rating

- Green Thumb Industries (CSE: GTII): $43.50 up from $43, reiterates Overweight rating

- Columbia Care Inc. (CSE: CCHW): $5.30 down from $6.57, reiterates Neutral rating

- Jushi Holdings Inc. (CSE: JUSH): $5.25 down from $6.15, reiterates Neutral rating

- Trulieve Cannabis (CSE: TRUL): $56 down from $71, reiterates Overweight rating

First off is Cresco Labs, Pablo says that he lowered their price target due to “sectoral derating and a lower peer-premium assumption.” He believes the analyst consensus for the second quarter to be low due to the market’s growth and the consolidation of assets.

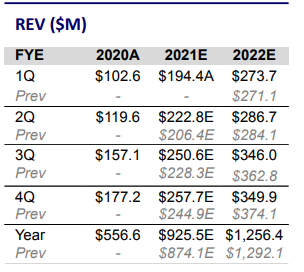

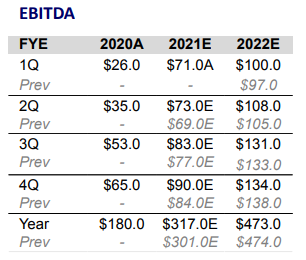

They raise all their revenue and EBITDA estimates into 2022, with their second-quarter revenue estimate being $206.7 million and $51.9 million in EBITDA above 6% above the consensus. He says this is the case due to Illinois and California markets grew 19% and 8% sequentially, while Pennslyvania slowed down a little, only growing 6% compared to 11% last quarter.

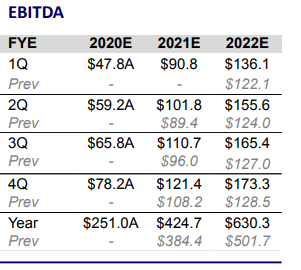

Onto Green Thumb, Pablo’s slight price target raise did not warrant any explanation on the note provided, he is just as bullish on Green Thumb beating the consensus estimates as he was on Cresco Labs. He expects second-quarter revenue to come in at $222.8 million, about 6% above the consensus.

Zuanic believes that the second half of 2021 will be great as the company has a solid eastern state exposure “that can go rec or are in the process of going rec.” Pablo remains more bullish on Green Thumb than consensus due to three out of the company’s four top states grew at a better rate than in the first quarter.

For Trulieve, whose price target got slashed the most, Pablo says the reason to be “sector derating and a more consistent approach across MSOs,” but says that investors should not take that in such a bad light or “make a big deal” about the slash. Pablo believes that Trulieve should be the top position in any cannabis investors portfolio.

As you can tell, Pablo is very bullish on Trulieve, estimating that second quarter sales will come in at C$222.8 million, higher than the $209 million consensuses and growing 15% sequentially. He also expects the second half of 2021 to be strong with the company reporting cultivation expansions in Massachusetts and Pennslyvania while he believes the company will add assets both organically (license wins) and M&A.

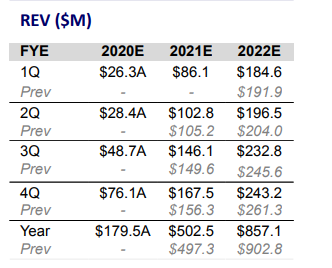

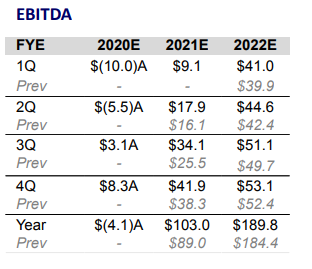

Onto Columbia Care, Pablo believes that Columbia Care’s second-quarter revenue will generally come in line with consensus estimates, he estimates $102.8 million for the quarter. Which is slightly lowered from his previous $105.2 million estimates, Pablo went ahead and slightly lowered his 2021 and 2022 outlook for both revenue and EBITDA estimates.

He believes that the companies full year revenue guidance of $500-$530 million is doable, as the first half of the year will come in at $203 million. This means the company only needs to have two $148 million quarters while there are multiple things happening in the second half of the year to look forward to between new opening of stores in multiple states to 3-4x’ing capacity in 3 states.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.